In the ever-evolving world of finance, after hours trading options offer a tantalizing opportunity to extend market participation beyond the familiar 9-to-5 trading day. A sanctuary for those with an insatiable hunger for financial action or the flexibility of unconventional schedules, after hours trading is a realm where fortunes can be forged and risks embraced under the cloak of twilight.

Image: tastytrade.com

Step into the nocturnal vortex of after hours trading, where the rhythm of the market transforms into a hypnotic dance. Options, those versatile instruments of uncertainty, take center stage, empowering traders to navigate the veiled contours of price fluctuations. As the sun retreats and the喧嚣 of daytime trading subsides, a hush falls over the financial landscape, giving way to an intimate atmosphere where strategy and anticipation reign supreme.

Unmasking the Enigmatic Nature of After Hours Trading Options

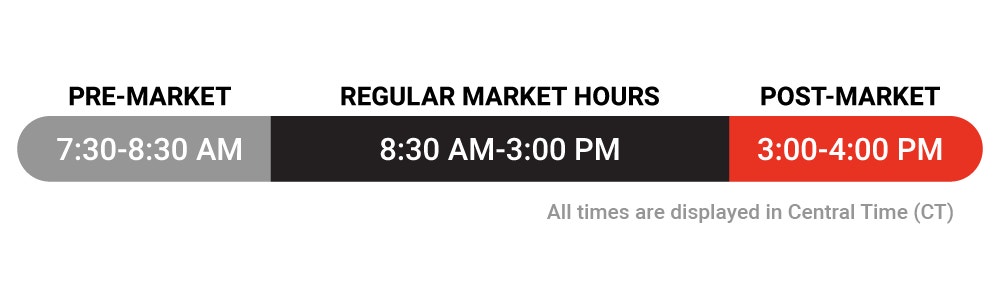

After hours trading options present a unique opportunity to capitalize on market movements that occur outside of regular trading hours. This nocturnal playground, spanning from 4 pm to 8 pm EST, grants traders the agility to react to breaking news, corporate announcements, and other market-moving events that may arise after the closing bell.

The allure of after hours trading lies in its potential for enhanced profit margins. With reduced market liquidity during these hours, traders can often secure more favorable prices compared to the hustle and bustle of daytime trading. However, with great power comes great responsibility, as the diminished liquidity also amplifies the significance of each trade and the potential for both substantial gains and losses.

Stepping into the Arena: A Comprehensive Guide to After Hours Trading Options

Embarking on the path of after hours trading options requires a steadfast grasp of foundational concepts. Options, in their essence, are contracts that bestow upon the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific expiration date.

Within the realm of after hours trading, options contracts extend their lifespan beyond the confines of the traditional trading day, allowing traders to speculate on price movements during the extended session. These options, aptly named “after hours options,” provide a unique vantage point to capitalize on market shifts that may occur after the primary trading hours have concluded.

Image: successfultradings.com

After Hours Trading Options

Navigating the Nuances of After Hours Trading Options

As with any financial endeavor, traversing the terrain of after hours trading options demands a thorough understanding of the inherent risks and rewards. The reduced liquidity during these extended hours can exacerbate market volatility, amplifying the impact of each trade