Are you looking to expand your investment portfolio and potentially increase your returns? Trading options on Fidelity can be a lucrative strategy for both beginners and experienced investors alike. Options provide a flexible and multifaceted tool for managing risk, generating income, and speculating on the future direction of stocks, indices, and other assets. In this comprehensive guide, we’ll dive deep into the world of options trading on Fidelity, providing you with the knowledge and insights needed to confidently navigate this dynamic market.

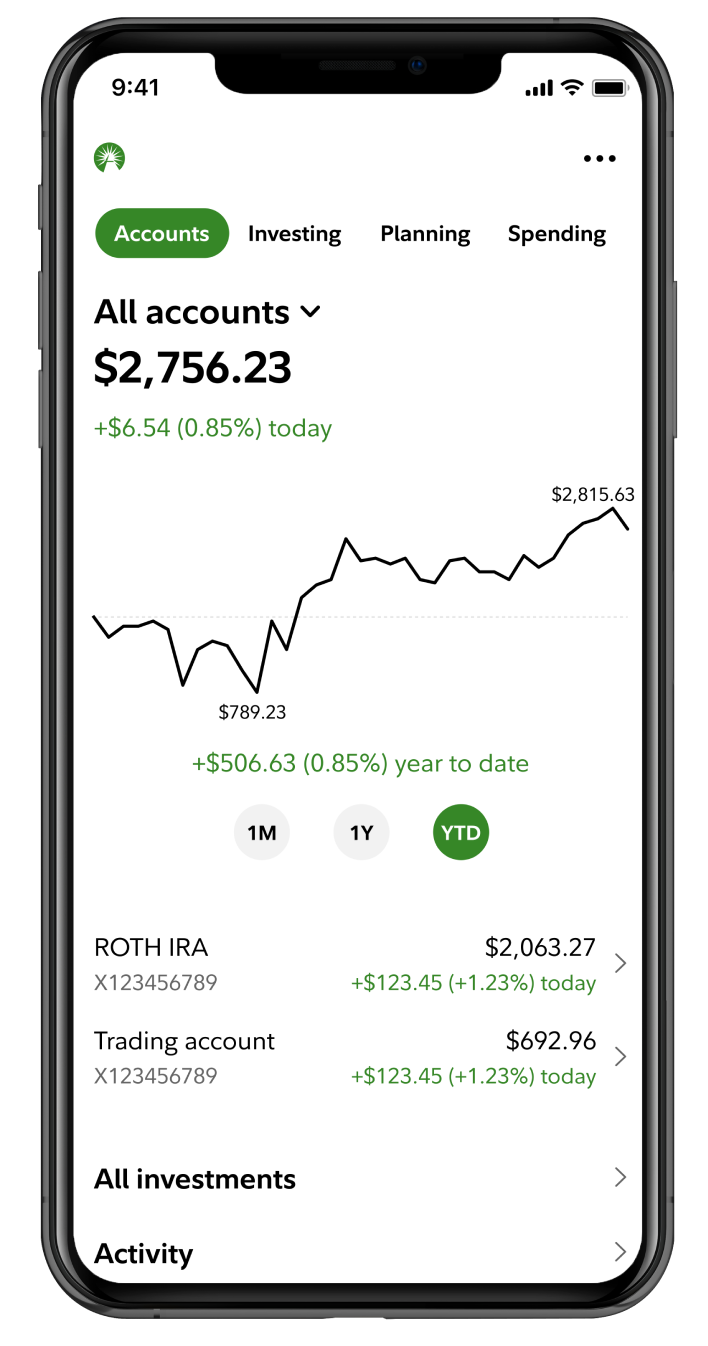

Image: www.fidelity.com

What are Options?

Options are financial contracts that represent the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a defined date. There are two primary types of options: calls and puts. Call options give holders the right to buy the underlying asset at the strike price, while put options give them the right to sell the underlying asset at the strike price. The strike price refers to the predetermined price at which you can buy or sell the underlying asset. The expiration date, on the other hand, specifies the end of the option’s life.

Benefits of Trading Options on Fidelity

Trading options with Fidelity offers several advantages, including:

- Flexibility: Options provide investors with a flexible approach to managing their portfolios. They can be used to hedge risk, generate income, leverage upside potential, and position their portfolios for various market scenarios.

- Income Generation: By selling or writing options, you can generate income from the premiums paid by buyers. This strategy is known as “option selling” and can be a consistent source of returns.

- Leverage: Options allow investors to amplify their profits while potentially limiting their losses. For instance, buying a call option gives the holder the right to buy an underlying asset that is trading above the strike price. This can result in an outsized upside return compared to simply buying the asset itself.

- Downside Protection: By acquiring call options, investors can limit their downside risk on stocks they believe in. For example, an investor who holds a portfolio of growth stocks could buy call options on a broad market index. If the underlying markets decline, the call options would gain value, resulting in a cushion against potential losses.

Getting Started with Options Trading on Fidelity

It’s crucial to have a firm understanding of options basics before you begin trading. Fidelity provides a plethora of educational resources, including webinars, videos, and articles, to assist in your learning journey. Once you’ve gained the necessary knowledge, you can open a Fidelity brokerage account and get started with options trading.

Image: www.youtube.com

Understanding the Role of Options in Portfolio Management

Incorporating options into your investment strategy can enhance your portfolio’s performance. Options can be used to hedge risk, generate income, and take advantage of specific market scenarios. By carefully considering your objectives and risk appetite, you can harness the power of options to optimize your portfolio’s outcomes.

Advanced Options Strategies for Experienced Traders

If you’re a seasoned investor looking to delve deeper into the world of options trading, Fidelity offers advanced strategies to help optimize returns. These strategies include multi-legged options, spread trading, and volatility harvesting. By mastering these techniques, experienced traders can enhance their risk management, capitalize on complex market dynamics, and unlock even greater potential for profitability.

Recent Developments and Trends in Options Trading

Fidelity is continuously innovating to provide investors with the most up-to-date tools and capabilities for options trading. Keep yourself informed about the latest trends in options trading, as well as Fidelity’s product developments, to maximize your success in this ever-evolving market.

Trading Options On Fidelity App

Conclusion

Whether you’re a novice investor or an experienced options trader, Fidelity offers a comprehensive platform and a wealth of educational resources to accommodate your needs. Embracing the power of options trading can open doors to increased profitability and enhanced portfolio management. Dive into the world of options trading on Fidelity, embrace the opportunities it offers, and witness the transformative impact it can have on your investment journey.