Have you ever stared at the options chains, those intricate grids filled with numbers, and felt a surge of both excitement and trepidation? The world of options trading can be exhilarating, promising high rewards. However, it’s also fraught with the potential for significant losses. What if there was a strategy that allowed you to navigate this volatile landscape with a bit more peace of mind? Enter the Iron Condor, a strategy designed to help you profit from uncertainty while limiting your risk.

Image: unofficed.com

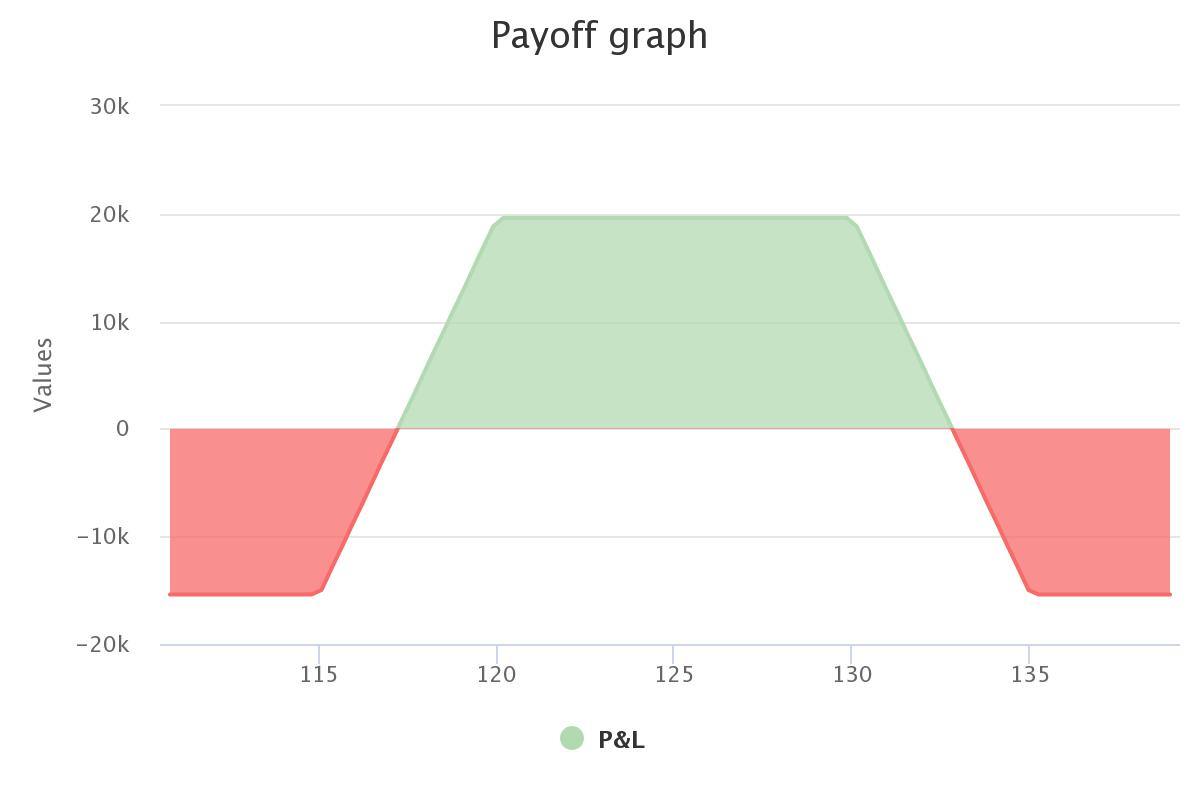

The Iron Condor is a multi-leg options strategy that essentially creates a defined risk and defined reward scenario. It’s a strategy that’s often favored by traders who prefer a controlled approach, seeking to capitalize on the potential for price movement within a specific range while remaining protected from extreme price fluctuations. This article will unravel the intricacies of the Iron Condor, shedding light on its strengths, weaknesses, and how it can be a crucial tool in your trading arsenal.

Understanding the Iron Condor: A Layered Approach

At its core, the Iron Condor involves four separate options contracts. It consists of:

-

Selling a Put Option (Short Put): This bet on the underlying asset’s price remaining above the strike price. You receive a premium for selling this option, but you’re obligated to buy the underlying asset at the strike price if the market moves against you.

-

Buying a Put Option (Long Put): This option acts as a safety net, guaranteeing you the right to sell the underlying asset at the strike price. It protects you against significant downward price movements.

-

Selling a Call Option (Short Call): Similar to the short put, this option bet on the asset’s price remaining below the strike price. You receive a premium for selling it, but you’re obligated to sell the underlying asset at the strike price if the market rallies against you.

-

Buying a Call Option (Long Call): This call option protects you against the upside, providing you the right to buy the underlying asset at the strike price.

The Key to Profitability: The Iron Condor thrives in markets with limited volatility, where the underlying price is expected to remain relatively stable within a defined range. This strategy is designed to benefit from time decay, the gradual depreciation of options premium as time passes. It works best when the underlying asset price stays within the range defined by the strike prices of your options contracts.

The Appeal of the Iron Condor: A Balanced Approach

Why has the Iron Condor become a popular option trading strategy for sophisticated traders? Here’s a deeper look at its allure:

Limited Risk: The Iron Condor has a defined maximum loss, which is the difference between the net premium received and the width of the short strikes. It’s a strategy that allows for a level of predictability, providing a sense of security.

Defined Profit Potential: While the Iron Condor may not offer massive gains, it has a defined maximum profit. This profit is determined by the premiums received from selling the options and is typically achieved when the underlying asset price stays within the range defined by the strike prices.

Time Decay to Your Advantage: The Iron Condor leverages the passage of time. As time passes and the options contracts near their expiration date, their value erodes. This decrease in value is beneficial for the seller of the options, boosting their profit potential.

Flexible Implementation: The Iron Condor can be tailored to different market conditions and trading styles. It’s a versatile strategy that can be adjusted based on your risk tolerance and profit goals.

Practical Considerations: Navigating the Iron Condor

Understanding the Iron Condor is one thing, but putting it into action effectively requires careful consideration:

Choosing the Right Strike Prices: Selecting the right strike prices is paramount. The width of the “wings” of the Iron Condor, the difference between the strike prices of both the calls and the puts, dictates the potential profit and loss. The greater the width of the wings, the higher the potential profit but also the higher the maximum loss.

Expiration Date Selection: You’ll need to choose an expiration date that aligns with your expectations of market movement. If you anticipate heightened short-term volatility, a shorter expiration date might be more suitable. A longer expiration date could be chosen if you believe in a stable period of market conditions.

Market Volatility: Before entering an Iron Condor, it’s crucial to assess market volatility. Low to moderate volatility is conducive to Iron Condor success. If the market swings quickly and dramatically, your strategy may not perform as intended.

Underlying Asset Selection: Choose an underlying asset you understand well. Research its history, industry dynamics, and factors that could affect its price movements.

Image: www.pinterest.com

Expert Tips: Unleashing the Power of the Iron Condor

Experienced options traders often share these insights for maximizing your Iron Condor strategy:

Start with Small Positions: Don’t jump in headfirst. Begin with small positions. This allows you to refine your strategy, observe market reactions, and minimize potential loss.

Monitor Your Trades: Regularly monitor your trades and adjust your strategy as needed. If the market moves beyond your expectations, you may need to reposition your options contracts.

Consider Alternative Strategies: The Iron Condor is just one tool in your options trading toolbox. Explore other strategies, like the Iron Butterfly, which offer similar characteristics but may suit your risk appetite better.

Iron Condor Option Trading Strategy

Conclusion: A Safe Harbor in the Storm

The Iron Condor is a powerful tool for managing risk and profiting in volatile markets. It’s a strategy that can appeal to those who want a balanced approach to options trading, limiting potential losses while seeking to capitalize on price movements within a defined range. By understanding its mechanics, exploring its intricacies, and heeding the advice from seasoned traders, you can integrate the Iron Condor into your trading arsenal and navigate the uncertain world of options trading with greater confidence.

Remember, options trading isn’t a get-rich-quick scheme. It demands knowledge, strategy, and discipline. Before embarking on any options trading strategy, thoroughly educate yourself, practice risk management, and, when in doubt, consult with a financial advisor.