Introduction

Binary options trading has emerged as a lucrative investment avenue for many. However, understanding the tax implications associated with binary option trading income is crucial to ensure compliance and avoid legal pitfalls. This article delves into the specifics of binary option trading income taxation, providing clear guidance for traders and investors.

Image: www.bartleby.com

Binary Option Trading: A Primer

Binary options are financial instruments that offer the opportunity for investors to speculate on the future price fluctuations of an underlying asset, such as stocks, commodities, or indices. Traders make a binary bet, predicting whether the asset’s price will rise or fall within a specified time frame. If their prediction is correct, they receive a predefined payout; if not, they lose their investment.

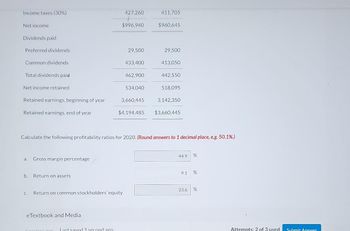

Taxation of Binary Option Trading Income

In the United States, binary option trading income is classified as business income and falls under self-employment income. This means that traders must report their binary option trading gains and losses on their individual income tax returns (Form 1040).

- Income Reporting: Traders are required to include all their binary option trading profits and losses on Schedule C (Form 1040), Profit or Loss from Business.

- Self-Employment Taxes: Since binary option trading is considered self-employment income, traders are subject to self-employment taxes (SE taxes), which encompass Social Security and Medicare contributions. The SE tax rate is 15.3%, divided as 12.4% for Social Security and 2.9% for Medicare.

- Quarterly Estimated Tax Payments: Traders with estimated self-employment tax liability of $1,000 or more are required to make quarterly estimated tax payments using Form 1040-ES. This ensures that your tax obligations are met throughout the year and helps avoid penalties.

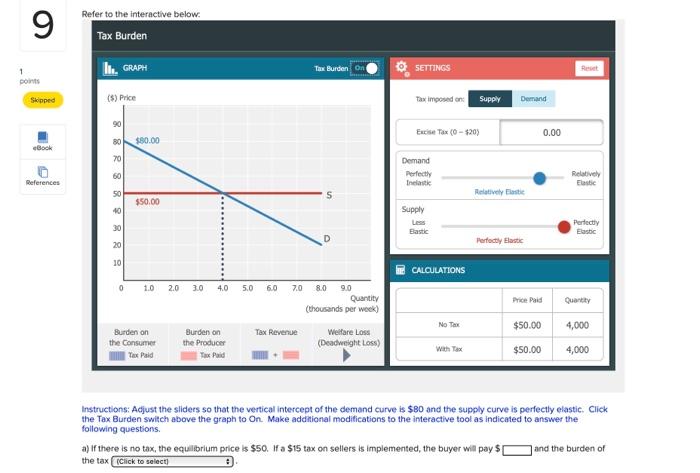

Capital Gains vs. Ordinary Income

Distinguishing between binary option trading income classified as capital gains versus ordinary income is essential for tax purposes.

- Capital Gains: If a binary option trade is held for more than a year before being closed, any profit realized is generally treated as a capital gain. Capital gains are taxed at preferential rates, typically lower than ordinary income tax rates.

- Ordinary Income: If a binary option trade is closed within a year, the profit is taxed as ordinary income. Ordinary income is subject to regular income tax rates, which can be higher than capital gains rates.

Image: www.chegg.com

Record Keeping and Documentation

Maintaining accurate records of your binary option trading activities is critical for tax compliance. Traders should keep meticulous track of the following:

- Trade dates and times

- Underlying assets traded

- Strike prices

- Expiration times

- Profits and losses

Detailed record-keeping facilitates accurate income reporting and helps in case of an audit.

Tax-Deductible Expenses

Traders can deduct certain expenses directly related to their binary option trading activities from their gross income. These deductions can reduce the amount of taxable income and lower their overall tax liability. Common deductible expenses include:

- Trading platform fees and commissions

- Education and research expenses

- Home office expenses (if applicable)

Seek Professional Advice

Navigating the complexities of binary option trading taxation can be challenging. Consulting with a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), is highly recommended. They can provide tailored guidance based on your specific situation, ensuring that you comply with all applicable tax laws.

Binary Option Trading Income In Income Tax Department

Image: mastertrader.com

Conclusion

Understanding the tax implications of binary option trading income is essential for traders to avoid legal troubles and optimize their financial position. By following the guidelines outlined above, reporting income accurately, keeping detailed records, and considering tax-deductible expenses, binary option traders can navigate the tax landscape with confidence.