Investing in the financial markets can be a fascinating and potentially lucrative endeavor. While there are countless strategies to navigate the markets, options trading stands out as an efficient method to capitalize on price movements in an underlying asset.

Image: www.cityindex.com

Options Trading: A Beginner’s Guide

Options trading involves contracts that give buyers the right (but not the obligation) to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date).

Understanding the basics of options trading is crucial. Option contracts derive their value from the underlying asset’s price and volatility, time remaining until expiration, and interest rates. Option premiums, which represent the purchase price of options contracts, reflect these factors.

Essential Option Trading Strategies

Options trading encompasses a multitude of strategies, each tailored to different objectives and risk tolerances. Some fundamental strategies include:

- Covered Calls: Sell a call option against an existing long position in the underlying asset, generating additional income while potentially limiting upside.

- Protective Puts: Buy a put option alongside a long position in the underlying asset, providing downside protection in exchange for a premium.

- Bull Call Spread: Simultaneously buy a call option with a lower strike price (in-the-money) and sell a call option with a higher strike price (out-of-the-money), profiting from a moderate increase in the underlying asset’s price.

Advanced Strategies for Seasoned Traders

As traders grow more experienced, more complex strategies can be explored.

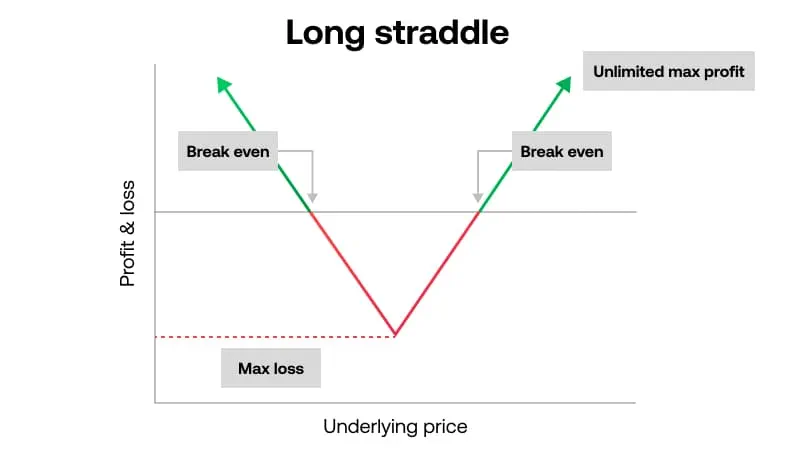

- Straddles: Buy both a call and put option with the same strike price and expiration date, profiting from significant price movements in either direction.

- Strangles: Buy a call and put option with different strike prices and expiration dates, offering more flexibility in market positioning.

- Iron Condors: Create four separate options contracts—two calls and two puts—with different strike prices, reducing risk and generating income through time decay.

Image: www.slideshare.net

Tips for Success in Option Trading

To maximize success in option trading, consider these expert tips:

- Know Your Strategy: Understand the mechanics and risks associated with each strategy you employ.

- Manage Risk: Limit exposure to potential losses by using appropriate risk management techniques like stop-loss orders.

- Be Patient: Option strategies often require patience and discipline, waiting for market conditions to align.

FAQ on Basic Option Trading

- What is the difference between a call and put option?

- A call option gives the buyer the right to buy an asset, while a put option gives the right to sell an asset.

- What factors determine option premiums?

- Price of the underlying asset, volatility, time to expiration, and interest rates.

- Can options be profitable?

- Yes, options trading can be profitable, but it requires a comprehensive understanding of strategies and risk management.

Basic Option Trading Strategies

https://youtube.com/watch?v=1_rH6u4cOiw

Conclusion

Option trading provides a versatile tool for investors seeking to optimize profit potential in the financial markets. By mastering the basics, implementing effective strategies, and adhering to risk management principles, individuals can harness the power of options trading to enhance their investment returns. Whether you are a seasoned trader or a novice, the world of options trading offers endless opportunities.

Are you ready to delve into the exciting realm of option trading? Share your thoughts and questions below.