Option trading has become increasingly popular in the United States, providing investors with an effective way to manage risk and enhance portfolio returns. With a wide range of options trading platforms available, choosing the right one can be a daunting task. This article will guide you through the intricacies of option trading platforms in the US, empowering you to make informed decisions based on your trading needs and preferences.

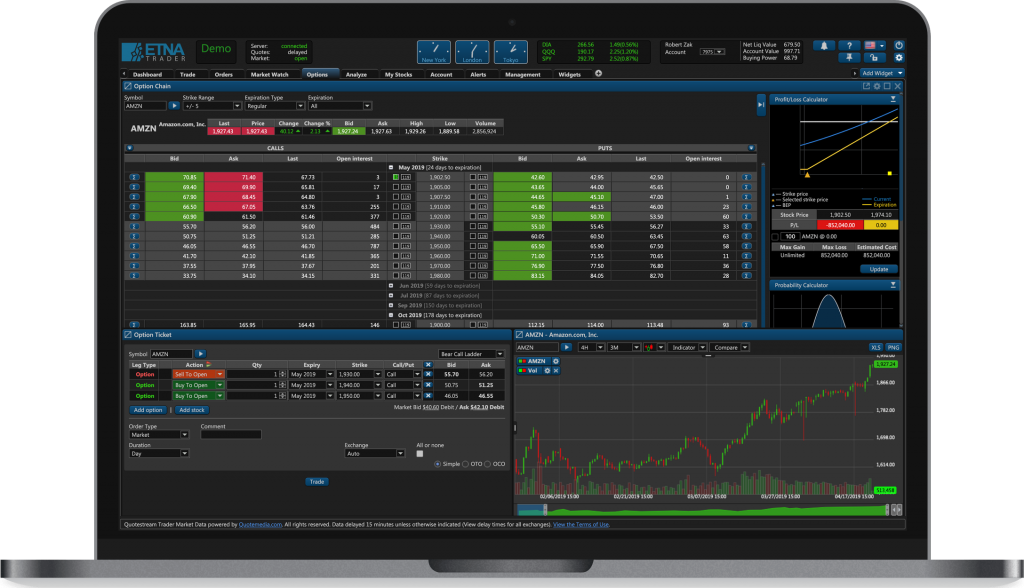

Image: www.etnasoft.com

As a seasoned trader, I have witnessed firsthand the transformative potential of option trading platforms. Whether you’re a seasoned veteran or a novice just starting out, this guide will equip you with the knowledge and insights you need to navigate this exciting market.

The Basics of Option Trading Platforms

An option trading platform is an online platform that facilitates the buying and selling ofオプションcontracts. These platforms provide traders with access to real-time market data, analytics tools, and trading functionality. By utilizing these platforms, traders can execute trades quickly and efficiently, monitor their portfolios, and manage their risk.

Types of Option Trading Platforms

Option trading platforms can be broadly categorized into two types:

- Self-Directed Platforms: These platforms give traders complete control over their trading decisions, allowing them to make trades directly with other market participants. Examples include Interactive Brokers, Thinkorswim, and tastytrade.

- Managed Platforms: With managed platforms, traders delegate their trading decisions to professional money managers. These platforms offer a range of options, from fully managed accounts to more tailored advisory services. Examples include Motif and Wealthfront.

Factors to Consider When Choosing a Platform

When selecting an option trading platform, it’s crucial to consider several key factors:

- Fees and Commissions: Trading costs can significantly impact your profitability. Compare fees and commissions, including brokerage fees, option premiums, and exchange fees.

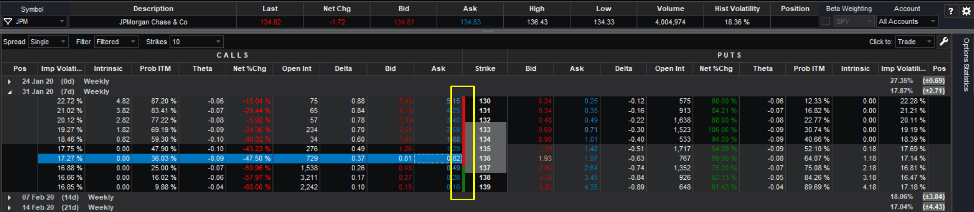

- Trading Tools and Features: The platform should provide comprehensive trading tools, including advanced charting capabilities, real-time market data, and risk management features.

- Educational Resources: Access to educational resources is invaluable, especially for novice traders. Consider platforms that offer webinars, tutorials, and other educational materials.

- Customer Support: Reliable customer support is essential. Ensure the platform offers dependable and responsive support whenever you need assistance.

- Reputation and Security: Choose reputable and well-established platforms with a proven track record of security and reliability.

Image: www.tradestation.io

Expert Tips for Option Trading Success

To maximize your success in option trading, consider the following expert tips:

- Understand Options: Thoroughly grasp the basics of options, including terminology, strategies, and key concepts.

- Manage Risk: Risk management is paramount. Implement a disciplined risk management strategy, including stop-loss orders and position sizing.

- Research and Analysis: Conduct thorough research and analysis before executing trades. Stay informed about market trends, news, and economic factors.

- Practice and Discipline: Practice trading strategies on demo accounts or with paper money. Develop a disciplined trading plan and stick to it.

- Seek Professional Advice (Optional): If unsure or lacking experience, consider consulting with a financial advisor or professional trader for guidance.

Frequently Asked Questions

- Q: What is the minimum investment required for option trading?

A: The minimum investment can vary depending on the platform and the options contract you trade. - Q: Is option trading suitable for beginners?

A: While option trading can be complex, beginners can start by learning the basics and practicing on demo accounts. - Q: How can I learn more about option trading?

A: Many resources are available, including educational materials, books, and online courses. - Q: What are the risks involved in option trading?

A: The risks include losing a substantial amount of your investment or even the entire amount. - Q: How do I choose the right option trading platform for me?

A: Consider the factors discussed above, such as fees, trading tools, educational resources, and customer support, to make an informed decision.

Option Trading Platforms Us

Conclusion

Option trading platforms in the US offer traders a myriad of opportunities to enhance their portfolios and manage risk. By choosing the right platform and implementing sound trading strategies, you can harness the power of options to achieve your financial goals. Remember, always conduct thorough research, practice risk management, and seek professional advice if needed. Remember, whether you are new to option trading or an experienced trader, the right platform and knowledge can empower you to navigate the market and make informed decisions.

Are you interested in learning more about option trading platforms in the US? Share your questions and comments below, and let’s continue the conversation.