Decoding the enigma of weekly options trading can be a daunting feat for beginners, but with the right approach, you can turn this market into a lucrative playground. Whether you’re a seasoned trader or new to the options arena, this comprehensive guide will equip you with insider knowledge, empowering you to navigate the unique landscape of weekly options and unlock its profit potential.

Image: bojorquezstentartudge.blogspot.com

What Are Weekly Options?

Unlike traditional options, which expire on a monthly basis, weekly options hold a shorter fuse, expiring every Friday. This faster-paced environment introduces a unique set of opportunities and risks that require prudent strategies and nimble execution. The expiration date of weekly options enables traders to take advantage of shorter-term market movements and capitalize on intraweek volatility.

Benefits of Trading Weekly Options

- Reduced Risk: The compressed time frame of weekly options minimizes the impact of market upheavals compared to longer-term options.

- Greater Flexibility: Flexible expiration dates allow traders to customize their strategies to match their risk tolerance and market outlook.

- Amplified Volatility: Weekly options tend to exhibit higher volatility, providing avenues for higher returns.

- Faster Profit Realization: The quicker option decay empowers traders to capture profits or limit losses in a matter of days.

Core Strategies for Trading Weekly Options

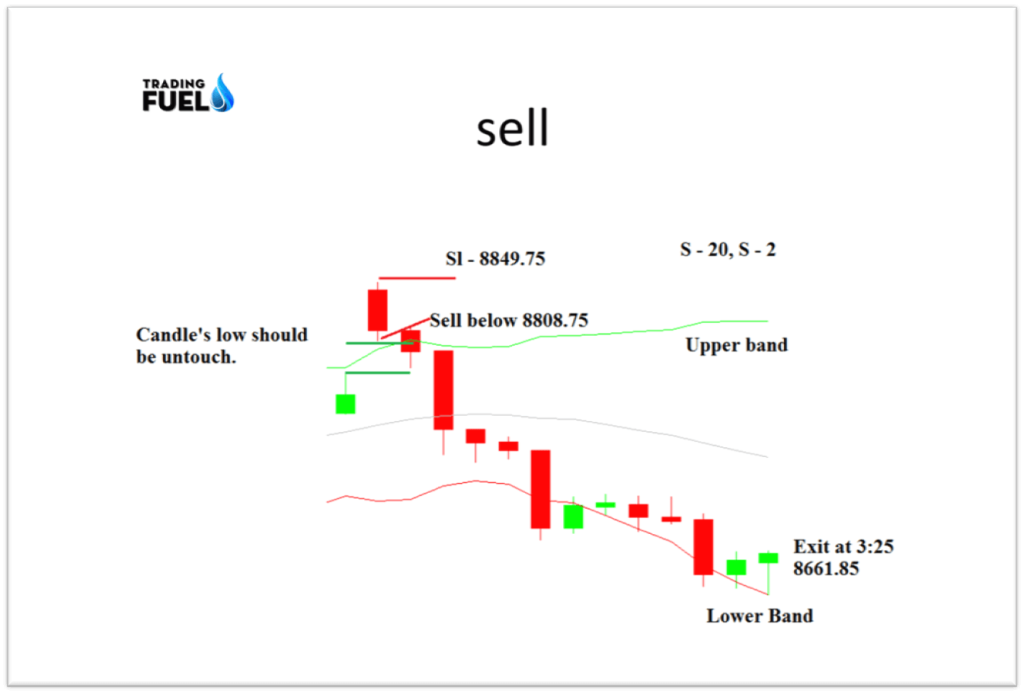

- Trend Following Options: Ride the wave of market momentum by selecting options aligned with the prevailing trend direction.

- Range Trading Options: Leverage the support and resistance levels within defined price ranges to identify suitable options.

- Implied Volatility Arbitrage: Capitalize on discrepancies between the implied volatility of options and the market’s realized volatility.

Image: www.xtremetrading.net

Risk Management for Weekly Options

- Time Decay Risk: The accelerated time decay of weekly options can erode option value rapidly, particularly in range-bound markets.

- Market Risk: Weekly options are directly impacted by the underlying asset’s price movements, increasing exposure to market volatility.

- Liquidity Risk: Weekly options are not as liquid as their monthly counterparts, making it essential to monitor volume and open interest before entering positions.

Insiders Guide To Trading Weekly Options

Image: stockscreenertips.com

Practical Tips for Successful Weekly Options Trading

- Research and Due Diligence: Understand the underlying market and the factors driving its movement.

- Disciplined Trade Management: Define clear entry and exit points, and stick to your strategy regardless of market fluctuations.

- Risk Monitoring: Monitor the progress of your trades and adjust your position accordingly to minimize losses.

- Stay Updated: Keep track of market developments, economic indicators, and earnings reports that can influence option prices.

Navigating the world of weekly options trading requires a blend of knowledge, strategy, and risk management prowess. Armed with the insights provided in this insider guide, you can confidently venture into this exhilarating market and uncover its wealth of profit-making opportunities.