Image: mapsandmasters.com

Introduction

In the realm of finance, options trading often baffles newcomers with its enigmatic terminology and complex strategies. Fear not, for this comprehensive guide will illuminate the labyrinthine world of basic option trading terms, empowering you to navigate this exciting market with confidence. From the humble beginnings of options inception to the nuances of their trading strategies, let us embark on this educational odyssey, unlocking the secrets of this fascinating financial instrument.

Understanding Options: The Basics

Options, in essence, are financial contracts that bestow upon the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset such as a stock, bond, or commodity at a predetermined price (strike price) on or before a specific date (expiration date). Consider options as insurance policies for your investments, providing you with the flexibility to hedge against market risks or capitalize on potential gains.

Call Option: A Potential Bull’s Dream

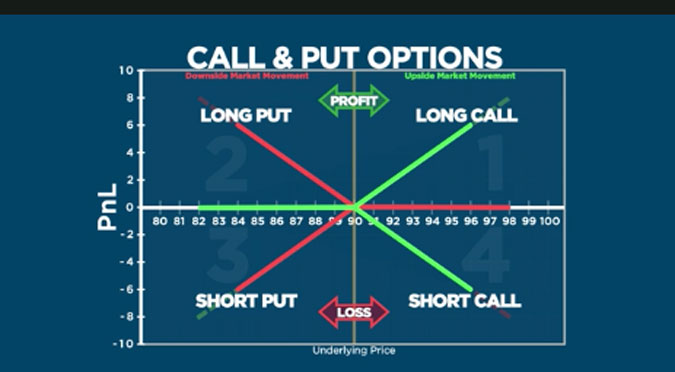

A call option grants the buyer the right to purchase the underlying asset at the strike price on or before the expiration date. It becomes a valuable asset when the market sentiment turns bullish, as the underlying asset’s price is expected to rise. By exercising the call option, the buyer secures the right to buy the asset at a price potentially lower than the prevailing market price.

Put Option: A Safe Haven in Bearish Markets

Put options, on the other hand, are the refuge of investors in bearish markets. They provide the right to sell the underlying asset at the strike price on or before the expiration date. When the market outlook is pessimistic, the value of the underlying asset is expected to decline. Exercising the put option allows the buyer to sell the asset at a price potentially higher than the prevailing market price, mitigating potential losses.

Strike Price: The Crossroads of Opportunity

The strike price, an essential term in options trading, represents the predetermined price at which the buyer can buy (call option) or sell (put option) the underlying asset. This critical point serves as the fulcrum upon which the buyer’s decision to exercise their option rests.

Expiration Date: The Timed Test

The expiration date is the predetermined day on which the option contract expires. Exercising the option right must occur on or before this date, as the contract becomes worthless thereafter. The time value of an option, representing the premium paid for the right to buy or sell, diminishes as the expiration date approaches.

Premium: The Cost of the Option

The premium is the price paid by the buyer to acquire the option contract. This fee encompasses both the intrinsic value (the difference between the current market price and the strike price) and the time value (the value of the option’s remaining life). The premium encapsulates the potential profitability and the risk associated with the option.

Options Trading Strategies: Navigating the Maze

Options trading unveils a plethora of strategies, each tailored to specific market scenarios and risk appetites. Covered calls, cash-secured puts, and spreads are but a few examples of these intricate maneuvers. By employing the appropriate strategy, investors can enhance their portfolio’s performance, hedge against potential losses, or generate passive income.

Expert Insights: Wisdom from the Masters

“Options empower investors with the flexibility to adapt to changing market conditions,” asserts renowned options expert Marc Sebastian. “Understanding the nuances of basic options terms is paramount to unlocking their full potential.”

Another luminary in the field, Larry McMillan, emphasizes the importance of risk management. “Options trading inherently involves risk, but prudent investors can mitigate it through proper position sizing and thoughtful strategy selection.”

Conclusion

With a firm grasp of basic option trading terms, you possess the foundational knowledge to embark on your options trading journey. Remember, education and due diligence remain your constant companions in this dynamic market. Consult with financial professionals, study market trends, and practice with simulated trading platforms to enhance your skills.

May this guide serve as your beacon in the options trading realm, guiding you towards informed decisions and unlocking the potential of this versatile financial instrument. Embrace the thrill of the options market, seize opportunities, and navigate the complexities of investing with confidence.

Image: www.developerinvention.in

Basic Option Trading Terms