Chapter 1: Understanding the Fundamentals of Options Trading

Options 101:

Options represent intriguing financial instruments that bestow upon their holders the prerogative to either acquire (in case of call options) or dispose of (put options) underlying assets at predetermined prices on specified expiry dates. Imagine them as “rights,” empowering the purchaser to capitalize on potential price fluctuations without assuming the obligation to transact.

Image: carlyqnikolia.pages.dev

How it Operates:

Imbued with this flexibility, options trading offers a versatile tapestry of strategies. From hedging against risks to speculating on market movements, these versatile tools cater to diverse investor aspirations. The key to harnessing their full potential lies in understanding the intricacies of how they function.

The Mechanics:

Each option contract symbolizes 100 shares of the underlying asset, thereby entailing potentially substantial gains or losses depending on market conditions and trading acumen. Prior to venturing into options trading, equip yourself with a thorough comprehension of the mechanics involved, delving into factors such as strike price, expiration date, and premium pricing.

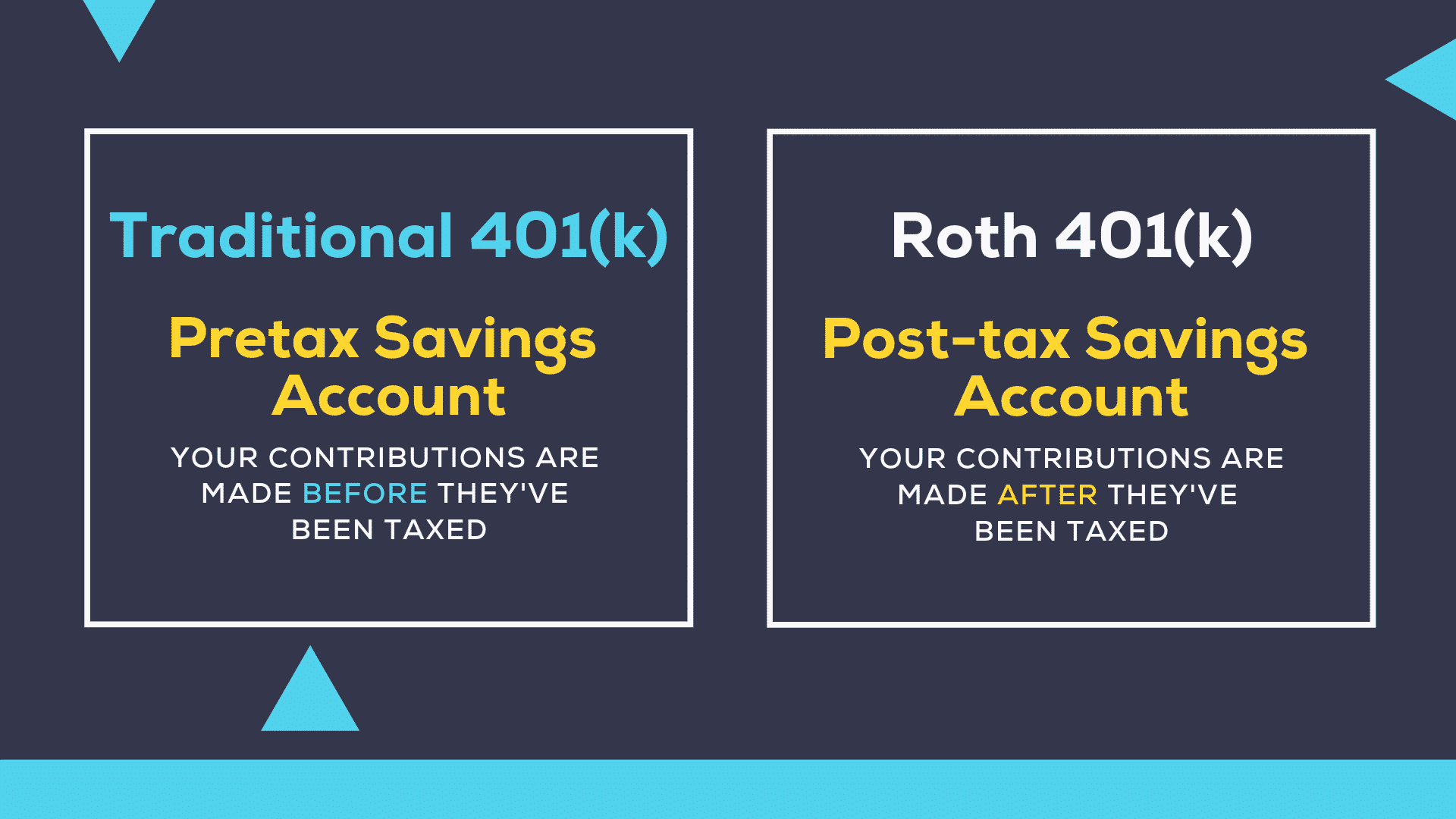

Chapter 2: Exploring Options Trading within 401(k) Accounts

Traditional Limitations:

Traditionally, 401(k) accounts have been predominantly restricted to more conventional investment avenues such as stocks, bonds, and mutual funds. However, in recent times, the landscape has begun to evolve, with an increasing number of 401(k) plans embracing the inclusion of options trading as a permissible investment option.

Expanding Horizons:

This shift toward greater flexibility empowers participants to amplify their potential returns, albeit accompanied by commensurate risks. Options trading within 401(k) accounts can unlock a broader spectrum of investment strategies, enabling participants to tailor their portfolios more closely to their individual risk appetites and financial goals.

Assessing Suitability:

Before embarking on options trading within your 401(k) account, it is imperative to meticulously evaluate its suitability for your specific circumstances. Consider your risk tolerance, investment horizon, and financial literacy. If you possess a strong understanding of options trading and are comfortable assuming greater risks in pursuit of higher returns, then incorporating options into your 401(k) portfolio could prove advantageous.

Chapter 3: Risks and Considerations: Navigating the Options Trading Landscape

Inherent Volatility:

Options trading inherently entails heightened volatility, rendering it imperative to proceed with prudence. The value of options can oscillate dramatically, magnifying both potential gains and losses. Recognize that options are not synonymous with guaranteed profits and exercise caution to avert significant financial setbacks.

Tax Implications:

Comprehending the tax implications associated with options trading is paramount. Gains derived from options transactions are subject to taxation as either ordinary income or capital gains, contingent upon the holding period. Being cognizant of these tax ramifications can help optimize your investment strategy and minimize potential liabilities.

Professional Guidance:

Venturing into options trading necessitates a profound understanding of the complexities involved. If you lack the requisite knowledge or experience, seeking the counsel of a qualified financial advisor can prove invaluable. A seasoned advisor can guide you through the intricacies of options trading, assist in constructing a tailored strategy, and help you navigate market dynamics with greater confidence.

Chapter 4: Harnessing Options Trading Strategies within 401(k) Accounts

Diversification Benefits:

Options trading can serve as a potent tool for diversifying your 401(k) portfolio, reducing overall risk and enhancing the potential for long-term growth. By incorporating options into your investment strategy, you can mitigate exposure to market fluctuations and position yourself to capitalize on a broader range of market scenarios.

Hedging Strategies:

Options also provide a sophisticated means of hedging against downside risks within your 401(k) account. Put options, for instance, can be employed to safeguard your portfolio against potential market downturns. Tailoring hedging strategies to your specific investment objectives can bolster your portfolio’s resilience during periods of market volatility.

Income Generation:

Savvy utilization of options can facilitate income generation within your 401(k) account. By selling covered call options, you can receive premiums while simultaneously limiting your potential upside. This strategy can generate a steady stream of income, further augmenting your retirement savings.

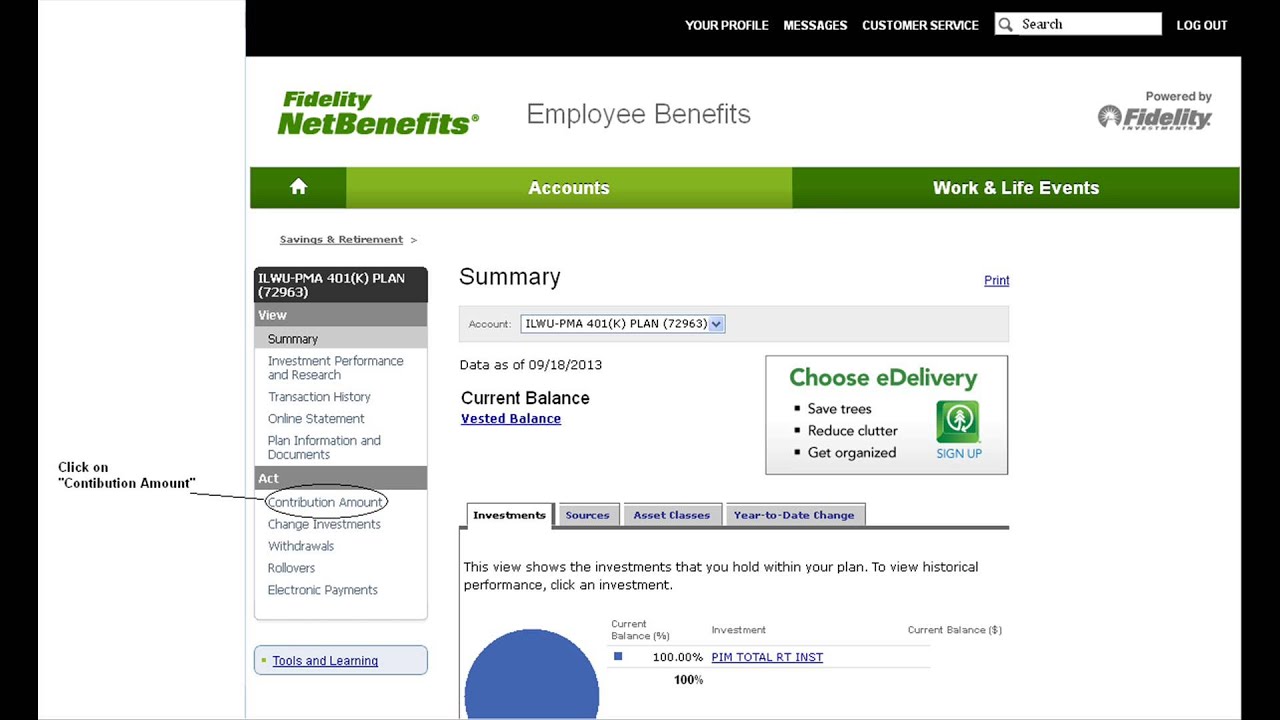

Image: mungfali.com

Chapter 5: Unveiling Success Stories: Real-World Examples of Options Trading in 401(k) Accounts

Case Study 1:

Meet Sarah, a prudent investor diligently contributing to her 401(k) account. She possessed a moderate risk tolerance and aspired to enhance her portfolio’s return potential. After consulting with a financial advisor, Sarah allocated a portion of her 401(k) to a diversified portfolio of options. Over time, her options trading strategies consistently outperformed the benchmark index, significantly amplifying her retirement savings.

Case Study 2:

John, a seasoned investor with an above-average risk tolerance, sought to maximize the growth potential of his 401(k) account. Armed with in-depth knowledge of options trading, John meticulously crafted a tailored strategy involving a combination of call and put options. Through astute market timing and skillful execution, John’s options trading pursuits yielded substantial returns, propelling his 401(k) account to new heights.

Common Pitfalls:

While options trading within 401(k) accounts offers immense potential rewards, it is not without its pitfalls. Common missteps include:

-

Overtrading: Unrestrained trading can erode profits and amplify losses. Exercise restraint and only trade when compelling opportunities arise.

-

Insufficient Knowledge: Options trading demands a comprehensive understanding of market dynamics and options strategies. Embark on thorough research and seek professional guidance to minimize risks.

-

Ignoring Risk Management: Effective risk management is paramount. Determine your risk tolerance, set stop-loss orders, and monitor your positions diligently to mitigate potential losses.

Chapter 6: Additional Considerations: Maximizing Your Options Trading Potential

Research and Education:

Continuously enhance your knowledge and stay abreast of market trends. Delve into books, articles, and webinars to deepen your understanding of options trading strategies and market dynamics.

Practice Makes Perfect:

Simulators and paper trading platforms provide a risk-free environment to hone your trading skills and test different strategies before committing real capital. Utilize these tools to perfect your techniques and build confidence.

Discipline and Patience:

Options trading demands discipline and patience. Resist emotional decision-making and adhere to your predefined trading plan. Avoid impulsive trades and let your strategies play out over time.

Can I Do Options Trading With My 401k Account

Image: www.pinterest.com

Chapter 7: Conclusion: Empowering Investors with Options Trading in 401(k) Accounts

Options trading within 401(k) accounts empowers investors with a versatile tool to diversify their portfolios, hedge against risks, and potentially enhance returns. However, it is imperative to proceed with prudence, armed with a profound understanding of options trading dynamics and unwavering adherence to sound risk management principles. By leveraging the insights unveiled in this guide, you can navigate the intricacies of options trading within 401(k) accounts with greater confidence and unlock its full potential for financial growth. Remember, the path to successful options trading lies in continuous learning, diligent research, and unwavering discipline. Embrace these principles, and you will be well-positioned to harness the power of options trading to amplify your retirement savings and achieve your long-term financial aspirations.