Are you looking for an investment opportunity with high returns and manageable risks? If so, option trading may be a great choice for you. Options are a versatile financial instrument that can be used to speculate on the direction of a stock, commodity, or index. They offer a number of advantages over other investment options, including the potential for high returns and leverage.

Image: www.projectfinance.com

One of the key reasons why option trading is so effective is because it allows investors to control their risk. When you buy an option, you are not obligated to purchase or sell the underlying asset. This means that you can limit your losses to the premium that you paid for the option. Additionally, options can be used to create a variety of different strategies, which allows investors to tailor their investments to their specific risk tolerance and financial goals.

The Basics of Option Trading

To understand how option trading works, it is first important to understand the concept of an option.

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

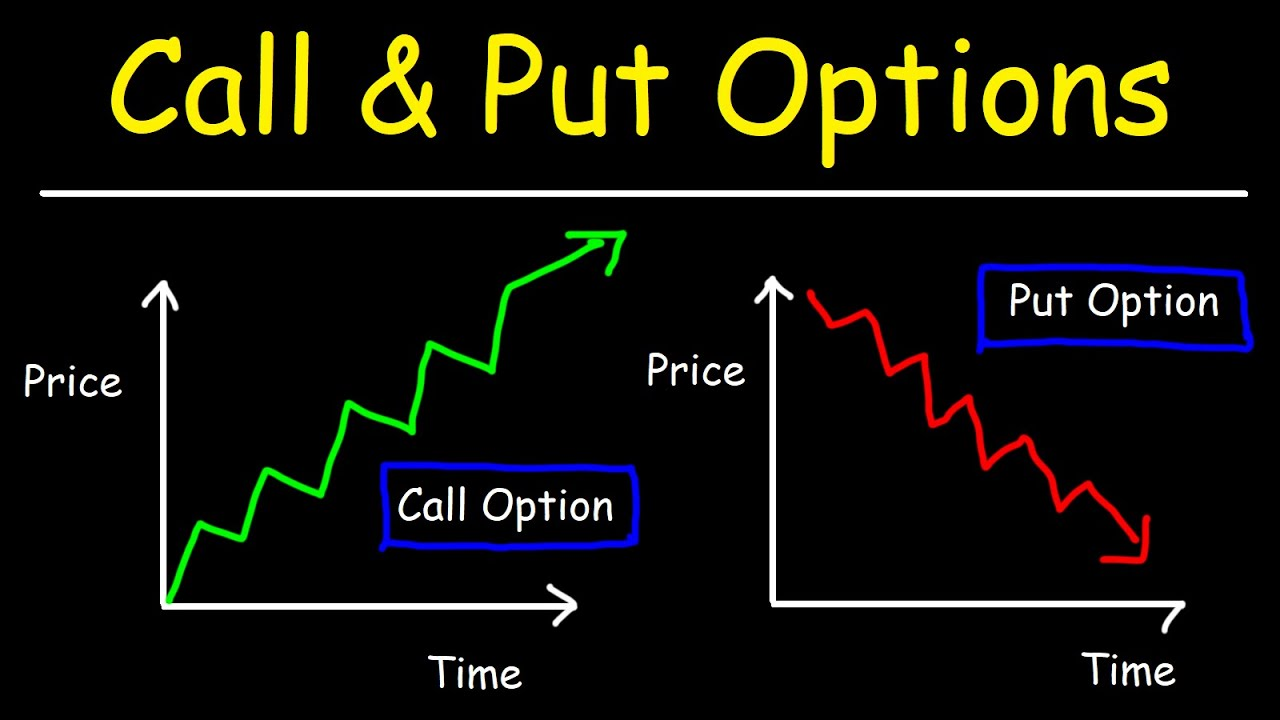

There are two types of options: calls and puts.

- A call option gives the buyer the right to buy an underlying asset at a specified price.

- A put option gives the buyer the right to sell an underlying asset at a specified price.

The price that is specified in the option contract is known as the strike price.

The date on which the option expires is known as the expiration date.

When you buy an option, you are paying a premium for the right to exercise the option.

The premium is determined by a number of factors, including:

- The current price of the underlying asset

- The strike price

- The time until expiration

- The volatility of the underlying asset

How to Make Money with Option Trading

There are a number of ways to make money with option trading. One of the most common strategies is to buy options that you believe will increase in value.

For example, if you believe that the price of a stock is going to go up, you can buy a call option on the stock.

If the stock price does go up, the value of your call option will increase. You can then sell the option for a profit.

Another way to make money with option trading is to sell options that you believe will decrease in value.

For example, if you believe that the price of a stock is going to go down, you can sell a put option on the stock.

If the stock price does go down, the value of your put option will increase. You can then buy back the option for a profit.

Tips for Successful Option Trading

If you are new to option trading, there are a few things that you should keep in mind:

- Do your research. Before you start trading options, it is important to understand how they work. There are a number of resources available online that can help you learn more about option trading.

- Start small. When you first start trading options, it is important to start small. Do not risk more money than you can afford to lose.

- Be patient. Option trading is not a get-rich-quick scheme. It takes time to develop the skills and knowledge necessary to be successful.

- Use a stop-loss order. A stop-loss order will help you to limit your losses in the event that the market moves against you.

Image: tradewithmarketmoves.com

Conclusion

Option trading can be a powerful investment strategy, but it is important to understand the risks involved before you get started. If you are willing to take the time to learn how to trade options, you can increase your chances of success.

Are you interested in learning more about option trading? If so, please let me know in the comments below.

Why Do Option Trading Work So Well

Image: www.pinterest.com

FAQ

Q: What is option trading?

A: Option trading is a strategy that involves buying or selling options, which are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

Q: How do I get started with option trading?

A: To get started with option trading, you need to open an account with a broker that offers options trading. Once you have an account, you can begin researching options and placing trades.

Q: What are the risks of option trading?

A: The risks of option trading include the potential for loss of principal, the potential for unlimited losses, and the potential for margin calls.

Q: Is option trading right for me?

A: Option trading is not suitable for all investors. If you are not comfortable with the risks involved, you should not trade options.