Options trading has emerged as a powerful tool for investors seeking to enhance their returns and manage risk. Among the various options strategies, call options stand out as a particularly lucrative one, offering traders the potential for exceptional gains. However, navigating the complexities of call options trading requires a reliable and user-friendly platform. In this article, we delve into the essential aspects of call options trading platforms, exploring their features, benefits, and how to choose the best platform for your needs.

Image: ar.inspiredpencil.com

Understanding Call Options and Their Benefits

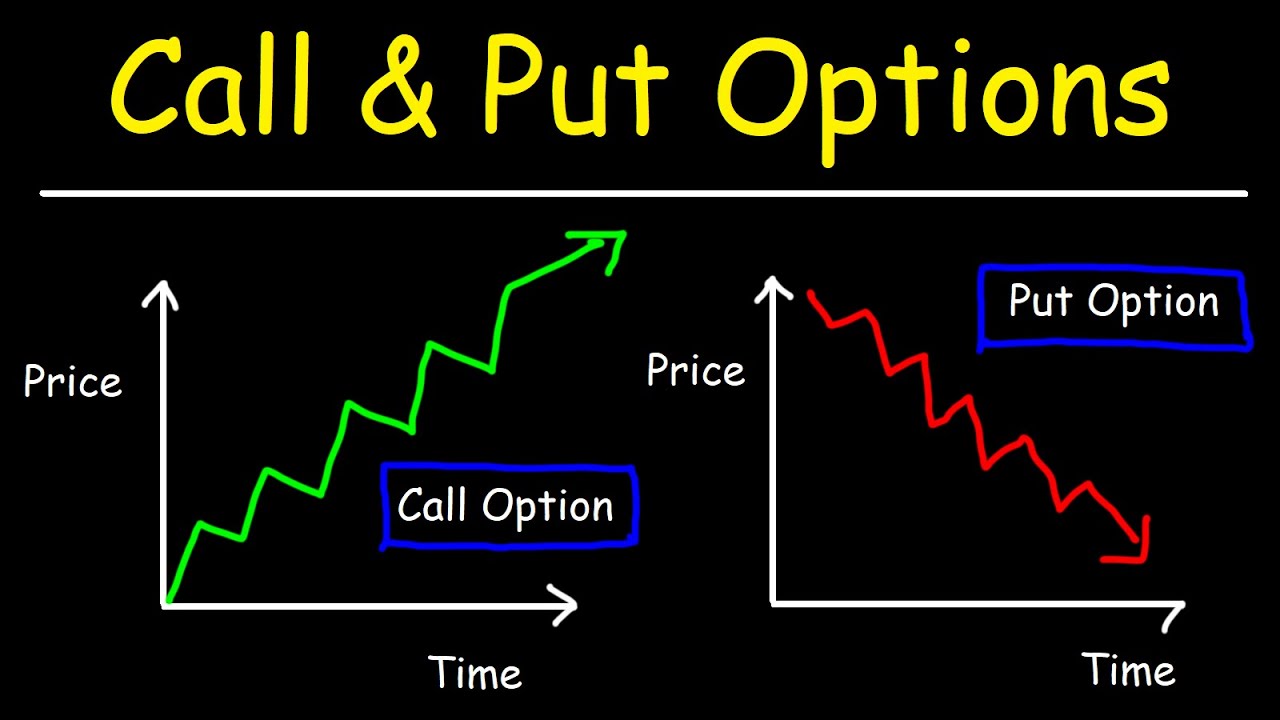

Call options are financial contracts that grant the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined price on or before a specified date. This unique feature provides traders with a significant degree of flexibility, allowing them to capitalize on potential price appreciation in the underlying asset.

The benefits of trading call options are numerous. First and foremost, call options offer limited risk compared to buying the underlying asset outright. The maximum loss is capped at the option premium paid, providing downside protection. Additionally, call options allow traders to leverage their capital, potentially amplifying their profits with a modest investment.

Key Features to Consider in a Call Options Trading Platform

When selecting a call options trading platform, it is crucial to consider several key features that directly impact the user experience:

Intuitive User Interface: Choose platforms with user-friendly interfaces that simplify navigation and order placement. Look for platforms that provide customizable dashboards and clear visualizations of market data.

Advanced Order Types: Search for platforms that support a wide range of order types, including limit orders, stop orders, and OCO (one-cancels-the-other) orders. Advanced order types offer greater control over trade execution and risk management.

Real-Time Market Data: Opt for platforms that provide real-time market data, including bid-ask spreads, option Greeks, and historical data. Up-to-date market information is essential for making informed trading decisions.

Trade Execution Capabilities: Consider platforms that offer seamless trade execution with low latency and reliable connectivity. Efficient trade execution ensures that your orders are filled promptly, minimizing slippage.

Research and Analysis Tools: Platforms with robust research and analysis tools empower traders with valuable insights. Look for platforms that provide technical analysis tools, news feeds, and earnings calendars.

Educational Resources: Find platforms that offer educational resources such as tutorials, webinars, and articles. These resources can enhance your understanding of options trading and improve your trading strategies.

Choosing the Right Call Options Trading Platform

Selecting the optimal call options trading platform depends heavily on your individual trading style and preferences. Here are a few factors to guide your decision:

Brokerage Reputation and Reliability: Research potential platforms thoroughly to gauge their reputation and track record. Choose platforms regulated by reputable regulatory bodies and known for their reliability.

Fees and Commissions: Compare the fees and commissions charged by different platforms. Consider factors such as transaction fees, platform fees, and spreads. Choose platforms that offer competitive rates to maximize your profitability.

Product Offerings: Ensure that the platform you choose offers access to the underlying assets and options contracts you wish to trade. Consider platforms with diverse product offerings, including equity options, index options, and commodity options.

Customer Support: Opt for platforms with responsive and knowledgeable customer support teams. Efficient customer support can resolve any queries or issues promptly, ensuring a seamless trading experience.

Account Minimums and Margin Requirements: Review the account minimums and margin requirements imposed by different platforms. Ensure that the platform you choose aligns with your financial capabilities and trading strategy.

Image: speedtrader.com

Call Options Trading Platforms

Image: kurskpu.ru

Conclusion

Call options trading platforms empower investors to harness the potential of call options strategies. By understanding the key features and considerations involved, traders can select a platform that best aligns with their trading needs. With the right platform, traders can access a user-friendly interface, real-time market data, and advanced order types, all of which contribute to enhanced profitability and risk management. Whether you are an experienced trader or just starting to explore the world of options trading, a reliable and feature-rich call options trading platform is an invaluable tool in your financial toolkit.