Introduction

In the realm of investing, options trading has emerged as a potent tool for harnessing volatility and extracting substantial returns. Options contracts grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. By skillfully navigating the options market, traders can amplify their profits and mitigate risks, unlocking a world of financial opportunities.

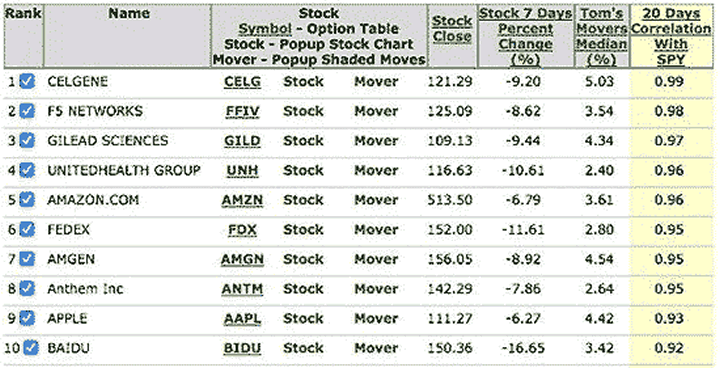

Image: www.marketoracle.co.uk

To guide you through this lucrative landscape, we present the top 10 stocks that have consistently exhibited high volatility, making them ideal candidates for options trading. These stocks represent a diverse array of industries and sectors, offering traders a wide range of investment choices.

1. Tesla (TSLA)

Tesla, the electric car behemoth, has captivated investors with its transformative technology and audacious vision. Its stock has consistently defied expectations, exhibiting substantial price swings that make it a prime target for options traders. With a focus on innovation and a loyal customer base, Tesla is poised for continued growth in the burgeoning electric vehicle market.

2. Amazon (AMZN)

Amazon, the e-commerce giant, has revolutionized the way we shop, and its stock has mirrored that success, delivering remarkable returns for investors. As a market leader in cloud computing and artificial intelligence, Amazon is well-positioned to benefit from the ongoing digital transformation, making it an attractive option for options traders seeking stable growth and occasional bursts of volatility.

3. Apple (AAPL)

Apple, the tech behemoth behind the iconic iPhone, continues to dominate the consumer electronics industry. Its stock has a history of steady appreciation, punctuated by occasional moments of high volatility, creating opportunities for options traders to profit from price fluctuations while capitalizing on the company’s long-term growth trajectory.

Image: ijunkie.com

4. NVIDIA (NVDA)

NVIDIA, a leader in the semiconductor industry, is at the forefront of the artificial intelligence revolution. Its cutting-edge graphics processing units (GPUs) power everything from gaming to scientific research. With a track record of strong financial performance and a bullish outlook on the future of AI, NVIDIA is a tantalizing target for options traders.

5. Alphabet (GOOGL)

Alphabet, the parent company of Google, has become synonymous with innovation and technological prowess. Its suite of products, including Google Search, Android, and YouTube, has permeated our lives. As a result, Alphabet’s stock exhibits a combination of stability and volatility, offering options traders the chance to harness value from both long-term trends and short-term fluctuations.

6. Microsoft (MSFT)

Microsoft, the software powerhouse, has undergone a transformation in recent years, embracing the cloud and emerging technologies. Its stock has responded with steady growth and occasional spikes, making it a reliable choice for options traders looking to balance risk and reward.

7. JPMorgan Chase (JPM)

JPMorgan Chase, a financial services giant, stands as one of the largest banks in the world. While the banking sector tends to be less volatile than other industries, JPMorgan Chase’s stature and involvement in investment banking and trading make its stock an intriguing option for options traders seeking exposure to the financial sector.

8. Nike (NKE)

Nike, the sportswear juggernaut, has built a global brand synonymous with athleticism and innovation. Its stock has exhibited a steady upward trend, fueled by strong sales and an expanding international presence. While not as volatile as some other stocks on this list, Nike offers opportunities for options traders to capitalize on short-term fluctuations and participate in the company’s long-term growth story.

9. Walt Disney (DIS)

Walt Disney, the entertainment behemoth, remains a household name. Its theme parks, movie studios, and streaming platform attract audiences worldwide. Disney’s stock has historically shown periods of high volatility, particularly around major product launches and earnings announcements, making it a tempting target for options traders seeking to ride the waves of market sentiment.

10. Advanced Micro Devices (AMD)

Advanced Micro Devices (AMD), a semiconductor manufacturer, has emerged as a formidable competitor to Intel in recent years. AMD’s stock has witnessed significant volatility due to its exposure to the highly competitive tech industry and its focus on high-growth markets like gaming and data centers. This volatility presents ample opportunities for options traders to capitalize on both upward and downward price movements.

Top 10 Stocks For Options Trading

https://youtube.com/watch?v=6fwgSLhftnY

Conclusion

Harnessing the volatility of these top 10 stocks, options traders can craft strategies to enhance their investment returns. Whether seeking short-term gains or long-term growth, options trading offers a versatile and rewarding approach to profiting from the dynamics of the financial markets.

We urge aspiring options traders to conduct thorough research, master risk management techniques, and approach this endeavor with patience and diligence. As you navigate the world of options trading, remember to consult with financial professionals if necessary, and always consider your personal risk tolerance and financial goals before making any investment decisions.