Introduction

In the ever-changing landscape of financial markets, trading options have emerged as a powerful tool for investors seeking to enhance returns while managing risk. Among the leading retailers of electronics and home appliances, Best Buy has become a prominent platform for options trading, offering a wide selection of underlying assets and flexible strategies. This comprehensive guide delves into the intricacies of best buy trading options, empowering traders with the knowledge and insights to navigate this lucrative yet complex domain.

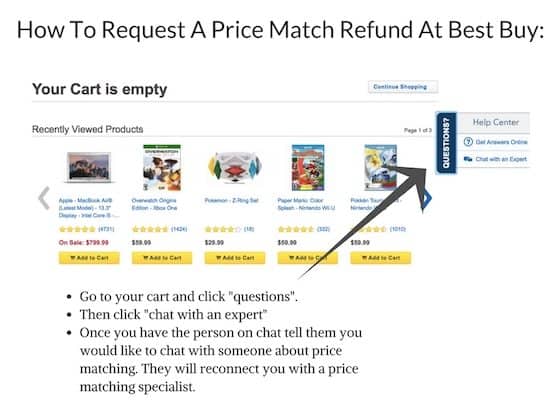

Image: www.savingyoudinero.com

Understanding Options

Options are financial contracts offering the buyer the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specified price (strike price) before a certain date (expiration). As opposed to direct investing in stocks or commodities, options provide leverage, allowing traders to control a significant number of shares at a fraction of the cost. This leverage can significantly amplify both gains and losses, making options trading a potentially rewarding but also risky endeavor.

Advantages of Best Buy Trading Options

Best Buy trading options offers several compelling advantages that have made it a popular choice for investors:

- Flexibility: Options provide unparalleled flexibility, enabling traders to customize their positions based on market outlook, risk appetite, and time horizon. Call options allow for bullish bets on rising prices, while put options offer protection against market downturns.

- Leverage: As mentioned earlier, options provide leverage, allowing traders to amplify their potential profits and control a large number of shares with a smaller investment.

- Risk Management: Options can be employed to hedge other investments, providing a safety net in volatile markets. By purchasing or selling options simultaneously, investors can reduce the overall risk of their portfolio.

- Income Generation: Options can also be used to generate income through premium collection. By selling covered calls (calls backed by an underlying asset), traders can receive a premium in exchange for the obligation to sell at the strike price.

- Diversification: Options offer diversification opportunities by providing exposure to different market sectors. By trading options on Best Buy and other companies, investors can spread their risk across multiple assets and reduce reliance on a single investment.

Types of Best Buy Options

Best Buy offers a comprehensive suite of options contracts, including:

- Call Options: Grant the buyer the right to buy the underlying asset at the strike price before expiration.

- Put Options: Grant the buyer the right to sell the underlying asset at the strike price before expiration.

- Covered Calls: Calls backed by an underlying asset owned by the seller, generating income through premium collection.

- Cash-Settled Options: Optionen, deren Auszahlung in bar erfolgt, anstatt die Lieferung des Basiswerts zu erfordern.

Image: www.rvandplaya.com

Strategies for Best Buy Options Trading

Successful options trading involves employing appropriate strategies based on market conditions and trader objectives. Some common strategies employed in Best Buy trading options include:

- Single-Leg Strategies: Involving buying or selling a single option contract, such as selling covered calls or purchasing protective puts.

- Multi-Leg Strategies: Combining multiple options contracts, such as a bull call spread (buying a call option and selling a call option with a higher strike price) or a bear put spread (selling a put option and buying a put option with a higher strike price).

- Technical Analysis: Applying technical indicators and chart patterns to identify trading opportunities, such as breakout patterns or moving average crossovers.

- Fundamental Analysis: Evaluating the company’s financial performance, market conditions, and industry outlook to make informed trading decisions.

Best Buy Trading Options

Conclusion

Best Buy trading options offers a myriad of opportunities for investors to capitalize on market fluctuations and generate income. However, it is crucial for traders to understand the intricacies of options and develop a comprehensive strategy before venturing into this dynamic market.