Introduction

In the realm of financial markets, options trading stands as a potent instrument that can amplify investment returns. Amidst the vast array of options strategies, the ace trading option emerges as a beacon of precision and profitability. This elite trading strategy empowers traders with the potential to maximize gains while minimizing risks, propelling them towards financial success.

Image: www.cryptowisser.com

Unveiling the Ace Trading Option

Ace trading options embody a sophisticated strategy that involves simultaneously buying and selling multiple options contracts with varying strike prices and expiration dates. This intricate interplay of options creates a “synthetic” position that seeks to capitalize on the direction and volatility of the underlying asset. Ace traders exploit inefficiencies in the options market by crafting tailored positions that capture specific market conditions.

Principles that Govern Ace Trading

The ace trading option strategy rests upon a foundation of meticulously calibrated elements. Paramount among these are:

-

Careful Selection of Options: Ace traders meticulously evaluate the strike prices and expiration dates of options contracts to optimize position performance. They meticulously analyze underlying asset behavior, volatility trends, and market sentiment before selecting the most suitable options.

-

Strategic Position Sizing: The number of options contracts bought and sold in an ace trading position is crucial. Ace traders leverage precise calculations and risk management principles to determine optimal position sizes for their desired leverage and risk tolerance.

-

Timing Is Paramount: Ace trading demands adeptness in timing both the entry and exit points of the strategy. Traders monitor market conditions diligently to identify opportune moments to initiate and unwind positions, aiming to maximize gains and mitigate potential losses.

Navigating Market Dynamics with Ace Trading

Ace trading options excel in capturing specific market conditions, offering traders a versatile tool to respond to diverse market scenarios.

-

Tailwinds of Volatility: Ace traders capitalize on increased market volatility, as heightened asset price fluctuations amplify the potential returns from well-positioned options strategies.

-

Steering through Trends: The ace trading option strategy is adept at anticipating and exploiting market trends. Traders leverage the synthetic position it creates to capture directional movements in the underlying asset.

-

Sailing Against the Storm: Ace trading options can navigate even adverse market conditions. By constructing positions that hedge against downturns, traders can potentially generate income or mitigate losses in challenging markets.

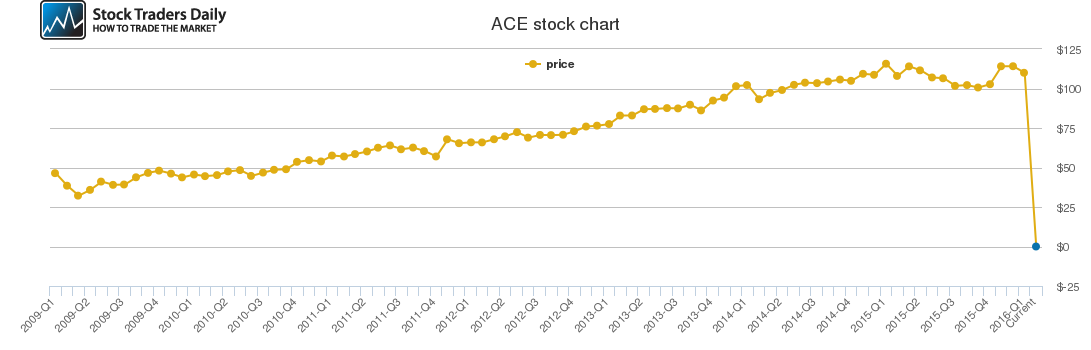

Image: www.stocktradersdaily.com

Proven Strategies for Ace Traders

Ace trading options offer a range of strategies tailored to different market conditions and risk appetites. Among the most popular are:

-

Bull Spread: A bullish strategy that involves buying an in-the-money call option and selling an out-of-the-money call option. It benefits from rising asset prices and moderate volatility.

-

Bear Spread: A bearish strategy conversely involves selling an in-the-money put option and buying an out-of-the-money put option. It thrives in falling asset prices and moderate volatility.

-

Iron Condor: A neutral strategy that creates a position with simultaneously bought and sold calls and puts at varying strike prices. It profits from low volatility and potentially generates income in range-bound markets.

Evolving Landscape of Ace Trading

The dynamic nature of financial markets necessitates continuous adaptation in ace trading options. Recent advancements include:

-

Technology-Driven Advancements: Sophisticated trading platforms and tools have revolutionized ace trading, providing traders with unprecedented access to market data, analytical capabilities, and automated execution.

-

Data-Driven Strategies: Ace traders increasingly harness big data and machine learning to optimize their strategies. These advanced techniques enhance position selection and risk management, leading to improved performance.

-

Enhanced Risk Management: The ever-evolving risk landscape has led to the development of sophisticated risk management tools specifically tailored to ace trading options. These tools help traders identify, quantify, and mitigate potential risks, ensuring the preservation of capital.

Unlocking the Power of Ace Trading for Enhanced Financial Performance

Ace trading options empower traders with a potent arsenal of strategies to navigate the complexities of financial markets. By masterfully combining the principles, techniques, and advanced tools outlined in this article, traders can harness the full potential of ace trading options to:

-

Maximize Returns: Ace trading options provide unparalleled opportunities to amplify investment returns, outpacing traditional investment methods.

-

Mitigate Risks: The inherent flexibility of ace trading options strategies allows traders to construct positions that align with their risk appetite, offering protection against adverse market movements.

-

Enhance Flexibility: Ace trading options strategies cater to diverse market conditions, offering traders the agility to adapt to changing market dynamics.

Ace Trading Option

Conclusion

The ace trading option strategy stands as a pinnacle of options trading, offering discerning traders the tools to achieve heightened financial success. Its astute combination of strategy, timing, and risk management enables traders to navigate market complexities and capture opportunities. By embracing the principles, techniques, and advancements outlined in this comprehensive guide, traders can harness the power of ace trading options to unlock enhanced returns, mitigate risks, and embark on a journey towards financial empowerment.