Dive into the World of Options Trading with USAA

Investing in options can be a powerful way to enhance your investment portfolio. However, it’s crucial to fully understand the ins and outs of options trading to avoid potential pitfalls. USAA, a leading financial institution with a strong reputation for serving military members and their families, offers a comprehensive options trading platform designed to empower investors.

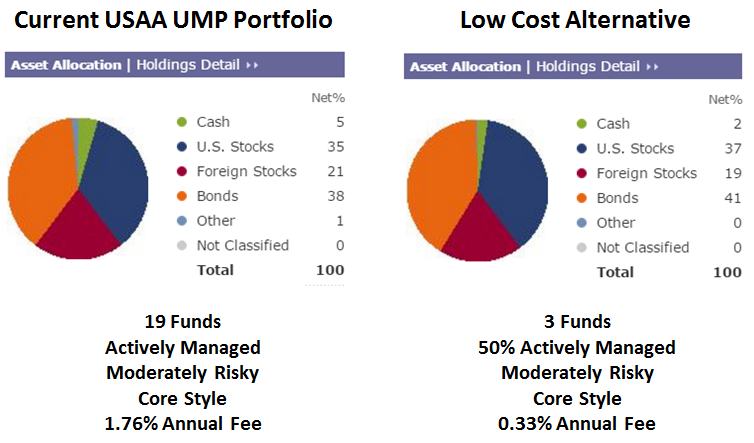

Image: www.mutualfundobserver.com

What is Options Trading?

Options are financial contracts that provide the buyer of the option with the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Options are typically used to manage risk, speculate on price movements, and enhance returns.

The Advantages of Options Trading with USAA

USAA offers a range of benefits for investors looking to trade options, including:

- Beginner-friendly platform: Navigating the intricacies of options trading can be daunting for beginners. USAA’s intuitive platform simplifies the process, making it accessible to investors of all experience levels.

- Educational resources: USAA provides ample educational materials, including interactive tutorials, articles, and webinars. These resources empower investors to develop a solid understanding of options trading strategies and enhance their decision-making process.

- Competitive fees and margin rates: USAA offers competitive fees and margin rates, making it more cost-effective for investors to trade options. Lower fees translate into increased potential profits.

Expert Tips for Options Trading Success

- Start small: Begin by trading a small number of contracts until you gain confidence and familiarity with the market.

- Manage risk: Use stop-loss orders to limit potential losses and consider selling covered calls or buying protective puts to mitigate downside risk.

- Select the right strategy: Choose an options trading strategy that aligns with your investment goals, risk tolerance, and time horizon. Consider factors such as market volatility, time decay, and liquidity.

- Monitor market trends: Stay informed about economic news and market events that may impact the underlying asset. Regularly review your open positions and make adjustments as needed.

- Seek professional advice if necessary: If you’re new to options trading or facing complex situations, consult with a financial advisor or options specialist who can provide guidance and support.

Image: www.tradingview.com

FAQs on USAA Options Trading

Q: Does USAA offer options trading accounts for experienced investors?

A: Yes, USAA provides advanced options trading accounts with access to extended trading hours and a wider range of options strategies.

Q: What types of options can I trade with USAA?

A: USAA offers a broad spectrum of options, including equity options, index options, ETF options, and commodity options.

Q: Is options trading right for me?

A: Options trading can be suitable for investors seeking to enhance returns, manage risk, or speculate on market movements. However, it’s crucial to fully understand the risks and potential rewards before getting involved.

Usaa Options Trading

Conclusion

USAA options trading empowers investors with a robust platform, educational resources, and expert guidance. By following the tips and insights outlined above, you can navigate the complex world of options trading with confidence.

Are you interested in maximizing your investment potential through USAA options trading? Contact a USAA representative today to learn more and get started.