In the intricate world of financial markets, gold stands tall as a haven asset, offering resilience against economic downturns. Its enduring value and price volatility make it a compelling choice for traders seeking high-return opportunities. Among the spectrum of trading strategies, options emerge as sophisticated instruments that empower investors to leverage gold’s price movements. In this comprehensive guide, we delve into the realm of gold options trading strategies, guiding you through their intricacies and empowering you to embrace these powerful tools skillfully.

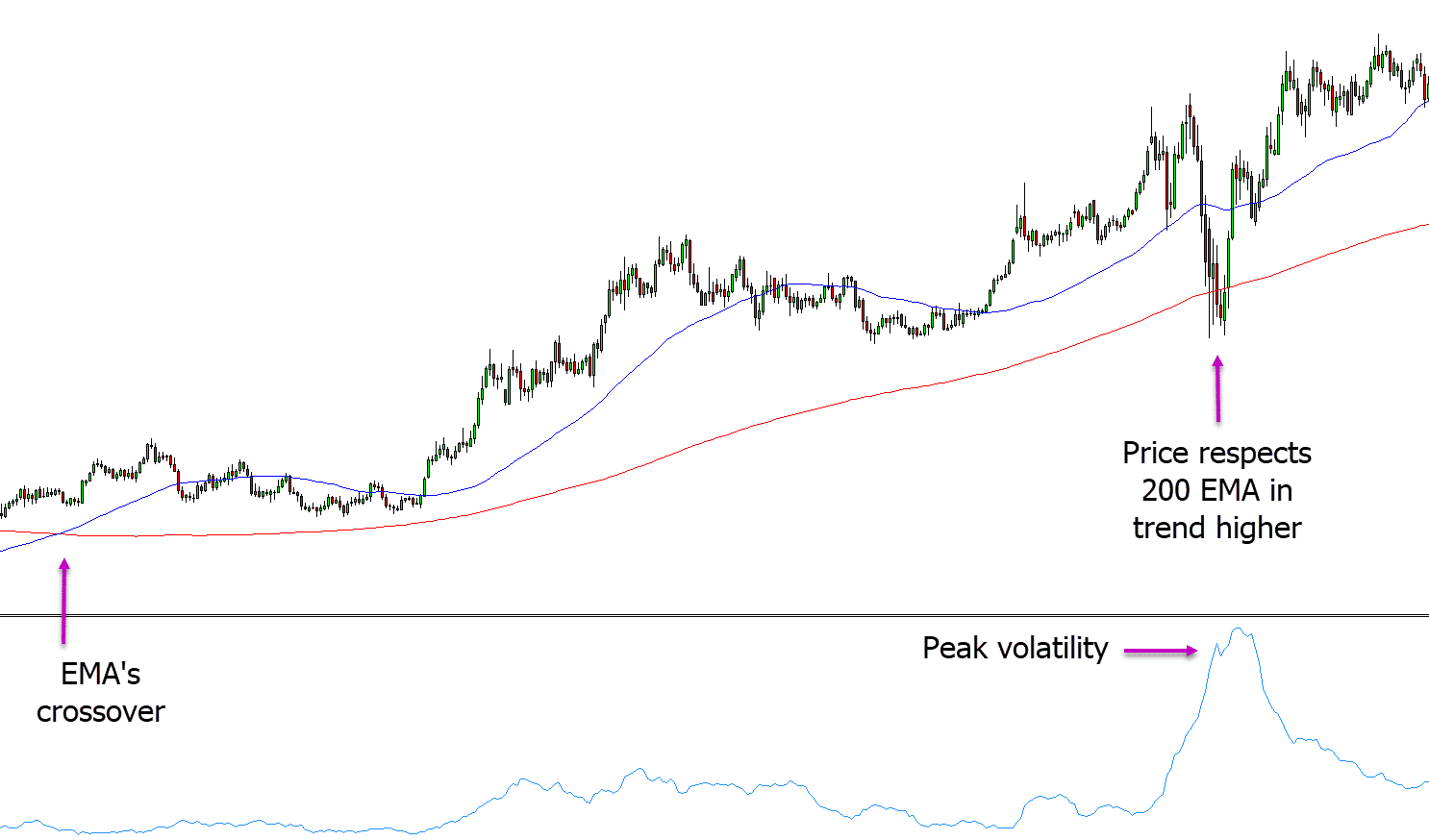

Image: learnpriceaction.com

Decoding Gold Options Trading Strategies

Options contracts, unlike futures, are derivatives that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific expiry date. Gold options trading strategies revolve around these contracts, allowing traders to speculate on gold’s future price direction without owning the physical metal.

Three fundamental strategies form the cornerstone of gold options trading:

- Covered Call: Selling a call option against a long position in gold, generating income while limiting potential upside.

- Protective Put: Buying a put option alongside a long position in gold, providing downside protection against sharp price declines.

- Collar: Combining a covered call with a protective put, creating a range within which the trader aims to profit.

Diving Deeper into Advanced Strategies

Beyond these core strategies lies a universe of advanced techniques employed by seasoned gold traders. Butterfly spreads, iron condors, and calendar spreads are just a few examples of these sophisticated combinations. These strategies involve buying and selling multiple options contracts with varying strike prices and expiry dates, creating complex risk and reward profiles tailored to specific market conditions.

Embracing Gold Options Trading

To successfully navigate the intricacies of gold options trading, a robust understanding of the underlying principles is paramount. Seek guidance from credible sources, consult with financial advisors, and diligently study market dynamics. Emotional discipline is equally essential, as greed and fear can cloud decision-making.

Leveraging Expert Insights

“The key to successful gold options trading lies in identifying trends and market sentiment accurately,” advises Mark Leeds, a renowned gold options expert. “By closely monitoring economic indicators, central bank policies, and geopolitical events that influence gold prices, traders can gain an edge in strategizing their trades.”

“Risk management is the cornerstone of prudent trading,” emphasizes Sarah Carter, a veteran gold options trader. “Carefully define your profit and loss targets before entering a trade and adhere to them strictly. Managing risk effectively not only protects your capital but also enables you to optimize your returns.”

Unveiling Actionable Tips

- Start Small: Begin with small trades to gain experience and build confidence before venturing into larger positions.

- Control Risk: Define clear entry and exit points for each trade. Use stop-loss orders to limit potential losses.

- Stay Informed: Continuously monitor gold market news and analysis to stay abreast of emerging trends and market-moving events.

- Diversify: Spread your investments across multiple gold options strategies and other asset classes to mitigate risk.

- Seek Professional Guidance: Consult with a qualified financial advisor if you encounter complexities beyond your expertise.

Conclusion

Gold options trading strategies provide a compelling avenue for investors seeking to harness the dynamic price movements of this precious metal. By understanding the fundamentals and embracing advanced techniques, traders can unlock the full potential of these powerful instruments. Remember, knowledge, emotional discipline, and risk management are the keys to unlocking success in gold options trading. Embark on this exciting journey, embrace the learning curve, and discover the exceptional rewards that await skilled traders in the captivating realm of gold options.

Image: www.youtube.com

Gold Options Trading Strategies

https://youtube.com/watch?v=7HXW91aFSl4