Have you ever heard of “options” in the financial world but felt a little intimidated by the concept? It’s no surprise; the term “options trading” often evokes a sense of mystery and complexity. But what if I told you that understanding options trading could open doors to exciting investment opportunities and empower you to navigate the financial markets with greater confidence?

:max_bytes(150000):strip_icc()/Futures-19f64f0cf82148619e4d485cdb5b2c19.jpg)

Image: www.investopedia.com

In a nutshell, options trading is a powerful tool that allows investors to take controlled risks and potentially reap significant rewards. But diving deeper requires a grasp of the fundamental concepts. This article will demystify options trading, shedding light on its core principles, strategies, and potential benefits for you.

Decoding Options: A Building Block of Financial Strategies

To understand options trading, imagine this: you’re at a flea market, and you see a beautiful antique vase. You like it, but you’re not sure if you want to buy it right away. You negotiate with the vendor to pay a small fee to have the right to purchase the vase at a set price later. This right is your “option.”

In the financial market, an option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, commodity, or index) at a predetermined price (the strike price) on or before a certain date (the expiration date).

Here’s why options trading is so captivating: it offers a level of flexibility and control that isn’t readily available with traditional stock trading. Unlike buying a stock outright, options provide the opportunity to participate in the market’s potential upside while mitigating potential losses.

Two Sides of the Coin: Calls and Puts

There are two primary types of options: calls and puts, each representing a different perspective:

- Call options grant the buyer the right to buy the underlying asset at the strike price. This is preferred if you believe the price of the underlying asset will go up.

- Put options grant the buyer the right to sell the underlying asset at the strike price. This is preferred if you believe the price of the underlying asset will go down.

Think of it like a wager. With a call option, you’re betting that the price will rise, while with a put option, you’re betting that it will fall.

The Anatomy of an Options Contract: Breaking it Down

Each options contract has specific characteristics that determine its value and potential outcomes. Let’s break down the key components:

- Underlying Asset: This is the asset that the option gives you the right to buy or sell, such as a stock, index, or commodity.

- Strike Price: This is the predetermined price at which you can buy or sell the underlying asset.

- Expiration Date: This is the date when the option contract expires, and the right to buy or sell the underlying asset ceases to exist.

- Premium: This is the price you pay to purchase the option contract. It represents the cost of acquiring the right to buy or sell the underlying asset.

Now, let’s consider the real-world implications of these components. Imagine you buy a call option for 100 shares of Apple stock, with a strike price of $150 and an expiration date of June 2024. This means you pay a premium to acquire the right to buy 100 shares of Apple stock at $150 per share anytime before June 2024. If the stock price rises above $150 before that date, you can exercise your option and buy the shares at a lower price than the market value. If the price doesn’t rise above $150 before the expiration date, you lose the premium you paid, but you aren’t obligated to buy the shares.

Image: ratapolekaxo.web.fc2.com

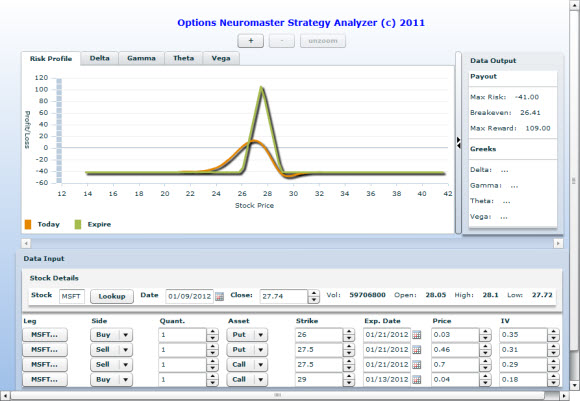

Exploring the Landscape: Options Strategies

The beauty of options trading lies in its versatility. You can tailor your approach to your risk tolerance and investment goals. Let’s explore a few common options strategies:

1. Covered Call Writing

If you already own shares of a company, you can sell a call option on those shares. This strategy generates income, but it limits your potential gains if the stock price rises significantly. If the stock price falls, your shares act as a cushion, limiting your losses.

2. Protective Put Strategy

This strategy involves buying a put option on a stock you own. If the stock price falls, the put option will protect you from losses. You only lose the premium you paid for the put option. This strategy is ideal for investors who want to limit potential downside risk.

3. Covered Put Writing

If you’re sure a specific stock price won’t drop significantly, you can sell a put option on it. You’ll receive premium income, but if the price falls and the buyer exercises the option, you’ll be forced to buy the stock at the strike price. This strategy is suitable if you’re optimistic about the underlying asset’s future.

4. Straddle Strategy

This strategy involves buying both a call option and a put option with the same strike price and expiration date. You profit if the price of the underlying asset moves significantly in either direction. However, the risk is that you lose the premium if the price doesn’t move substantially.

5. Strangle Strategy

Similar to a straddle, a strangle involves buying both a call and put option. But unlike a straddle, the strike prices are different, one being out-of-the-money and the other being in-the-money. This strategy provides a lower premium than a straddle but has a lower probability of profit.

Navigating the Options Realm: Risks and Rewards

Options trading offers a unique array of possibilities, but it’s crucial to always remember the potential risks.

- Limited Losses, Limited Gains: Unlike traditional stock purchases, where the potential loss is unlimited, options contracts only involve the premium paid. However, the potential gains of options are also limited.

- Time Decay: The premium of an option contract diminishes as it gets closer to its expiration date. This phenomenon is known as time decay.

- Volatility: Options prices are highly sensitive to volatility. Higher volatility in the underlying asset price leads to higher option premiums.

- Leverage: Options trading involves leverage, which means that small price movements in the underlying asset can lead to large losses on your option position.

Balancing Risks and Opportunities: Embracing Knowledge

Options trading is powerful, but it demands a thorough understanding of the intricacies involved. It’s not a gamble but a strategic approach that requires study, planning, and risk management. A successful option trader doesn’t jump into the market blindly, but rather forms a well-informed plan based on research and analysis.

The key takeaway? Options trading requires due diligence and a commitment to continuous learning. You can learn about different strategies, manage risk, and understand the intricacies of option pricing using various resources, including books, online courses, and reputable brokerages that offer educational materials.

Beyond the Basics: A Continuous Journey of Learning

Options trading is a vast and dynamic landscape. This article has laid the groundwork of basic concepts, but it’s merely the starting point. As you delve deeper, you’ll encounter advanced strategies, technical analysis tools, and market indicators that provide further insights.

Remember, the journey of understanding options trading is continuous. Embrace the learning process, stay informed about market trends, and always approach risk with prudence.

Define Options Trading

Ready to Take the Next Step?

This article has hopefully sparked your interest and demystified options trading. As you embark on this exciting journey, consider exploring reputable resources, engaging with the trading community, and building your expertise one step at a time. The potential rewards of options trading can be significant, but remember, knowledge is your most valuable asset in this dynamic world.