In the realm of investing, options trading has emerged as a captivating avenue, promising the potential for both substantial gains and devastating losses. While options offer investors the opportunity to leverage their capital and potentially amplify their returns, it’s crucial to understand the inherent risks associated with this financial instrument. In this article, we delve into the intricate world of options trading and explore the sobering question: can you lose a lot of money trading options?

Image: www.youtube.com

Options, by their nature, are complex financial instruments that grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price within a specific period. This flexibility comes at a price, as options contracts typically carry a premium, which represents the cost of purchasing the option.

The potential for significant losses in options trading stems from the inherent volatility of the underlying asset. When the price of the underlying asset moves in an unfavorable direction, the value of the option can plummet, resulting in the loss of the entire premium initially paid. Moreover, options are time-sensitive, meaning that their value decays over time, even if the underlying asset’s price remains relatively unchanged. This time decay adds an additional layer of risk to options trading.

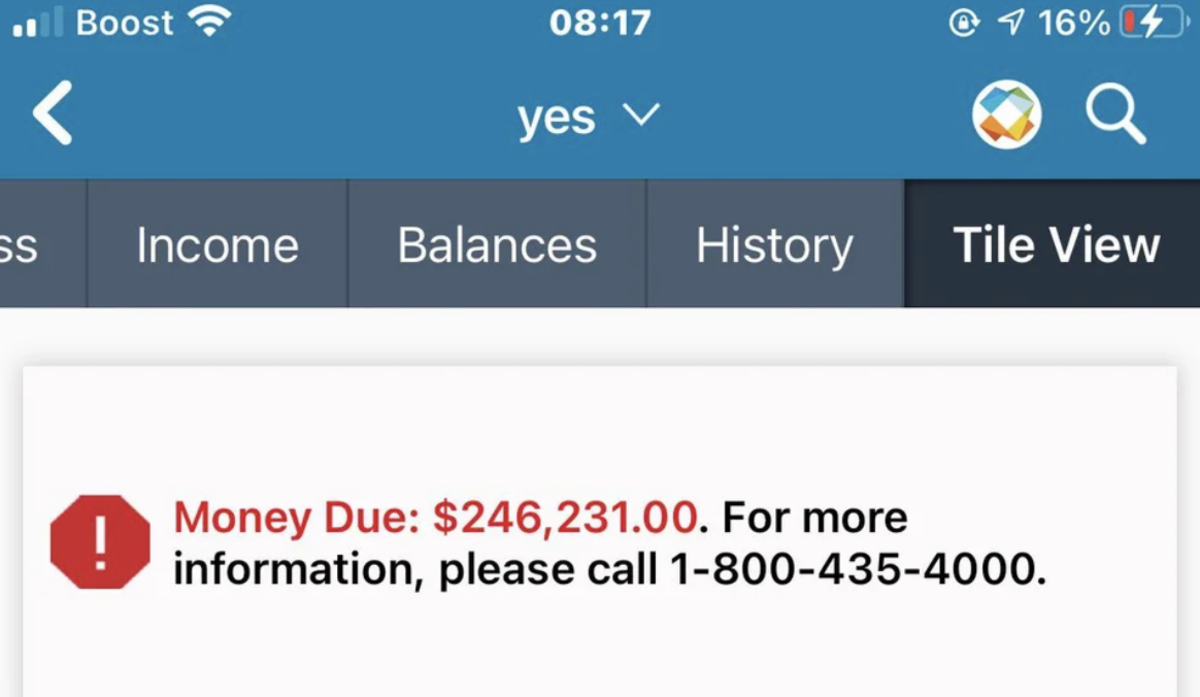

Options trading also exposes investors to unlimited loss potential. Unlike other forms of investing, where losses are capped at the amount of capital invested, options have no such limitations. The maximum loss in options trading is the entire amount of the premium paid, plus any additional funds required to cover potential margin calls.

Seasoned options traders, armed with in-depth market knowledge and risk management strategies, have a better grasp of the risks involved and can mitigate potential losses. However, even the most experienced traders are not immune to the unpredictable nature of markets and the inherent risks of options trading. It’s essential to approach options trading with caution and a healthy respect for the potential consequences.

So, to answer the question: yes, it is indeed possible to lose a lot of money trading options. Losing money in options trading is not just a hypothetical risk but a harsh reality that has befallen countless investors. While options provide opportunities for substantial gains, they also carry a significant potential for significant losses. It’s imperative to weigh the potential rewards against the risks and proceed with caution when considering options trading.

Expert Insights and Actionable Tips

“Options trading is not a game,” cautions financial expert Mark Douglas. “It’s a serious business that requires a deep understanding of the risks involved. Traders must always be aware of the worst-case scenario and have a plan to manage potential losses.”

To minimize the risks associated with options trading, experts recommend the following strategies:

- Educate Yourself: Thoroughly research options trading concepts, strategies, and risk management techniques. Seek guidance from reputable sources and consider consulting with a financial advisor.

- Start Small: Begin with modest trades to gain experience and develop a feel for the market. Avoid risking more than you can afford to lose.

- Choose Liquid Options: Opt for options with high trading volume to ensure easy entry and exit from positions. Thinly traded options can be difficult to sell at a fair price.

- Use Stop-Loss Orders: Set predetermined stop-loss levels to limit potential losses if the market moves against you.

- Manage Your Emotions: Options trading can be emotionally charged, leading to impulsive decisions. Stay disciplined and avoid letting fear or greed override your trading strategy.

Image: www.thestreet.com

Can You Lose A Lot Of Money Trading Options

Image: www.youtube.com

Conclusion

Options trading can be a lucrative endeavor but also carries substantial risks. It’s imperative to fully comprehend the ins and outs of options trading and the potential for significant losses before venturing into this realm. By educating yourself, exercising caution, implementing risk management strategies, and managing your emotions, you can increase your chances of success and mitigate potential losses in the world of options trading. Remember, the path to financial success often involves calculated risks, but it’s always wise to tread carefully and protect yourself from the perils that lie ahead.