In the dynamic world of financial markets, where risk and reward intertwine, option trading has emerged as a compelling strategy for savvy investors. To harness its full potential, meticulous planning and a keen understanding of market dynamics are paramount. Whether you’re a seasoned pro or a budding enthusiast, this guide will delve into the intricacies of option trading, unlocking the key setups that pave the way to informed decisions and potentially lucrative returns.

Image: osatajuvod.web.fc2.com

**Understanding Option Structures**

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). Armed with this understanding, traders can harness the power of leverage to amplify their profit potential while managing risk through various option strategies.

**Spotting Market Trends**

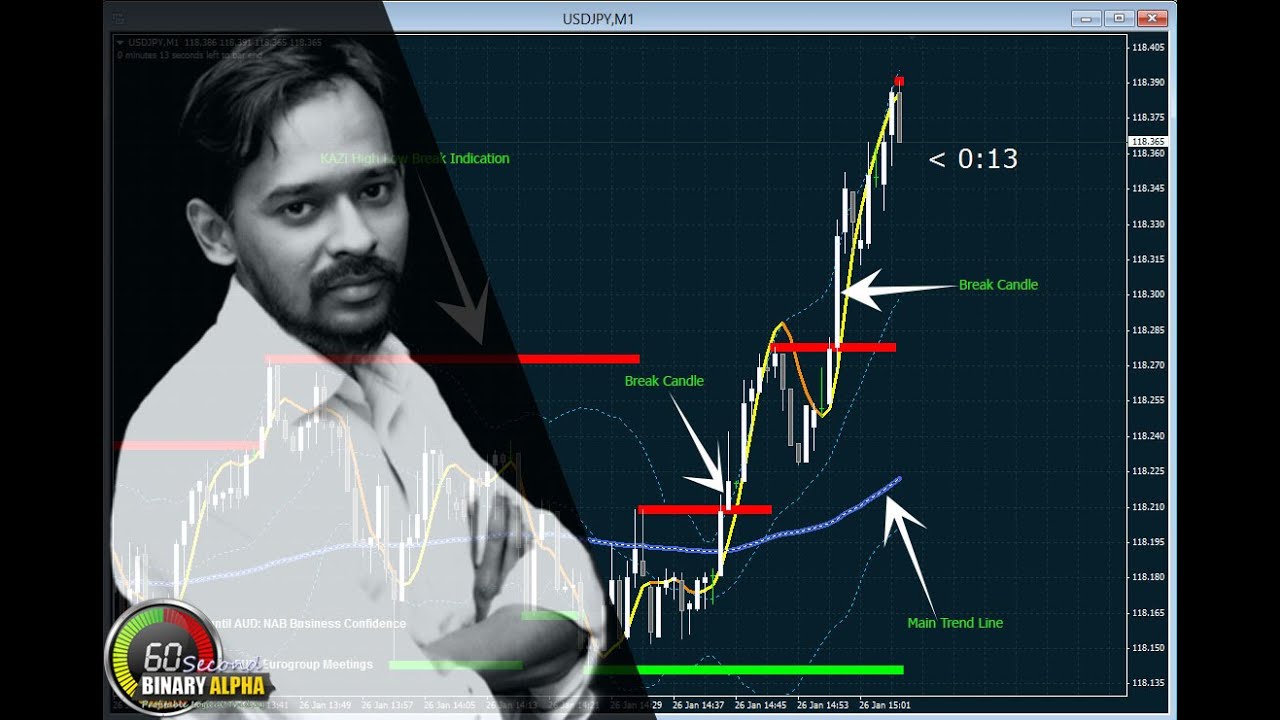

Mastering the art of option trading hinges on the ability to identify and capitalize on market trends. From studying historical charts to employing technical analysis tools, adept traders leverage a myriad of techniques to anticipate price movements and make informed trading decisions. By integrating these forecasting methods into your trading arsenal, you can gain a crucial edge in navigating the ever-evolving market landscape.

Image: www.reddit.com

**Selecting Profitable Setups**

The hallmark of successful option trading lies in the strategic selection of setups that align with market conditions. One popular approach involves exploiting market inefficiencies, such as pricing anomalies or deviations from historical price patterns. Another effective strategy entails identifying support and resistance levels, acting as potential reversal points for price trends. By vigilantly monitoring market data and scrutinizing price action, traders can uncover these setups, setting the stage for potentially rewarding trades.

Support and Resistance Levels

Support levels mark price points where buyers step in to prevent further declines, while resistance levels indicate areas where sellers push prices lower. These levels can be identified through technical analysis and serve as crucial reference points for option traders. By positioning trades around these boundaries, traders can capitalize on the likelihood of price reversals, increasing the probability of profitable outcomes.

Volatility Analysis

Volatility, a measure of price fluctuations, plays a pivotal role in option pricing and trading strategies. High volatility tends to inflate option premiums, potentially providing significant profit opportunities for traders who skillfully navigate these conditions. By analyzing historical volatility data and incorporating it into their decision-making, traders can enhance their understanding of market dynamics and fine-tune their trading strategies accordingly.

**Tips and Expert Advice**

To embark on the path to successful option trading, heeding the insights and advice of experienced professionals is invaluable. Seasoned traders emphasize the importance of:

- Thorough research: Diligently studying market dynamics, option pricing models, and trading strategies is essential for informed decision-making.

- Money management: Prudent risk management is paramount, entailing defining clear profit targets, stop-loss levels, and position sizing strategies.

- Emotional control: Maintaining emotional discipline is crucial to avoid impulsive trades and safeguard against substantial losses.

**Common FAQs**

- What is the difference between a call and a put option?

Call options grant the buyer the right to buy an underlying asset at a specified price, while put options confer the right to sell.

- How do options differ from stocks?

Options are derivative contracts that derive their value from an underlying asset. Stocks, on the other hand, represent ownership in a company.

- What factors influence option prices?

Option prices are influenced by the underlying asset’s price, volatility, time to expiration, and interest rates.

- What is the Greek alphabet used for in option trading?

Greeks are metrics used to measure the sensitivity of an option’s price to changes in various factors, such as the underlying asset’s price or volatility.

Best Set Ups For Option Trading

Image: tradingeducators.com

**Conclusion**

Option trading presents a powerful tool for discerning investors seeking to enhance their financial portfolios. By mastering the complexities of option structures, deftly spotting market trends, and meticulously selecting profitable setups, traders can harness the potential for significant returns while mitigating risk.

If you’re captivated by the intricacies of option trading and eager to delve deeper into its nuances, I strongly encourage you to continue your exploration. Immerse yourself in the wealth of resources available, engage with expert insights, and relentlessly expand your knowledge. The world of option trading awaits your curious mind and unwavering dedication.