Options trading has emerged as a lucrative way to generate income in the financial markets. But with countless strategies and unending terminology, it can be overwhelming for beginners. This comprehensive guide will empower you to navigate the world of options trading, particularly focusing on the art of winning with weekly options.

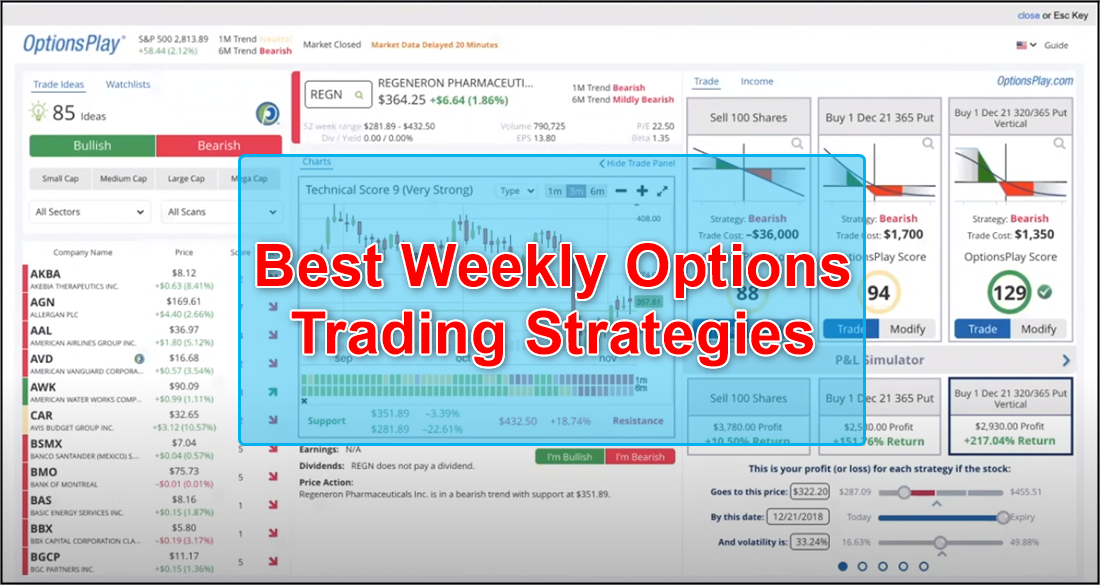

Image: stockscreenertips.com

What are Weekly Options?

Weekly options, as the name suggests, are options contracts that expire every week. Unlike traditional options that expire monthly, weekly options provide traders with a shorter-term exposure to the underlying asset. This shorter lifespan often translates to higher volatility, which can be both an opportunity and a risk for traders.

Benefits of Trading Weekly Options

- Reduced Holding Time: With weekly options expiring every week, traders can take advantage of short-lived market trends and reduce the risk of holding positions overnight.

- Higher Volatility: The shortened lifespan of weekly options introduces more uncertainty, leading to higher volatility. Skilled traders can capitalize on these fluctuations for potential profits.

- Efficient Capital Allocation: The shorter duration of weekly options reduces the capital requirement compared to longer-term options contracts. This allows traders to test different strategies with less capital at risk.

How to Win with Weekly Options

Consistently profiting from weekly options requires a combination of knowledge, skills, and discipline. Here’s a step-by-step guide to help you master this art:

1. Understand the Underlying Asset: Before trading any options contract, it’s crucial to have a thorough understanding of the underlying security. Research the company’s financial health, industry outlook, and market sentiment to make informed decisions.

2. Choose the Right Broker: Not all brokers offer trading in weekly options. Find a reputable broker that provides a user-friendly trading platform, low fees, and access to the desired options chain.

3. Select the Appropriate Option Type: There are two primary types of options: calls and puts. Calls give you the right (but not the obligation) to buy the underlying asset at a specified price. Puts provide the right to sell the asset. Determine the most suitable option type based on your market outlook.

4. Identify Trading Opportunities: Use technical analysis to spot potential entry and exit points. Study price charts, indicators, and market patterns to identify trends and areas of support and resistance.

5. Manage Risk Wisely: Options trading involves significant risk. Understand the potential for losses and use stop-loss orders to protect your capital. Never risk more than you can afford to lose.

6. Trade with Discipline: Emotions can cloud judgment in the financial markets. Develop a trading plan that defines your strategies, entry and exit criteria, and risk management parameters. Stick to the plan to maintain discipline and achieve consistent results.

7. Seek Continuous Education: The world of options trading is constantly evolving. Stay updated with the latest strategies and market insights by reading books, attending webinars, and connecting with experienced traders.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: thewaverlyfl.com

Options Trading How To Win With Weekly Options

Conclusion

Options trading, particularly with weekly options, can be a rewarding endeavor. By understanding the concepts, choosing the right strategies, and maintaining discipline, you can leverage the power of this financial instrument to enhance your investment portfolio. Remember that success in trading requires patience, perseverance, and a constant pursuit of knowledge. Embrace the journey, learn from your experiences, and conquer the market with confidence.