Have you ever dreamt of making substantial profits by mastering the complex world of options trading? It’s a captivating prospect, but the steep learning curve and the inherent risks can be daunting. What if we told you that acquiring the knowledge and skills needed to navigate this exciting market is entirely free? It’s the perfect time to embark on your options trading journey, as numerous resources offer invaluable insights, strategies, and tools without costing a dime.

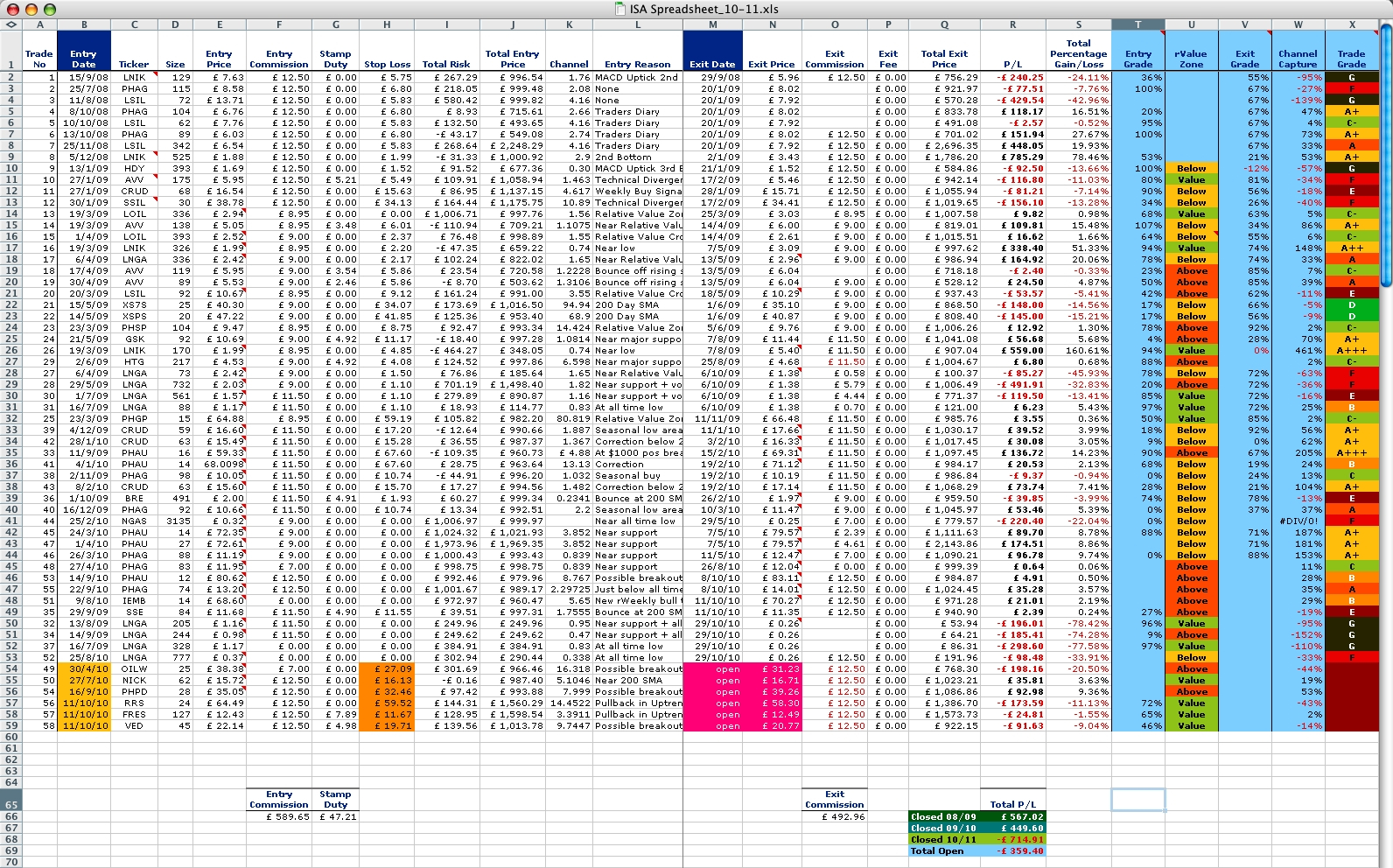

Image: db-excel.com

This comprehensive guide explores the world of free options trading training, providing you with a roadmap to gain valuable insights and develop the confidence to step into the bustling realm of options. We’ll walk you through the benefits of free training, unveil the top resources available, and equip you with the knowledge to make informed decisions. This journey will empower you to navigate the complexities of options trading with newfound clarity and assurance.

Exploring the Value of Free Options Trading Training

While investing in paid educational programs can provide structured learning experiences, free options trading resources offer a substantial advantage to beginners and seasoned traders alike. Here’s why:

Accessibility: The Gateway to Knowledge

Free resources eliminate the financial barrier, opening the doors to a vast pool of information. You can learn at your own pace without any upfront investment, making options trading accessible to a wider audience. This is a crucial stepping stone for individuals considering a career in trading or looking to expand their investment portfolio.

Diverse Perspectives: Learning from the Experts

Free options trading training comes in many forms: interactive tutorials, comprehensive courses, insightful articles, and engaging videos. This diversity provides you with exposure to various perspectives and trading strategies, ensuring a well-rounded learning experience. Through these diverse resources, you can connect with experienced traders, learn about risk management, and gain insights into the nuances of market analysis and prediction.

Image: www.pinterest.com.mx

Continual Learning: Staying Ahead of the Curve

The financial market is dynamic and constantly evolving, making it critical to keep your knowledge up-to-date. Free resources facilitate a continuous learning process, allowing you to stay informed about emerging trends, market shifts, and new trading strategies. You can access the latest research, analysis, and expert opinions without any financial commitment, enabling you to adapt and refine your approach to options trading.

Navigating the World of Free Options Trading Resources

The abundance of free resources available can feel overwhelming at first. To guide you through this landscape, we’ve compiled a comprehensive list of reliable and informative options, categorized for easy access.

1. Educational Platforms: The Foundation of Learning

Interactive platforms offer a structured learning experience, providing a solid foundation for understanding the complexities of options trading. Here are some standout resources:

- Investopedia: Options Trading Basics: This online platform offers a wealth of articles, videos, and interactive tools explaining options trading principles and strategies. Its simplified approach makes it an excellent starting point for beginners.

- Khan Academy: Finance & Capital Markets: This non-profit organization provides free online courses covering various financial topics, including options trading. The platform’s clear explanations and engaging visuals make learning enjoyable.

- The Options Industry Council (OIC): The OIC offers a comprehensive online course called “Understanding Options,” which is a great resource for getting a solid understanding of the basics of options trading.

2. Brokerage Platforms: Demystifying the Trading Process

Leading brokerage platforms are not only essential for executing trades, but many also offer valuable educational resources to their clients.

- TD Ameritrade Thinkorswim Paper Trading: TD Ameritrade provides an impressive platform with a user-friendly interface and a paper trading account that allows you to practice your skills without risking real money. It’s a fantastic resource for gaining confidence and honing your strategies before entering the live market.

- Interactive Brokers Educational Resources: Interactive Brokers offers a dedicated page with comprehensive articles covering a wide array of options trading topics, from basic concepts to advanced strategies.

- Fidelity Learning Center: Options Trading: Fidelity provides a dedicated learning center with articles, videos, and webinars focused on options trading. You can gain valuable insights into different strategies, risk management, and market analysis.

3. Online Communities: Connecting with Fellow Traders

Engaging with a community of fellow traders can be tremendously valuable for exchanging ideas, learning from experiences, and gaining insights into the latest market trends.

- Reddit: r/options: This subreddit is a vibrant community where traders of all experience levels share strategies, news, and analysis. It’s a fantastic resource for staying up-to-date and engaging in discussions.

- StockTwits: $OPTIONS: StockTwits provides a real-time feed where traders can share their thoughts and insights on specific options. This platform can offer valuable real-time market analysis.

- The Options Trading Discord Server (various communities): Discord servers dedicated to options trading provide a platform for live discussions, real-time analysis, and sharing strategies among like-minded individuals.

4. Blogs and Websites: Insights from Industry Experts

Numerous blogs and websites offer valuable content on options trading, providing in-depth analyses, actionable strategies, and expert perspectives.

- The Options Playbook: This blog by Joel Greenblatt provides insights into options trading strategies, risk management, and market analysis.

- Options Trading Tips: This website offers a comprehensive collection of articles, tutorials, and resources dedicated to options trading.

- The Options Clearing Corp (OCC): The OCC, the largest clearinghouse for options in the world, offers educational resources to help investors understand the options market. They provide clear explanations of options concepts and risks.

5. YouTube Channels: Visual Learning at Your Fingertips

YouTube offers a treasure trove of educational content on options trading. Explore these popular channels:

- The Options Warrior: This channel provides informative tutorials, in-depth analysis, and actionable strategies for options trading.

- Trader University: This channel provides a broad range of educational videos covering various financial topics, including options trading.

- Investopedia: Investopedia delivers clear explanations of options concepts through their extensive video collection.

Building a Foundation: The Essentials of Options Trading

Before diving into complex strategies, it’s essential to build a strong foundation by understanding the core concepts of options trading. Here are some critical areas to focus on:

1. Options Terminology: Deciphering the Language of Trading

Options trading involves a new vocabulary, and familiarizing yourself with these terms is crucial for comprehension. Here are a few key terms:

- Call Option: Gives the buyer the right, but not the obligation, to buy an underlying asset at a specific price (strike price) before a certain date (expiration date).

- Put Option: Grants the buyer the right, but not the obligation, to sell an underlying asset at a specific price before a certain date.

- Strike Price: The price at which the underlying asset can be bought or sold using the option.

- Expiration Date: The last date the option can be exercised.

- Premium: The price paid for the option, which gives the buyer the right to buy or sell the underlying asset.

2. Understanding Option Payoffs: Quantifying Potential Profits and Losses

It’s crucial to grasp how option payoffs work to understand the potential profits and losses associated with different trading strategies. Your profits or losses will depend on the direction of the underlying asset’s price movement:

- Call Option Profit: If the underlying asset’s price rises above the strike price, the call option buyer will profit. If the price stays below the strike price, the buyer will lose the premium paid for the option.

- Put Option Profit: If the underlying asset’s price falls below the strike price, the put option buyer will profit. If the price stays above the strike price, the buyer will lose the premium paid for the option.

3. Risk Management: Protecting Your Investments

Options trading is inherently risky, so it’s imperative to implement effective risk management strategies to protect your capital. Here’s where to begin:

- Limit Your Losses: Use stop-loss orders to automatically sell your options position when the price reaches a predetermined level. This limits potential losses and safeguards your capital.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying your portfolio across multiple assets and trading strategies mitigates risk by spreading it across different investments.

- Understand Your Risk Tolerance: Assess your level of risk tolerance and invest only what you can afford to lose. Don’t chase high returns at the expense of your financial security.

Learning by Doing: The Importance of Paper Trading

Once you’ve gained a solid foundation of knowledge, it’s time to put your learning into practice. Paper trading is a fantastic way to test your strategies, build confidence, and avoid risking real money. With paper trading, you simulate real-market conditions without risking your capital. Here’s how it works:

- Choose a Paper Trading Platform: Many online brokers offer paper trading accounts that mirror real-market trading conditions.

- Select a Strategy to Test: Choose a specific options trading strategy you’ve learned and want to practice.

- Execute Trades in a Simulated Environment: Place trades as you would in a live market, using virtual money.

- Analyze Your Performance: Track your trades, analyze your wins and losses, and identify areas for improvement.

The Future of Free Options Trading Training

The availability of free options trading training is constantly evolving, with new platforms and resources emerging to meet the growing demand for knowledge and accessible education. Here’s what the future holds:

- Increased Focus on Artificial Intelligence (AI): AI-powered tools can analyze vast datasets, identify patterns, and provide real-time insights, empowering traders to make data-driven decisions. Free resources will likely incorporate AI capabilities to enhance learning experiences.

- Personalized Learning Paths: As AI becomes more integrated, free learning platforms can offer customized learning plans tailored to individual needs and skill levels.

- Interactive and Immersive Learning Experiences: Educational platforms will continue to leverage technology to create interactive and immersive learning experiences, making options trading education more engaging and accessible.

Free Options Trading Training

Conclusion

Navigating the world of options trading can seem intimidating, but thanks to the abundance of free resources, mastering this complex market has become more accessible than ever before. By utilizing the educational platforms, brokerage resources, online communities, expert blogs, YouTube channels, and paper trading tools available, you can build a solid foundation of knowledge and gain the confidence to confidently navigate the options market. Remember, the key to success lies not only in acquiring knowledge but also in embracing a continuous learning mindset, adapting to market dynamics, and developing risk management strategies. Embrace this journey of learning and watch as your understanding of options trading grows with each step you take.