Unveiling the Importance of Call Option Pricing

In the realm of investing, call options play a crucial role in providing investors with the right to purchase an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). Understanding how these options are priced is fundamental to making informed trading decisions.

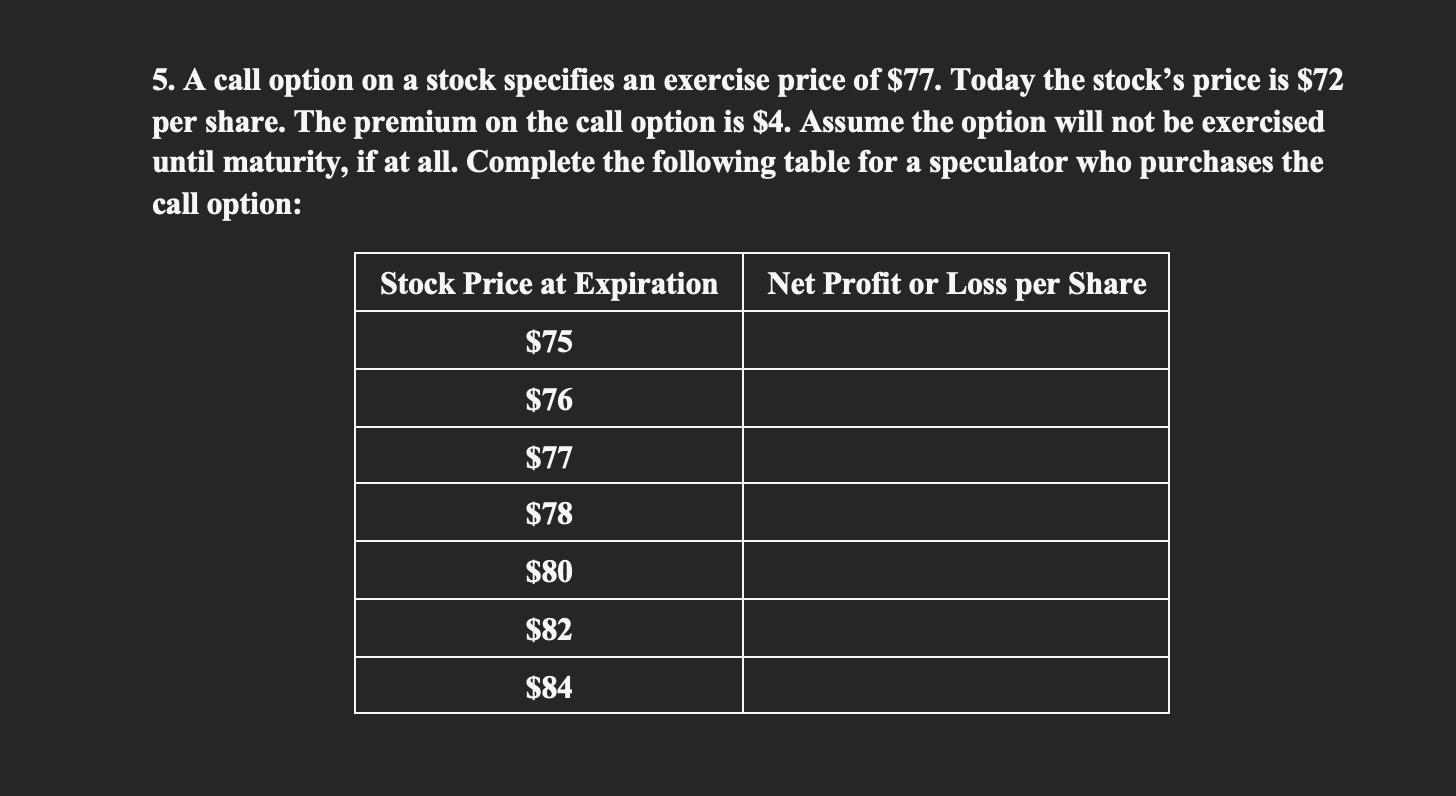

Image: www.chegg.com

Call option pricing takes into account various factors that influence its value, primarily the underlying asset’s current price, the strike price, the time remaining until expiration, the risk-free interest rate, and the volatility of the underlying asset. These factors are intricately intertwined, impacting the option’s premium, which is the price paid for acquiring the option contract.

The pricing of call options is essential in determining whether it is financially beneficial to exercise the option. When the underlying asset’s price exceeds or closes to exceeding the strike price, it might be advantageous to exercise the call option, allowing the holder to acquire the underlying asset at a favorable price.

Striking the Right Balance: The Exercise Decision

The decision to exercise or hold a call option is influenced by a combination of factors. These include the current market price of the underlying asset relative to the strike price, the time remaining until expiration, and the investor’s risk tolerance. By carefully considering these factors, investors can determine the optimal time to exercise their call option, maximizing their potential returns.

Exercising a call option prior to expiration carries certain advantages. If the price of the underlying asset significantly rises above the strike price, exercising the option allows investors to lock in their profits by purchasing the asset at a lower price than its market value. Additionally, they are not subject to the risk of the option expiring worthless, a potential outcome if the asset’s price falls below the strike price by the expiration date.

Tips for Maximizing Returns

- Evaluate Market Trends: Assess the underlying asset’s historical performance and current market conditions to predict its future price movements.

- Monitor Volatility: Keep a close watch on the volatility of the underlying asset. Higher volatility typically translates to higher option premiums.

- Consider Time Decay: As the expiration date approaches, the option premium decays, reducing its value. Be mindful of this when determining the optimal exercise time.

Investing Intelligently: Trading Call Options

Trading call options involves buying and selling these contracts to capitalize on fluctuations in the underlying asset’s price. Successful trading requires a deep understanding of the factors that influence call option prices and the ability to anticipate market movements.

Traders often employ various strategies when trading call options. These include:

- Covered Call: Selling a call option against an underlying asset that the investor owns.

- Naked Call: Selling a call option without owning the underlying asset, exposing the seller to unlimited potential losses.

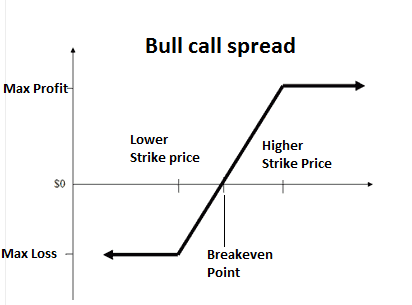

- Call Spread: Buying one call option at a lower strike price and selling another call option at a higher strike price to create a spread.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Image: www.investopedia.com

Call Option Pricing The Exercise Decision And Trading

Image: investluck.com

Frequently Asked Questions (FAQs)

Q: What is the significance of call option pricing?

A: Call option pricing plays a critical role in determining whether it is financially beneficial to exercise the option and serves as a foundation for making informed trading decisions.

Q: When should I exercise a call option?

A: The optimal time to exercise a call option depends on various factors, including the current market price of the underlying asset, the strike price, the time remaining until expiration, and the investor’s risk tolerance.

Q: How can I enhance my call option trading strategies?

A: To optimize call option trading strategies, monitor market trends, consider time decay, and understand the risks associated with different trading strategies.