Ever feel like your option trading results are a chaotic jumble of wins and losses, leaving you questioning your strategy? You’re not alone. Mastering the art of option trading requires discipline, patience, and a systematic approach. And one of the most powerful tools in your arsenal is a meticulously kept trading journal. It bridges the gap between random trades and a truly informed approach, turning your trading journey from a guessing game into a data-driven quest for consistent profitability.

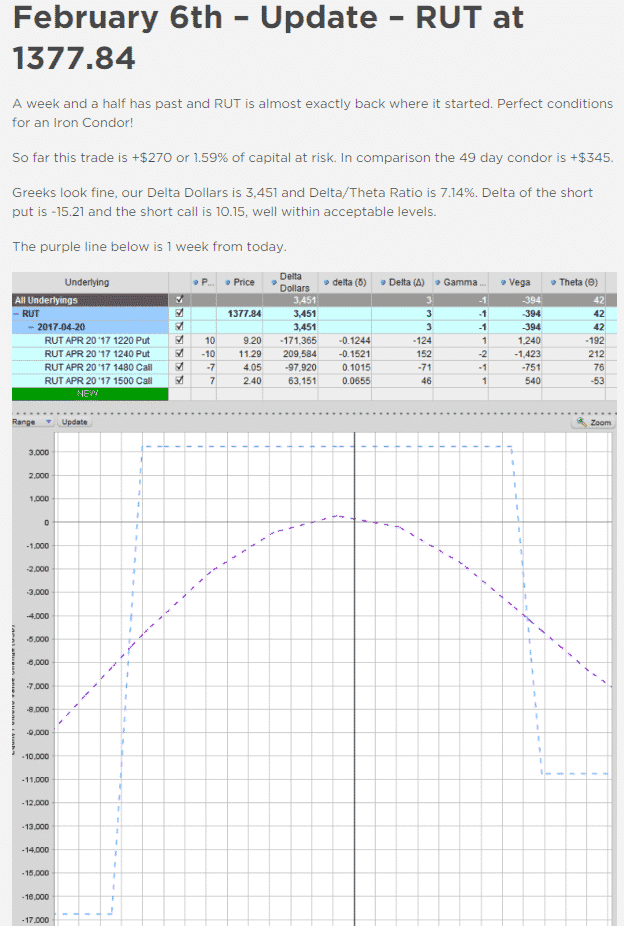

Image: optionstradingiq.com

Imagine this: you’re sifting through your past trades, not just remembering the excitement of a winning trade but also analyzing the calm strategy behind it. You dissect the logic behind every entry and exit point, noticing patterns in your mistakes and areas where your intuition shines. This is the transformative power of a trading journal, a tool that allows you to learn from every trade, build a solid foundation for future success, and unlock the potential for consistent gains in the complex world of option trading.

The Anatomy of a Profitable Trading Journal: Essentials for Option Traders

A trading journal is more than just a record of your trades. It’s a personal roadmap to your trading success. To maximize its effectiveness, structure your entries with key elements that offer valuable insights:

1. Trade Details: Capturing the Essence of Each Trade

Start with a clear and concise record of each trade, detailing:

- Date and Time: Timestamping your trades provides a chronological framework for your analysis.

- Underlying Asset: Identify the specific stock, index, or commodity you’re trading.

- Option Type: Specify whether you’re trading a call or put option.

- Strike Price: Note the target price for the option to become profitable.

- Expiration Date: Indicate the expiry date of the option contract.

- Entry Price: Capture the exact price at which you purchase or sell the option.

- Exit Price: Record the price at which you close your position, whether profitable or not.

- Quantity: Specify the number of contracts traded.

2. Trade Rationale: Unveiling the Logic Behind Your Decisions

Beyond the raw data, your journal should reflect the “why” behind each trade. This is where true learning begins:

- Trade Setup: Describe the market conditions, technical indicators, or fundamental analysis factors that influenced your decision to enter the trade.

- Entry Strategy: Explain the specific strategy you employed for entering the trade. Did you use price patterns, technical indicators, or fundamental analysis?

- Exit Plan: Outline your pre-defined exit strategy, including profit targets and stop-loss levels.

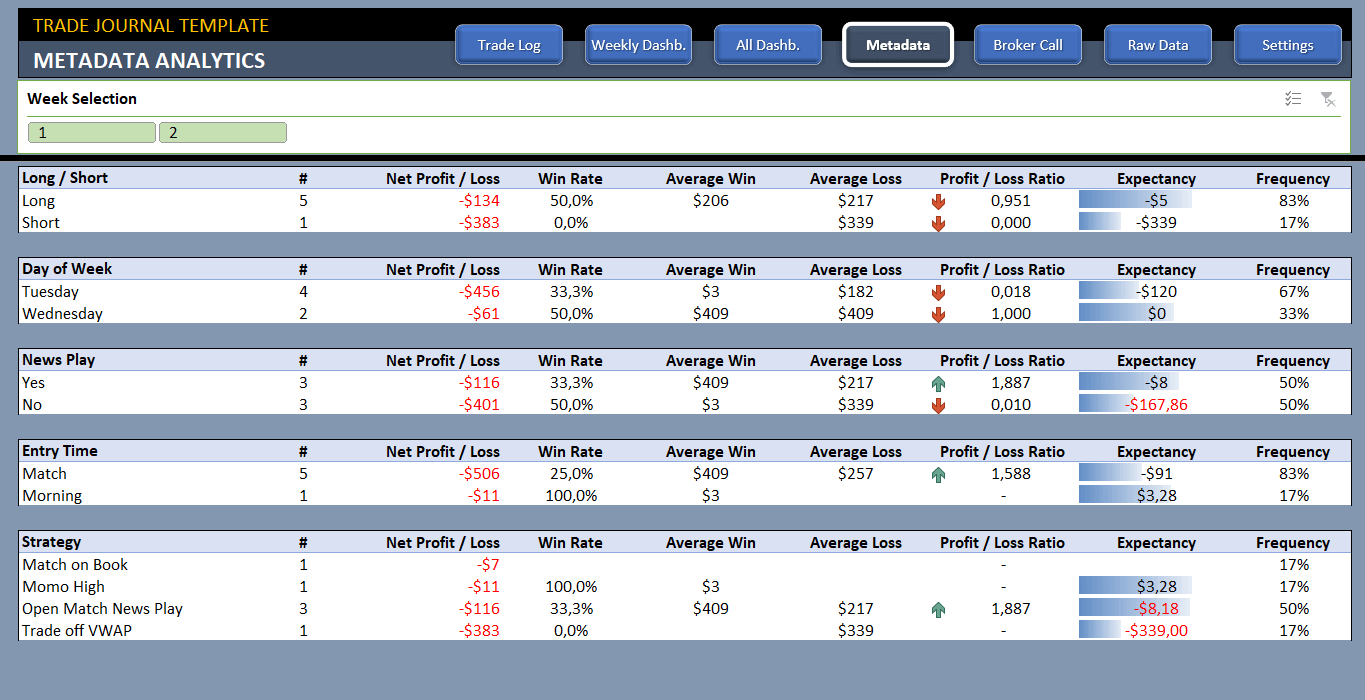

Image: www.someka.net

3. Post-Trade Analysis: Uncovering the Essence of Learning

This section is where you dissect your traded decisions, transforming raw data into actionable knowledge:

- Trade Result: Note whether the trade was profitable or a loss, and the percentage gain or loss.

- Market Movement: Assess how the price of the underlying asset moved during the trade and how it aligned (or diverged from) your expectations.

- Performance Review: Evaluate your performance in relation to your pre-defined exit plan. Did you follow your strategy meticulously, or did emotions influence your decisions?

- Lessons Learned: Articulate the key takeaways from the trade. What worked well? What could you have done differently? Identify areas for improvement in your trading strategy.

Beyond the Basics: Transforming Data into Actionable Insights

A journal is more than just a static record; it’s a dynamic tool for continuous improvement. Here’s how to leverage it effectively:

1. Identify Trading Patterns: Unveiling the Symphony of Your Trades

As your journal grows, begin to look for patterns in your trading results. Are there specific strategies that consistently yield profits, while others are prone to losses? Do you perform better during certain market conditions or with particular asset classes? These insights can guide your future trade selection and help you focus on your strengths.

2. Analyze Your Emotions: Emotional Intelligence for Trading Success

Trading involves a significant emotional component. Your journal can serve as a window into your emotional responses to market fluctuations. Did you panic and exit a winning position too early? Did you hold on to a losing trade too long? By recognizing these emotional triggers, you can develop strategies to manage them effectively and make more rational trading decisions.

3. Benchmarking Your Progress: Tracking Your Trajectory to Success

Regularly review your trading journal to track your progress over time. Are you consistently improving your win rate? Are your losses smaller than they used to be? Are you making more informed trading decisions? Your journal serves as a powerful benchmark, allowing you to measure your progress and chart your path to trading excellence.

4. Backtesting Strategies: Testing the Waters Before Jumping In

Your journal provides valuable data for backtesting trading strategies. You can use historical data to simulate different scenarios and assess how your strategies would have performed in the past. This process allows you to refine your approach and increase your confidence in your chosen strategies.

Option Trading Journal

The Power of a Trading Journal: From Insight to Action

Option trading is a dynamic and competitive realm. Success requires both an analytical mind and a discipline to act on that analysis. Your trading journal is your trusted companion, guiding you through complex market situations and helping you refine your strategy for consistent gains. It’s not about perfection, but about continual growth, learning from every trade, and building a robust foundation for a successful trading journey.

Remember, your trading journal is a personal tool. Adapt it to your needs, personalize its format, and embrace its power to transform your approach to option trading. The path to profitability begins with introspection, and your journal is the key that unlocks the door to informed, well-executed trades, leading you towards your trading goals.