Harnessing Market Data for Strategic Execution

As an avid options trader, I’ve always been fascinated by the interplay between open interest and market dynamics. One memorable encounter at a trading conference sparked my curiosity further. An industry veteran shared the pivotal role open interest plays in deciphering market sentiment and ultimately optimizing trading decisions.

Image: www.youtube.com

In this comprehensive guide, we’ll delve into the intricacies of calculating open interest, exploring its significance for option trading. Moreover, we’ll unveil practical tips and expert insights to empower you with the knowledge and tools to navigate the complexities of this fascinating market.

Open Interest: A Window into Market Sentiment

Open interest represents the total number of outstanding contracts for a particular options contract. It reflects the level of participation in the market, providing valuable insights into investor positioning and market sentiment.

High open interest indicates a significant number of open contracts, often suggesting an active and liquid market. This liquidity enhances ease of execution and mitigates the risk of slippage, particularly in volatile market conditions. Conversely, low open interest may indicate a thin market, potentially leading to wider spreads and greater execution challenges.

Calculating Open Interest

Calculating open interest is a straightforward process involving a few simple steps:

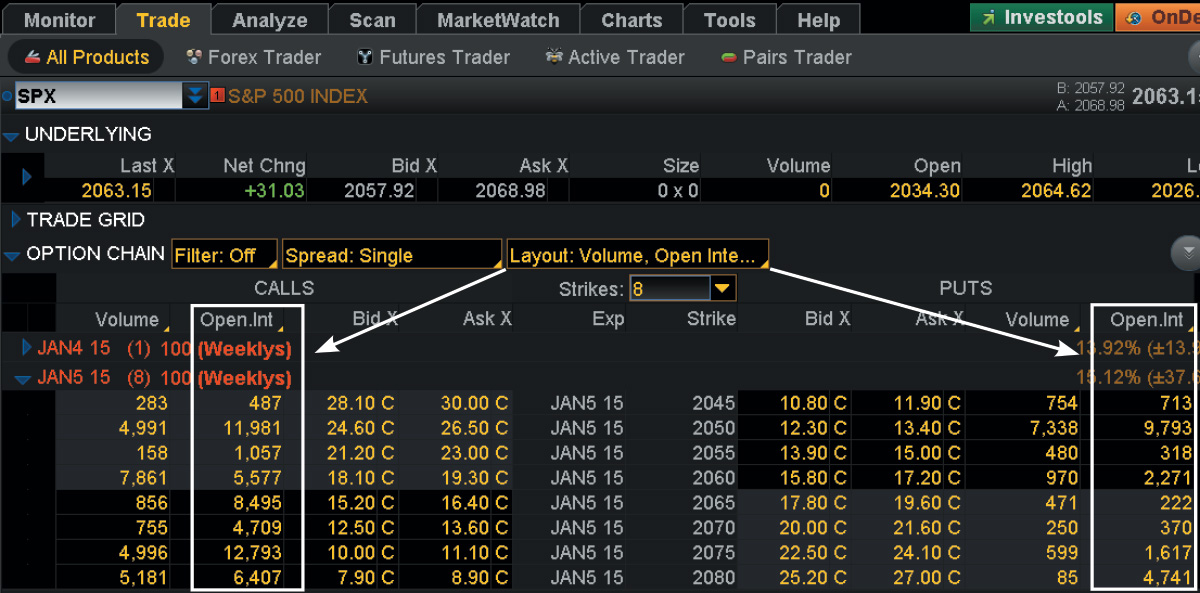

- Identify the options chain: Determine the underlying asset and expiration date for the options contract you’re interested in.

- Access market data: Utilize trading platforms, financial websites, or data providers to retrieve the options chain.

- Locate open interest: Within the options chain, open interest is typically displayed as a numerical value for each contract.

- Aggregate values: If calculating open interest for a specific option series (e.g., all call options with a particular strike price), sum up the open interest values for each contract within that series.

Tips for Enhanced Trading

Seasoned options traders rely on open interest to make informed decisions. Here are a few practical tips to incorporate into your trading strategy:

- Identify market trends: Rising open interest often signals increasing market participation and could indicate a breakout trade or a potential reversal. Consider aligning your trading strategy with these trends.

- Gauge contract liquidity: Open interest provides a proxy for contract liquidity. High open interest suggests ample liquidity, reducing the risk of execution slippage and enhancing overall trading efficiency.

- Estimate market sentiment: Changes in open interest can reflect shifts in market sentiment. Increasing open interest may indicate growing bullish or bearish sentiment, providing valuable insights into the market’s underlying dynamics.

Image: tickertape.tdameritrade.com

Common FAQs

- Q: What factors can influence open interest?

A: Open interest is primarily driven by market participation, volatility, liquidity, and changes in underlying asset price. - Q: Can open interest be used to predict price movements?

A: While open interest is a valuable indicator, it should not be used exclusively for price prediction. It provides insights into market sentiment and participation but does not guarantee future price movements.

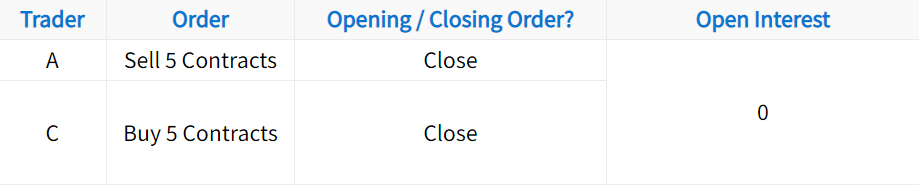

Calculate Open Interest For The Following Option Trading

Image: steadyoptions.com

Conclusion

Calculating open interest is an essential skill for any options trader seeking to maximize profits and mitigate risks. Understanding the significance of open interest, utilizing the calculation process, and incorporating expert tips into your trading strategy will empower you to make informed decisions and enhance your overall profitability in the dynamic options market.

Are you ready to delve deeper into the complexities of open interest and take your option trading to the next level?