<!DOCTYPE html>

Image: www.livingfromtrading.com

In the world of investing, there are multiple ways to amplify your returns. However, these strategies also come with amplified risks. Two such strategies are options trading and margin trading.

Margin trading allows investors to borrow money from their brokers to amplify their positions, while options trading involves buying or selling contracts that convey the right – but not an obligation – to buy or sell an underlying asset at a specific price.

Options Trading: A Double-Edged Sword

Options trading is a complex strategy that can be both lucrative and dangerous. It involves buying or selling options contracts, which give the buyer the right (but not the obligation) to buy or sell an underlying asset at a specified price within a specific period of time.

There are two main types of options contracts: calls and puts. Call options give the buyer the right to buy an asset at a specified price, while put options give the buyer the right to sell an asset at a specified price. The price at which the asset can be bought or sold is known as the strike price.

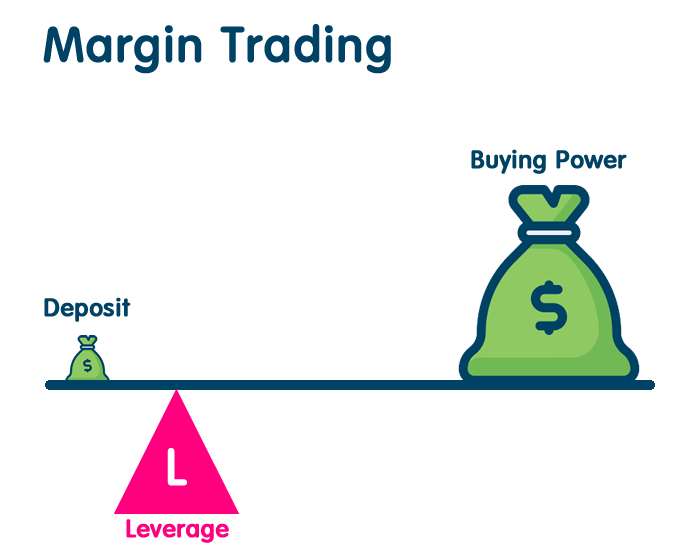

Margin Trading: Borrowing to Boost Returns

Margin trading, or leveraging, is a strategy that allows investors to increase their exposure to the market by borrowing money from their brokers. This can magnify both their potential gains and losses.

When an investor trades on margin, they can borrow up to 50% of the purchase price of a security. However, if the value of the security falls below a certain threshold, the investor may be required to deposit additional funds or sell the security to cover their losses.

Comparing Options vs Margin Trading

Options trading and margin trading are both strategies that can be used to boost returns. However, there are several key differences between the two strategies.

- Options trading involves buying or selling contracts that give the buyer the right to buy or sell an underlying asset at a specified price. Margin trading involves borrowing money from a broker to purchase an asset.

- Options trading is more complex than margin trading. It requires a more thorough understanding of options markets and options pricing models.

- Options trading can be both lucrative and dangerous. It is possible to lose more money than you invest when trading options. Margin trading can also be dangerous, as investors can lose more money than they initially invested.

Image: db-excel.com

Tips for Successful Trading

If you want to try either options trading or margin trading, there are a few things you should keep in mind.

- Do your research: Before you start trading, take the time to learn about options trading or margin trading. Make sure you understand the risks involved and how to use these strategies effectively.

- Start small: When you first start trading, it is a good idea to start with a small amount of money. This will help you to learn the ropes and avoid large losses.

- Use stop-loss orders: A stop-loss order is an order that tells your broker to sell a security if it falls below a certain price. Stop-loss orders can help you to protect your profits and limit your losses.

FAQs

Q: What is the difference between options trading and margin trading?

A: Options trading involves buying or selling contracts that give the buyer the right to buy or sell an underlying asset at a specified price. Margin trading involves borrowing money from a broker to purchase an asset.

Q: Which strategy is riskier?

A: Options trading and margin trading both carry risks. However, options trading is generally considered to be more complex and risky than margin trading.

Q: How can I learn more about options trading or margin trading?

A: There are a number of resources available to help you learn more about options trading and margin trading. You can find books, articles, and online courses on these topics.

Options Or Margin Trading

Conclusion

Options trading and margin trading can be complex and risky, however, they can also be used to generate substantial profits. if you are interested in these strategies, it is important to do your research and understand the risks involved.