Introduction

In the fast-paced and complex world of financial markets, the role of technology has become increasingly pivotal. Algorithmic trading, or algo-trading, has emerged as a game-changer, automating the execution of trades based on predefined rules and parameters. Within this realm, algo-trading for options has gained significant traction, offering traders unparalleled opportunities to navigate the intricacies of options markets effectively.

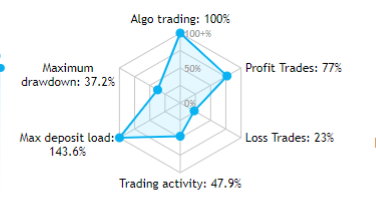

Image: www.mql5.com

Options, as derivative instruments, grant traders the right (but not the obligation) to buy or sell an underlying asset at a specified price on or before a specific date. By leveraging algo-trading techniques, traders can harness the power of algorithms to analyze market data, identify trading opportunities, and execute trades with precision and speed.

Unveiling the Potential of Algo-Trading for Options

At the heart of algo-trading for options lies the ability to optimize trading strategies, reduce manual errors, and minimize emotional biases that often plague human traders. Advanced algorithms can process vast amounts of real-time data, such as historical prices, market depth, and volatility, to make informed decisions on behalf of the trader.

The customizable nature of algo-trading allows traders to tailor algorithms to their specific trading goals, risk appetite, and market conditions. Whether it’s implementing sophisticated hedging strategies, exploiting arbitrage opportunities, or pursuing high-frequency trading, algo-trading provides the flexibility to adapt to diverse trading styles.

Demystifying Algo-Trading Techniques for Options

The wide array of algo-trading techniques available for options trading caters to the varying needs of traders. One common approach is statistical arbitrage, which seeks to exploit pricing inefficiencies between similar or related options contracts. Another technique, volatility trading, focuses on capturing profits from fluctuations in implied volatility.

More advanced algorithms employ machine learning and artificial intelligence (AI) to discern patterns and make predictions based on historical data. By leveraging AI’s data-driven insights, algo-trading systems can adapt to changing market dynamics in real-time, optimizing trading decisions and maximizing profitability.

Case Study: A Practical Application of Algo-Trading for Options

To illustrate the practical application of algo-trading for options, consider the following scenario: a trader seeks to construct a covered call strategy, where they sell (write) call options against an existing stock position they own. By using an algo-trading system, the trader can automate the process of identifying suitable call options to sell, taking into account factors such as strike price, expiration date, and implied volatility.

Moreover, the algo can monitor the performance of these options in real-time, adjusting positions or closing trades when predefined conditions are met. This level of automation frees the trader from the need for constant monitoring, enabling them to focus on other aspects of their trading strategy.

Image: www.angelone.in

Bridging the Gap Between Theory and Implementation: A Guide for Beginners

For those venturing into the world of algo-trading for options, a few essential considerations come to the fore:

1. Education and understanding: Gaining a thorough understanding of options trading, algo-trading principles, and different trading techniques is paramount.

2. Platform selection: Choosing a reputable algo-trading platform that aligns with your trading needs and offers necessary features is essential.

3. Backtesting and simulation: Before implementing algo-trading strategies live, it’s crucial to test and refine them using historical data and simulation tools.

4. Risk management: Establishing sound risk management practices, including position sizing, stop-loss orders, and hedging strategies, is non-negotiable.

Navigating the Regulatory Landscape of Algo-Trading

As algo-trading has become more prevalent, regulatory bodies worldwide have taken notice. It’s imperative for traders to remain aware of the evolving regulatory landscape and ensure compliance with applicable laws and regulations. These regulations may касаться areas such as trade reporting, best execution practices, and conflict of interest policies.

Algo For Options Trading

Conclusion

Algo-trading for options presents a powerful tool for traders seeking to enhance their trading efficiency, reduce risks, and exploit market opportunities. By embracing automation and leveraging advanced algorithms, traders can navigate the complexities of options markets more effectively, unlocking the potential for improved profitability. However, it’s crucial to approach algo-trading with education, due diligence, and a commitment to ongoing learning. By understanding the underlying principles, implementing sound risk management practices, and staying abreast of regulatory developments, traders can harness the power of algo-trading to elevate their options trading endeavors to new heights.