Introduction to Option Trading: Unveiling a World of Opportunities

In the bustling realm of the stock market, options emerge as a dynamic tool for savvy investors seeking to harness market movements and enhance their financial outcomes. Options trading, a strategy with multifaceted applications, beckons both seasoned traders and aspiring enthusiasts alike. As we embark on this journey, let us delve into the intricacies of option trading, unlocking its potential and empowering you to navigate the complexities of the financial landscape.

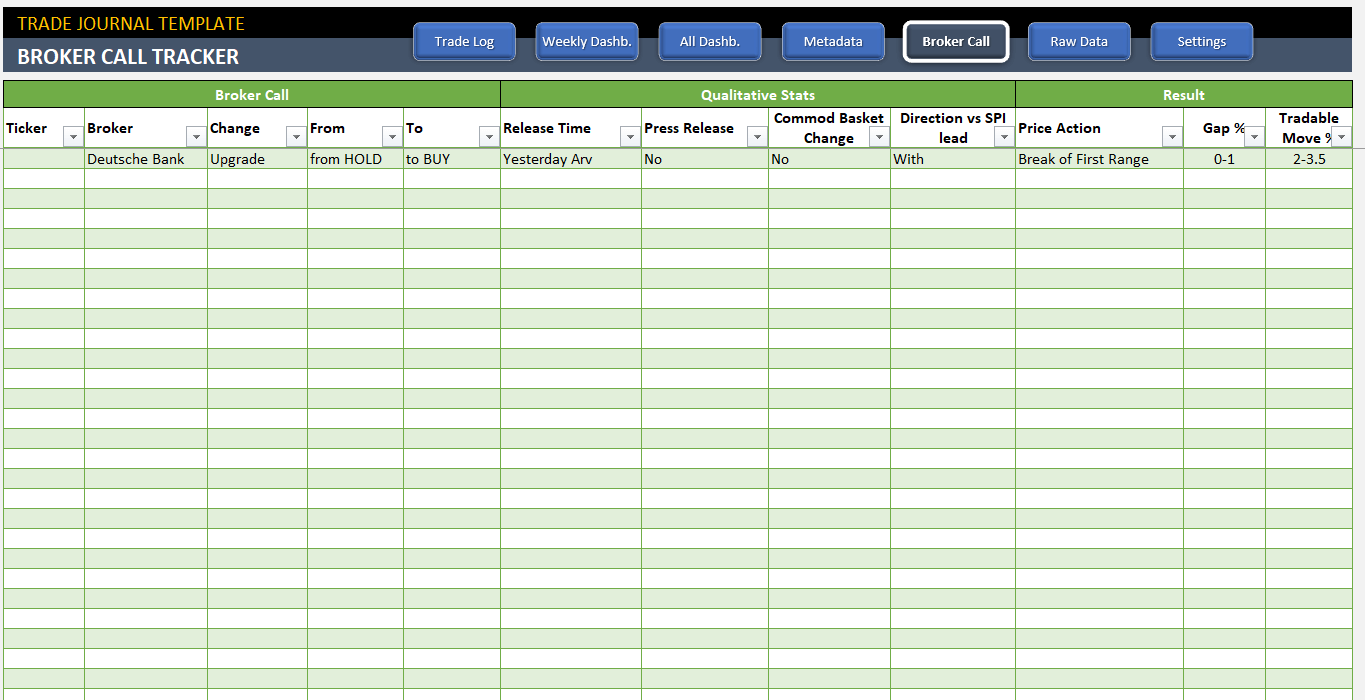

Image: templates.udlvirtual.edu.pe

Option trading grants investors the privilege of acquiring contracts known as options, which confer the right but not the obligation to buy (call options) or sell (put options) underlying assets at predetermined prices on or before a specified expiration date. These contracts serve as valuable tools for risk management, speculation, and income generation, opening avenues for adept traders to capitalize on market fluctuations.

Understanding the Mechanics of Option Trading

In the realm of option trading, a plethora of choices awaits investors, ranging from underlying assets such as stocks, bonds, and commodities to varied option types designed to adapt to diverse trading objectives. Call options empower traders to capitalize on expected price increases, while put options provide a hedge against potential declines. Understanding the intrinsic value of options, influenced by factors like the underlying asset’s price, time to expiration, and volatility, is fundamental to successful trading.

Moreover, option pricing models, such as the renowned Black-Scholes model, offer traders a framework to assess the fair value of options and make informed decisions. With a solid grasp of these fundamentals, traders can navigate the intricacies of option trading and leverage its multifaceted opportunities.

Latest Trends Shaping Option Trading

The world of option trading is in a state of constant evolution, influenced by emerging market dynamics and technological advancements. Artificial intelligence and machine learning algorithms are transforming the landscape, enhancing traders’ ability to analyze vast amounts of data and execute trades with precision and efficiency.

Additionally, the increasing popularity of exchange-traded funds (ETFs) and other complex financial instruments has created new opportunities for option traders to diversify their portfolios and manage risk. Keeping abreast of these evolving trends is crucial for traders seeking to stay ahead of the curve and reap the benefits of option trading.

Expert Advice for Successful Option Trading

The journey of a successful option trader is paved with knowledge, experience, and unwavering discipline. Seasoned traders emphasize the significance of thorough research, understanding the intricacies of different option types, and carefully evaluating market conditions before entering a trade.

Effective risk management strategies are paramount in option trading, safeguarding traders from potential losses. Prudent position sizing, meticulous stop-loss orders, and a comprehensive understanding of volatility and its impact on option prices are essential tools in a trader’s arsenal.

:max_bytes(150000):strip_icc()/GettyImages-1086745334-3add012e6f284e6b9196e3cfd37e7bb4.jpg)

Image: www.investopedia.com

Frequently Asked Questions on Option Trading

Embarking on the path of option trading often sparks a multitude of inquiries. Here are answers to some commonly asked questions:

- Q: What is the difference between a call option and a put option?

A: Call options confer the right to buy an underlying asset at a predetermined price, while put options grant the right to sell. - Q: What factors influence the price of an option?

A: The underlying asset’s price, time to expiration, volatility, and interest rates play key roles in determining option prices. - Q: How can I calculate the potential profit or loss from an option trade?

A: Option pricing models, like Black-Scholes, provide a framework for estimating potential outcomes based on input variables.

Option Trading Stock Market

Conclusion: Unveiling the Path to Option Trading Mastery

Delving into the realm of option trading unveils a world of opportunities, empowering investors to harness market movements and enhance their financial prospects. Whether you are an experienced trader or just starting your journey, a comprehensive understanding of option trading strategies and risk management techniques is essential for success.

So, ask yourself: are you ready to embrace the potential of option trading? The path to mastery awaits those who dare to delve into its complexities and seize the boundless opportunities it holds.