My journey into options trading began as a rollercoaster of emotions, marred by losses and fleeting triumphs. However, a pivotal moment arrived when I stumbled upon a mentor who shared invaluable insights. By embracing the right strategies, I transformed my fortunes and discovered the key to consistent profitability.

Image: www.pinterest.com

In this comprehensive guide, I’ll unveil the transformative lessons I’ve learned, providing you with a roadmap to harness the potential of options trading. Whether you’re a seasoned trader or just starting your adventure, this article will equip you with the knowledge and strategies you need to maximize your profits.

Understanding the Power of Options

Options are financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a given timeframe. This flexibility makes them a versatile tool for navigating the unpredictable market landscape.

Types of Options Contracts

- Call options give the holder the right to buy the asset.

- Put options empower the holder to sell the asset.

Benefits of Options Trading

- Limited risk: Traders only risk the premium paid for the option.

- Leverage: Options contracts leverage the potential returns compared to owning the underlying asset outright.

- Flexibility: Traders can customize strategies based on their risk tolerance and market outlook.

Image: www.tradingsim.com

Maximizing Profits: Proven Strategies

The key to unlocking profits in options trading lies in adopting a disciplined approach. Here’s a breakdown of effective trading strategies:

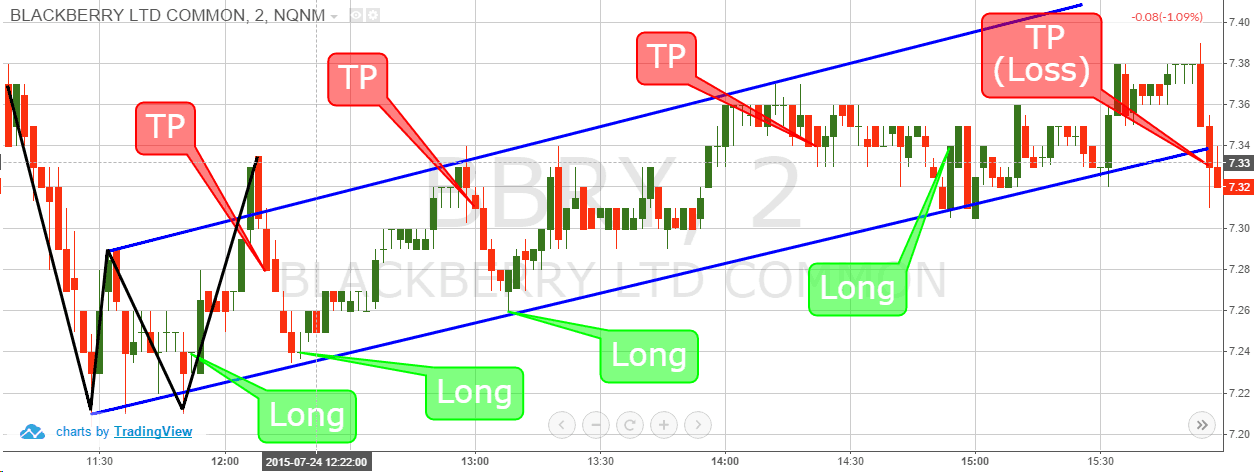

Breakout Trading

Breakout trading involves identifying stocks or assets that break out of pre-defined price ranges, signaling potential moves. By buying options contracts in the direction of the breakout, traders capitalize on the momentum.

Covered Call Strategy

Covered call strategy involves selling (or “writing”) call options against an underlying asset that you already own. The premium received from selling the options generates additional income, while the potential upside is capped at the option’s strike price.

Iron Condor Strategy

Iron condor strategy is a neutral strategy that seeks to capitalize on low volatility. By simultaneously selling a call option and buying a call option at a higher strike price, and selling a put option and buying a put option at a lower strike price, traders aim to collect net premiums if the underlying asset’s price remains within a specified range.

Navigating Market Trends and Developments

Staying abreast of market trends and developments is crucial for successful options trading. Monitor economic indicators, earnings reports, and industry news to gauge market sentiment and identify potential trading opportunities.

Leverage social media platforms and online forums to gather insights and connect with experienced traders. Don’t hesitate to consult with a financial advisor or mentor if you encounter complexities along your trading journey.

Expert Advice for Enhanced Results

- Manage risk: Set precise stop-loss orders to protect against substantial losses.

- Control emotions: Trading should be driven by logic, not impulsive reactions.

- Research the underlying asset: Understand the company, its industry, and the factors influencing its stock price.

Tips to Enhance Your Trading Performance

- Choose options contracts with reasonable premiums based on market conditions.

- Select strike prices that align with your risk tolerance and expected market movements.

- Monitor the Greeks, such as Delta and Theta, to track the option’s sensitivity to price movements and time decay.

Frequently Asked Questions (FAQs)

Q: How much capital do I need to start options trading?

A: The required capital varies depending on the chosen options contract, premium price, and trading volume. A minimum of $1,000 is recommended for starters.

Q: What are the risks involved in options trading?

A: The primary risk is losing the premium paid for the option, while advanced strategies may involve additional risks.

Q: Can options trading generate quick profits?

A: While options trading offers high potential, consistent profitability requires skill, patience, and a disciplined trading plan.

Profit In Options Trading

Conclusion

Profitability in options trading stems from strategic decision-making, informed by comprehensive knowledge and a disciplined approach. By implementing the strategies outlined in this guide, you can harness the power of options and unlock the potential for lucrative returns.

Are you ready to embark on a rewarding journey in options trading? Embrace the principles shared here, and let the journey begin!