Introduction:

Image: spencerront1983.blogspot.com

Unlocking Lucrative Trading Opportunities for H-4 Visa Holders

As a holder of an H-4 visa, navigating the complexities of the financial landscape can be a daunting task. However, with the advent of the 1099 H-4 visa option trading strategy, H-4 visa holders are now presented with an unprecedented opportunity to participate in the dynamic world of option trading. This comprehensive guide will delve into the intricacies of 1099 H-4 visa option trading, empowering you with the knowledge and insights you need to venture into this realm.

Understanding the Basics of Option Trading

What are Options Contracts?

An option contract is a financial instrument that grants the buyer, but not the obligation, to buy or sell an underlying asset, such as a stock or commodity, at a predetermined price within a specified timeframe. This flexibility empowers the buyer to capitalize on price fluctuations in the underlying asset.

Types of Option Contracts

There are two primary types of option contracts: calls and puts. A call option grants the buyer the right to buy an underlying asset at a set price, while a put option grants the buyer the right to sell a specified asset at a predetermined price.

Image: formquality.com

Benefits of Option Trading

Option trading offers several potential benefits, including:

- Leverage: Options provide a cost-effective way to gain exposure to potential price movements in the underlying asset.

- Limited Risk: Unlike buying or selling the underlying asset directly, the maximum potential loss for option buyers is limited to the premium paid.

- Income Generation: Options strategies, such as selling covered calls and puts, can generate additional income.

1099 H-4 Visa Option Trading

Eligibility and Requirements

To engage in 1099 H-4 visa option trading, individuals must meet specific eligibility criteria. The primary requirement is that the H-4 visa holder must be the spouse of an H-1B visa holder employed in a qualifying occupation. Additionally, the H-4 visa holder must possess an Employment Authorization Document (EAD) with unrestricted employment authorization.

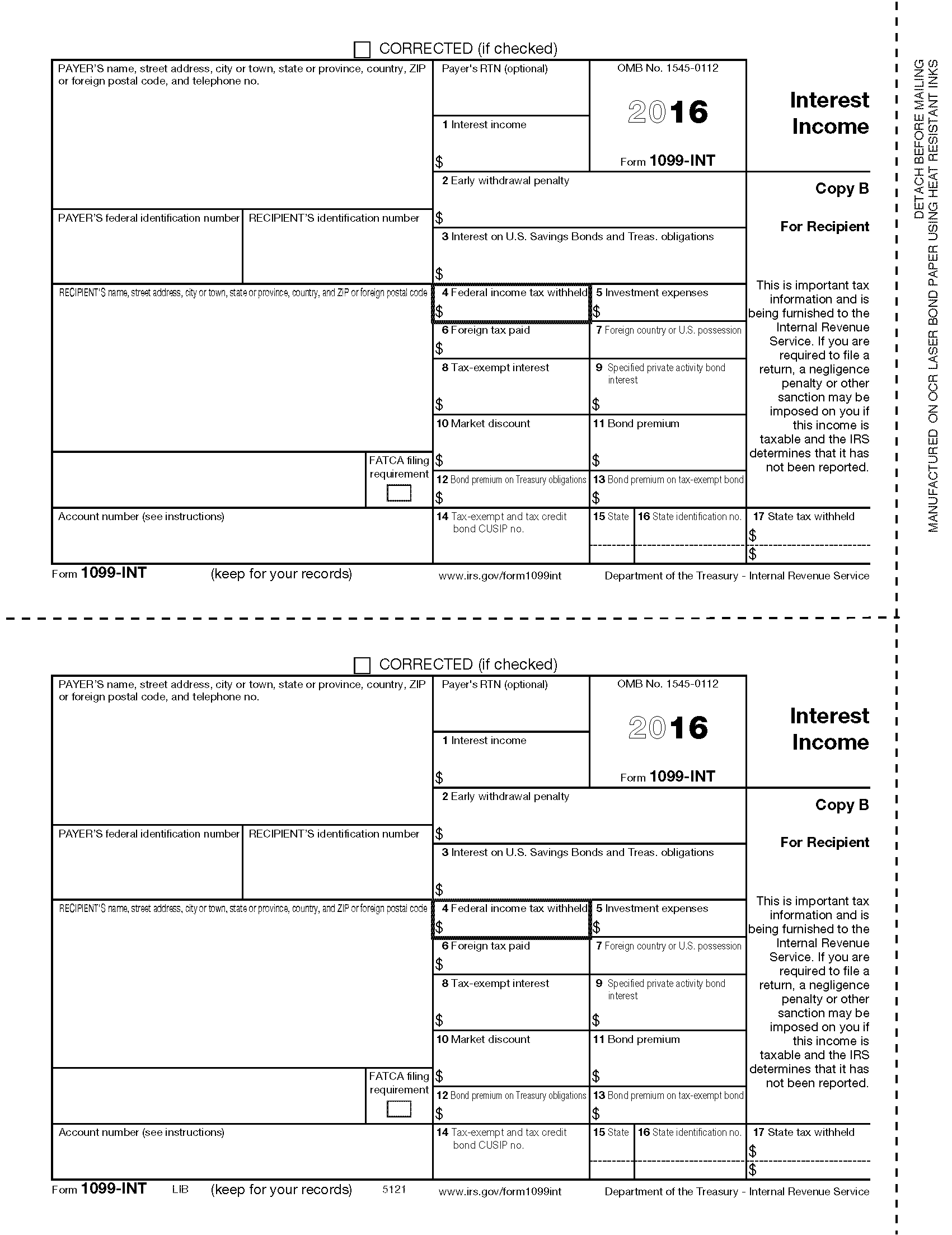

Tax Considerations

As a 1099 contractor, it is crucial to understand the tax implications associated with option trading income. 1099 income is subject to self-employment tax, which includes both income tax and the employee share of FICA taxes (Social Security and Medicare).

Best Practices for 1099 H-4 Visa Option Trading

Conduct Thorough Research

Before entering the world of option trading, it is imperative to conduct thorough research on various aspects, including market dynamics, trading strategies, and risk management techniques.

Understand and Manage Risk

Options trading involves inherent risk, which must be carefully understood and managed. One should only deploy funds they can afford to lose and develop a solid risk management plan.

Seek Professional Guidance

If needed, consider seeking guidance from an experienced financial advisor or option trading mentor to navigate the intricacies of the market and make informed trading decisions.

Conclusion:

1099 H4 Visa Option Trading

Enhancing Financial Possibilities through H-4 Visa Option Trading

By leveraging the 1099 H-4 visa option trading strategy, H-4 visa holders harness a unique opportunity to participate in the financial markets and potentially earn income. By understanding the basics of option trading, fulfilling the eligibility requirements, and following best practices, H-4 visa holders can empower themselves with a powerful tool to enhance their financial well-being. As always, conducting thorough research and seeking professional guidance when necessary can optimize trading performance and mitigate potential risks.