Introduction

The thrilling yet nuanced realm of options trading offers a plethora of distinctions from conventional stock trading. For uninitiated enthusiasts, the allure lies in its potential to amplify both profits and risks, making it a double-edged sword. This comprehensive article delves into the unique characteristics of options trading, exploring the essential differences that set it apart from its ubiquitous counterpart. Join us as we navigate the intricacies of this fascinating trading realm, deciphering its complexities with clarity and precision.

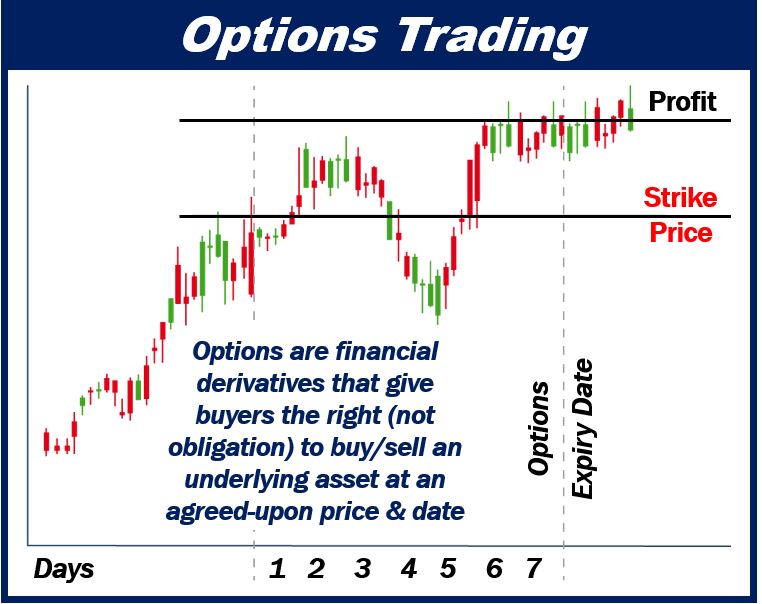

Image: derivfx.com

What is Options Trading?

Beginning with the fundamentals, options are financial instruments that furnish traders with the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined strike price on or before a specific expiration date. Unlike futures contracts, which lock in commitments to trade a specific quantity at a particular time, options provide greater flexibility due to their inherent right to decline exercising the contract.

Key Differences between Options and Stocks

-

Nature of Ownership: Options merely convey the right to buy or sell the underlying asset, while stocks represent direct ownership in the company.

-

Risks and Rewards: Options trading amplifies both potential profits and risks compared to stock trading, owing to the flexibility of choice and the utilization of leverage.

-

Capital Requirements: Options typically necessitate lower capital upfront as they don’t involve immediate full ownership of the underlying asset.

-

Holding Period: Options have predetermined expiration dates, ranging from a few days to several months, while stocks can be held indefinitely.

-

Flexibility: Options provide traders with a wider array of strategies, ranging from hedging to speculating, due to their inherent flexibility.

-

Complexity: Options trading demands a deeper understanding of market dynamics, volatility, and option-specific attributes compared to stock trading.

-

Time Sensitivity: The value of options decays over time due to their finite lifespans; this aspect adds an extra layer of complexity to options trading.

-

Exercise Price: Unlike stocks, options have predetermined strike prices, which serve as the reference point for exercising the option to buy or sell.

-

Leverage: Options can serve as highly leveraged instruments, amplifying potential profits but also heightening potential losses.

-

Trading Mechanics: Options involve unique trading strategies and terminology, including bid-ask spreads, open interest, and option Greeks.

Latest Trends in Options Trading

Contemporary options trading is undergoing a dynamic transformation shaped by technological advancements and regulatory changes. Here are some notable trends:

-

Algorithmic Trading: Electronic trading platforms equipped with sophisticated algorithms are reshaping options trading, enabling faster executions and minimizing market impact.

-

Increased Volatility: Geopolitical and economic uncertainties continue to trigger elevated volatility, creating both opportunities and challenges for options traders.

-

Regulatory Changes: Global regulators are paying closer attention to options trading, striving to ensure fair market governance and investor protection.

-

Emerging Markets: Options trading is expanding its presence into burgeoning emerging markets, offering new avenues for investment and growth.

Image: marketbusinessnews.com

Tips and Expert Advice for Options Traders

Navigating the complexities of options trading requires finesse and expertise. Seasoned traders offer the following tips and advice:

-

Understand the Risks: Thoroughly comprehend the potential risks associated with options trading before venturing into it.

-

Start Small: Begin with modest trades to gain a practical understanding of options trading dynamics and implications.

-

Research and Educate: Diligently study market trends, volatility patterns, and option-specific attributes to enhance your decision-making skills.

-

Trade with a Strategy: Develop a defined options trading strategy aligned with your risk tolerance and financial objectives.

-

Seek Professional Guidance: Consider consulting with a seasoned options trading advisor or broker to refine your approach and gain valuable insights.

Frequently Asked Questions about Options Trading

Q: What is the difference between a call option and a put option?

A: A call option grants the right to buy, while a put option grants the right to sell.

Q: What factors influence option prices?

A: Underlying asset price, time to expiration, volatility, interest rates, and supply and demand.

Q: What is the Greek alphabet used for in options trading?

A: Greek letters are employed to represent specific option attributes, influencing their price and behavior.

Q: Can you lose more money than you invest in options trading?

A: Yes, options trading involves leverage, which amplifies both profits and losses.

Q: How can I reduce risk in options trading?

A: Employ strategies such as diversification, hedging, and limiting position sizes.

10 Things Are Different About Trading Options

Conclusion

Options trading, with its unique set of traits and enigmatic complexities, presents traders with a fascinating yet demanding investment arena. We invite you to delve deeper into this thrilling realm, where careful analysis, adept strategy, and expert guidance serve as indispensable tools to navigate its inherent risks and unlock its captivating rewards. Are you prepared to embrace the transformative power of options trading and forge your path to financial success?