Introduction

Stepping into the realm of financial markets can be both exhilarating and daunting, especially when exploring derivatives like options trading. My initial encounter with options was a roller coaster ride, filled with moments of elation and nerve-wracking uncertainty. But through the ups and downs, I’ve gained valuable lessons and insights that I’m eager to share with you in this comprehensive guide.

Image: pngtree.com

Understanding Options Trading

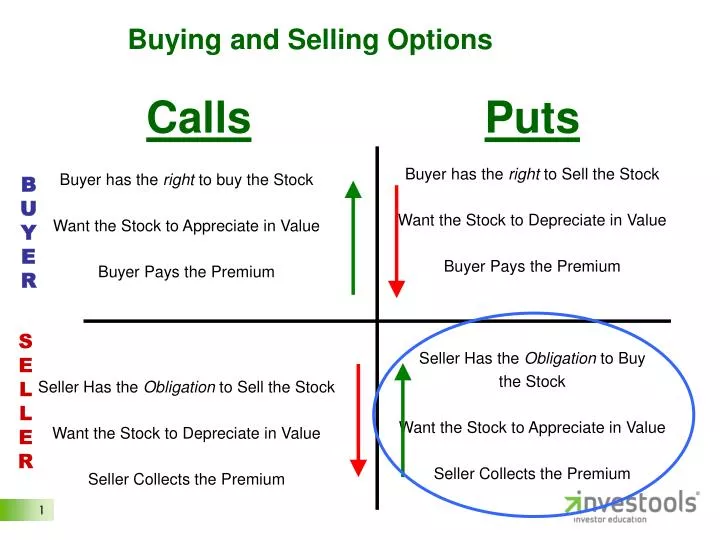

Options trading involves contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a particular date (expiration date). These contracts come in two primary flavors: calls and puts. Call options grant the holder the right to buy the asset, while put options give the right to sell.

Options trading can be a powerful tool for managing risk and enhancing potential returns. It enables investors to speculate on price movements, hedge against market fluctuations, or generate income through premium collection. However, it’s crucial to understand the risks involved and approach options trading with caution and informed decision-making.

Types of Options Strategies

The world of options trading offers a wide array of strategies tailored to different market scenarios and investor preferences. Some of the most common types include:

- Bullish strategies: Designed to profit from rising asset prices, such as buying call options or selling cash-secured puts.

- Bearish strategies: Aim to capitalize on falling asset prices, such as buying put options or selling covered calls.

- Time decay strategies: Utilize the erosion of options premium over time, such as writing naked options or selling covered options.

- Neutral strategies: Seek to maintain a balance between risk and potential reward, such as straddles or strangles.

Choosing the appropriate strategy is paramount and depends on factors like the underlying asset, market conditions, and your risk tolerance.

Expert Tips for Options Trading Success

Navigating the complexities of options trading can be challenging, but incorporating expert advice can significantly improve your chances of success. Here are a few valuable tips to guide your journey:

- Start small: Begin with small trades to minimize potential losses and gain confidence.

- Manage risk effectively: Utilize stop-loss orders or limit orders to protect your capital.

- Understand time decay: Options premiums decay over time, so factor this into your trading decisions.

- Monitor market conditions: Stay informed about economic news, earnings reports, and other events that may impact asset prices.

- Seek professional guidance: Consult with a financial advisor or attend workshops to enhance your knowledge and skills.

Image: www.slideserve.com

FAQ on Options Trading

Q: What is the difference between buying and selling options?

A: Buying an option gives you the right to exercise it, while selling an option obligates you to fulfill it if exercised.

Q: Can I lose money on options trading?

A: Yes, options trading carries significant risks. The maximum loss on a bought option is the premium paid, while the maximum loss on a sold option can be unlimited.

Q: What is a good strategy for beginners?

A: Consider starting with covered calls or cash-secured puts, as they limit potential losses.

Buying And Selling Options Trading

Image: www.angelone.in

Conclusion

Embarking on the journey of options trading requires a blend of knowledge, risk management, and strategic decision-making. By embracing the principles outlined in this guide, you can navigate this complex market with greater confidence.

If you’ve found this article informative and compelling, I encourage you to delve deeper into the topic. Join forums, engage in discussions, and continuously expand your understanding of options trading. With patience, perseverance, and an unwavering commitment to learning, you can harness the power of options to enhance your financial endeavors.