AFX options trading, also known as alternative futures contracts, has emerged as a transformative force within the financial markets, introducing a new era of flexibility and precision in the trading of derivatives. Unlike traditional futures contracts, which are standardized and have predetermined expiration dates, AFX options offer traders a tailor-made approach, allowing them to customize the contract’s specifications to suit their unique trading strategies and risk appetite. This article delves into the fascinating world of AFX options trading, exploring its history, key concepts, and the myriad of benefits it brings to investors and traders.

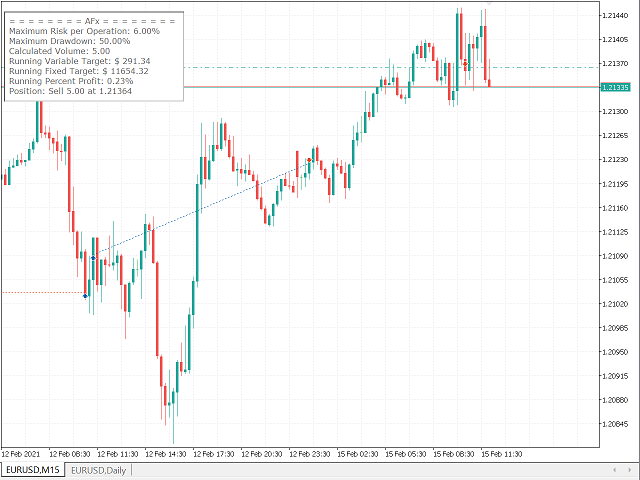

Image: www.mql5.com

AFX Options: A Historical Perspective

The concept of AFX options originated in the early 21st century in response to the growing demand for more flexible and efficient hedging instruments. Traditional futures contracts, while robust and widely traded, often proved inflexible for traders with specific needs or complex trading strategies. AFX options emerged as a solution to this issue, providing traders with the freedom to design contracts that precisely aligned with their investment goals and risk tolerance.

Core Concepts of AFX Options

AFX options are exchange-traded, standardized contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a certain date (expiration date). Unlike traditional futures contracts, AFX options offer two distinct types: call options and put options. Call options give the buyer the right to buy an asset at a predetermined strike price, while put options give the right to sell an asset at a specific price.

The price of an AFX option, commonly known as the premium, is influenced by various factors, including the underlying asset’s price, time to expiration, strike price, and market volatility. Traders can purchase AFX options for various underlying assets, including stocks, commodities, currencies, and indices.

Benefits and Applications of AFX Options

AFX options trading has gained immense popularity due to the numerous benefits it offers traders. Here are some of the key advantages:

Customization: AFX options allow traders to customize contract specifications to suit their specific needs and risk tolerance, including the underlying asset, strike price, and expiration date.

Enhanced Precision: The ability to tailor contracts enables traders to achieve greater precision in their trading strategies, allowing them to target specific market opportunities more effectively.

Improved Risk Management: AFX options provide versatile risk management tools, enabling traders to hedge against price fluctuations or speculate on future market movements with more flexibility and control.

Increased Profit Potential: By leveraging AFX options’ customization features, traders can potentially enhance their profit-making opportunities by capturing market trends and optimizing their positions according to changing market conditions.

Image: www.forexstrategiesresources.com

AFX Options in Practice

AFX options are traded on various exchanges worldwide, including the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). Traders can access these markets through brokerage firms and online trading platforms.

To illustrate the use of AFX options, consider a trader who anticipates a stock’s price to rise. They can purchase a call option with a strike price higher than the current market price and an expiration date that aligns with their investment horizon. If the stock’s price rises above the strike price before expiration, the option holder has the right to buy the stock at the locked-in strike price, potentially realizing a profit from the price difference.

Afx Options Trading

Conclusion

AFX options trading has revolutionized the derivatives market, empowering traders with unprecedented flexibility and precision in managing risk and pursuing profit-making opportunities. Its customizable nature and enhanced risk management capabilities make it an invaluable tool for sophisticated investors and traders alike. Understanding the concepts and benefits of AFX options empowers traders to navigate complex market environments and develop robust trading strategies that align with their individual financial goals. As the financial markets continue to evolve, AFX options are poised to remain a cornerstone of modern trading, empowering traders to shape the future of financial decision-making.