Embarking on the Option Trading Journey

The dynamic realm of option trading holds immense potential for savvy investors seeking to harness risk and reward. As a seasoned option trader, I’ve witnessed firsthand the transformative power of a meticulously crafted trading plan. In this post, I’ll share my invaluable insights and provide a comprehensive example of an option trading plan to help you embark on your trading journey with confidence.

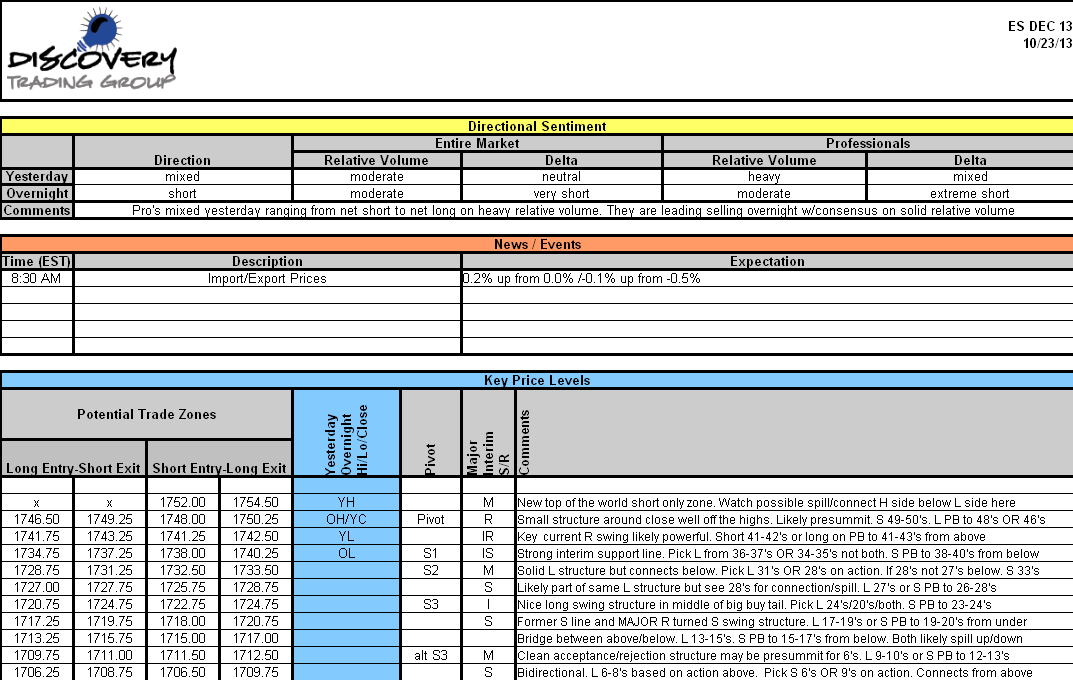

Image: discoverytradinggroup.com

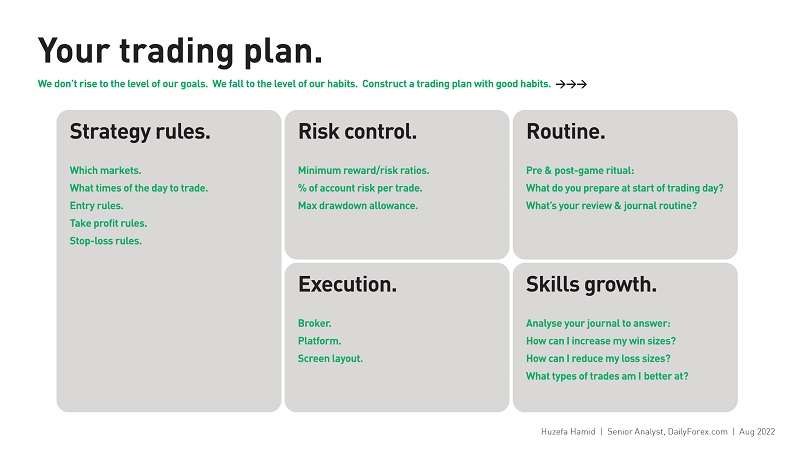

Defining Your Trading Strategy

Your trading plan should revolve around a well-defined strategy that aligns with your financial goals, risk tolerance, and market understanding. Begin by identifying the specific options strategies you’ll employ, such as buying calls or selling puts. Determine the market conditions that trigger your trades, whether it’s a specific stock price movement or a technical indicator. Clearly define your entry and exit points, including the specific price levels and time frames involved.

Managing Risk and Position Sizing

Risk management is paramount in option trading. Estimate the potential profits and losses for each trade and ensure your position size is appropriate for your risk appetite. Consider stop-loss orders to limit potential losses and establish clear rules for adjusting your position based on market movements.

Execution and Discipline

Effective execution is crucial to capturing profit and mitigating risk. Choose a reputable brokerage firm that offers a robust trading platform and reliable execution services. Adhere strictly to your defined trading plan and avoid impulsive decisions. Discipline is the cornerstone of successful trading, so always remain within the boundaries you’ve established.

Image: worleyhouseblog.com

Monitoring and Performance Evaluation

Regularly review your trading performance to identify areas for improvement. Keep a detailed trading journal to track your trades, profits, losses, and any deviations from your plan. Analyze your results over time and make adjustments as necessary to enhance your strategy and risk management techniques.

The Power of Education and Community

Continuously expand your knowledge and seek mentorship from experienced traders. Attend workshops, study option trading books, and engage in online forums to connect with like-minded individuals. Sharing insights and experiences can accelerate your learning and lead to improved decision-making.

Expert Tip: Breaking Down Option Trading Strategies

Option trading strategies can be broadly classified into three categories: buying calls for potential stock appreciation, selling calls to profit from a drop in volatility, or selling puts to capitalize on a rise in volatility. Each strategy carries its own risk-reward profile, so choose the ones that best align with your goals.

Insider Insight: The Psychology of Option Trading

Option trading can be a highly emotional endeavor. Avoid letting greed or fear cloud your judgment. Maintain objectivity by defining your rules and limits in advance. Remember that even the most experienced traders experience setbacks. Learn from your mistakes and continually refine your approach to achieve long-term success.

Frequently Asked Questions about Option Trading

-

Q: What is the minimum amount of capital needed to start option trading?

A: Capital requirements vary depending on the brokerage firm, but generally, several thousand dollars are recommended for beginners. -

Q: Can option trading generate income?

A: Yes, option trading can provide a potential source of income, but it’s not guaranteed and requires a strategic approach and proper risk management. -

Q: Which options trading strategy is best for beginners?

A: Covered calls and cash-secured puts are often recommended for beginners due to their relatively lower risk profiles. -

Q: How can I maximize my chances of success in option trading?

A: Develop a comprehensive trading plan, educate yourself continuously, manage risk effectively, and maintain discipline in your approach.

Option Trading Plan Example

Conclusion

Embracing option trading with a well-structured plan is essential for maximizing your chances of profit while mitigating risk. Remember, the journey is one of continuous learning and improvement. Stay informed, seek mentorship, and refine your strategies over time.

Are you ready to delve deeper into the world of option trading? If so, I encourage you to delve into this comprehensive guide to further empower your trading decisions.