Trading options can be a rewarding endeavor, offering investors the potential for substantial returns. However, it also carries a certain level of risk, making it essential to approach the market with a comprehensive understanding of the fundamentals. In this article, we delve into the world of options trading, providing a practical guide to comprehending and executing options strategies.

Image: www.myfinopedia.com

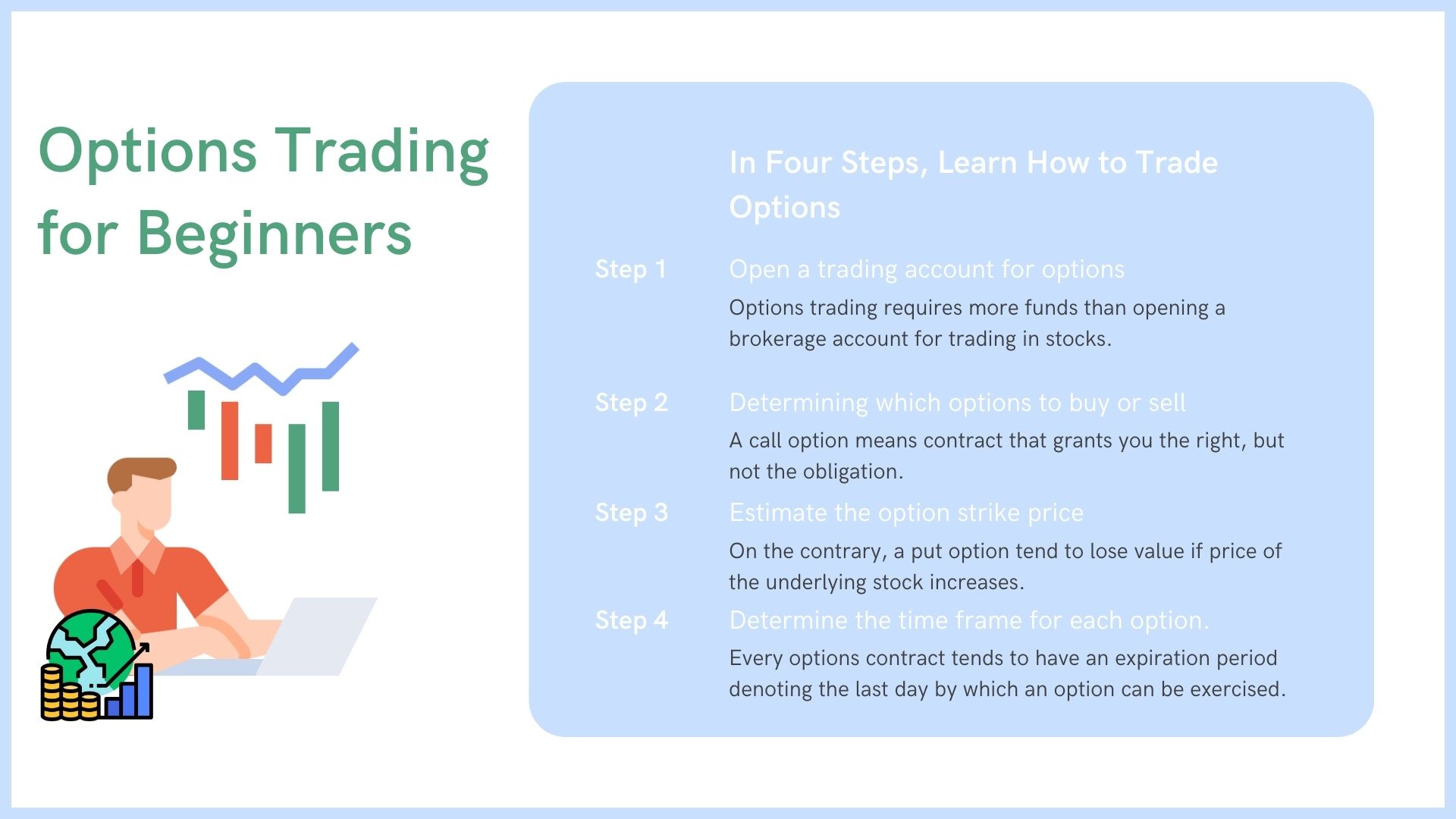

Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified expiration date. Essentially, they offer investors a means of speculating on the future price movement of an asset without directly owning it.

Fundamentals of Options Trading

To navigate the options market effectively, it’s crucial to grasp certain core principles:

Option Types

There are two primary types of options: calls and puts. Call options give the holder the right to buy an asset, while put options confer the right to sell.

Strike Price

This refers to the predetermined price at which the option holder can buy or sell the underlying asset.

Image: navi.com

Expiration Date

Each option contract carries an expiration date, which signifies the last day the option can be exercised.

Premium

When purchasing an option, the investor pays a premium, representing the cost of acquiring the right to buy or sell the asset at the strike price.

Strategies for Practical Options Trading

Options offer a diverse range of strategies, each with its own unique risk and reward profile:

Covered Call Writing

This entails selling call options against an underlying asset that the investor already owns. The premium received compensates for the potential downside risk.

Protective Put Buying

Involves purchasing put options to protect a portfolio from losses. The premium paid serves as insurance against a potential decline in the underlying asset’s price.

Bull Call Spread

Consists of buying one call option at a lower strike price and selling another call option at a higher strike price. The strategy profits when the asset’s price rises above the higher strike price.

Tips and Expert Advice

To enhance your options trading success, consider these valuable tips:

Start with Paper Trading

Gain experience and confidence by practicing options trading in a simulated environment before venturing into the live market.

Understand the Risks

Recognize that options trading carries inherent risks. Only commit capital you can afford to lose.

Set Realistic Expectations

Options trading is not a quick path to riches. Develop realistic expectations and approach the market with a long-term perspective.

FAQ on Practical Options Trading

Here are answers to some frequently asked questions about options trading:

Q: What is an option premium?

A: The premium is the price paid to acquire an option contract.

Q: Can I make money on options trading?

A: Yes, it’s possible to profit from options trading, but it requires skill, knowledge, and a disciplined approach.

Q: What is the difference between a call and a put option?

A: Call options give the right to buy an asset, while put options confer the right to sell.

Practical Options Trading

Conclusion

Options trading presents a dynamic and potentially lucrative opportunity for investors. However, it’s essential to understand the mechanics, risks, and strategies involved. By incorporating the principles outlined in this guide, you can enhance your chances of success in the options market. Are you ready to embrace the world of options trading?