Introduction

Imagine yourself as a trader navigating the labyrinthine world of finance. You’ve heard whispers of a financial instrument that holds the potential to amplify your profits or shield your investments. Its name? Call options. Intrigued yet apprehensive, you embark on a journey to unveil the secrets of this enigmatic strategy. Join us as we delve into the captivating world of call option stock trading, empowering you with the knowledge and confidence to navigate this exciting financial landscape.

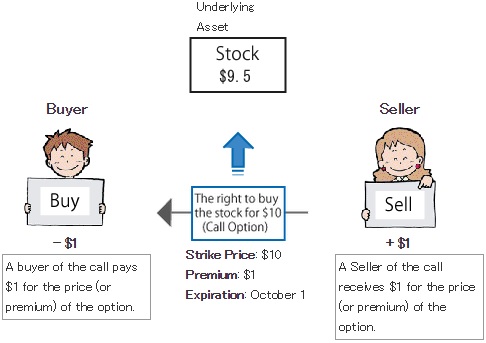

Image: varelgroup.com

Understanding Call Options: A Fundamental Breakdown

Call options are financial contracts that grant you the “right, but not the obligation,” to purchase a specific number of shares of a stock at a predetermined price, known as the strike price. This flexibility provides traders with the opportunity to leverage market dynamics in various ways.

Imagine you believe Amazon’s stock will surge in the coming days. Instead of directly purchasing shares, you could buy a call option at a strike price below the current market value. If your prediction holds true and the stock price climbs above the strike price, you can exercise your option and purchase the underlying shares at a discounted rate, netting you a potential profit.

The Power of Leverage: Unlocking Exponential Gains

The allure of call options lies in their ability to magnify profits exponentially. Suppose you purchase a call option with a premium of $5 and the underlying stock increases in value by 5%. Your $5 investment would instantly yield a 10% gain, effectively doubling your initial capital. This is the magic of leverage, where a small investment can lead to substantial returns.

However, the converse is equally true. A decline in the stock price below the strike price could result in the loss of your entire premium. Call options are not without risk, and traders must exercise prudence in their investment decisions.

Expert Insights: Navigating Market Volatility

“Call options provide an invaluable tool for investors seeking to capitalize on market fluctuations,” says renowned financial analyst Dr. Jennifer Rogers. “By understanding the underlying dynamics and timing your trades strategically, you can significantly increase your chances of success.”

One key strategy involves monitoring market volatility. Historically, options on stocks with high volatility tend to command higher premiums. While this may seem counterintuitive, it reflects the market’s perception of increased potential for substantial price swings.

For example, a stock with a history of wide price fluctuations may warrant a higher option premium but also offer the potential for greater returns. Conversely, stocks with low volatility may have lower premiums but also limit potential gains.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

Actionable Tips for Trading Call Options

- Set Realistic Expectations: Call options are not a get-rich-quick scheme. Embrace the reality of potential losses and trade within your risk tolerance.

- Research Thoroughly: Before diving into the market, conduct in-depth research on the underlying stock, the company’s financial performance, and industry trends. This due diligence will inform your decision-making.

- Manage Your Risk: Use stop-loss orders to limit potential losses and consider hedging strategies to protect your overall portfolio.

- Monitor Market Conditions: Stay abreast of economic news, market trends, and geopolitical events that could influence stock prices. Understanding these factors will guide your trade strategies.

Call Option Stock Trading

Image: ubawyzo.web.fc2.com

Conclusion

Call option stock trading is not for the faint of heart, but its mastery can unlock doors to significant profits. By gaining a deep understanding of this financial instrument, its risks, and potential rewards, you empower yourself to navigate the complexities of the financial markets with greater confidence. Remember to proceed with caution, conduct thorough research, and seek expert guidance when necessary. With the right knowledge and a calculated approach, call options can transform your investing journey, propelling you towards financial success.