Introduction

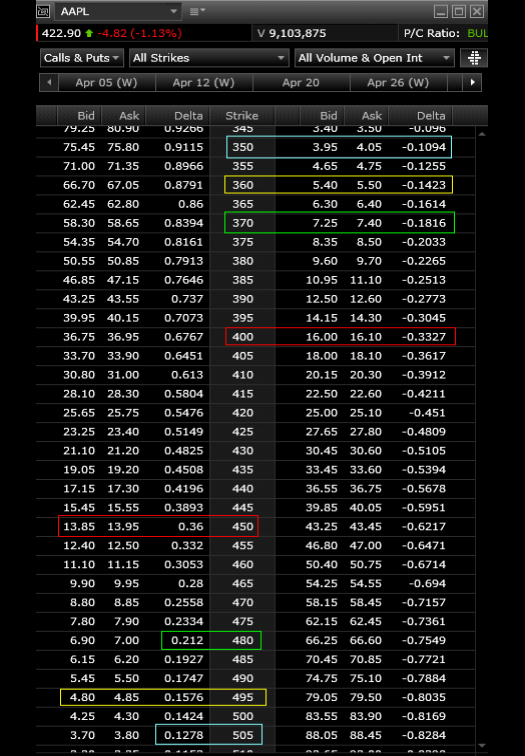

Are you looking to get started with options trading? If so, you’ll need to learn about delta. Delta is a critical concept in options trading, and it can help you make more informed trading decisions. In this article, we’ll explore what delta is, how it works, and some of the best deltas for option trading.

Image: www.youtube.com

Before we dive into delta, it’s necessary to understand what options are. An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price on a certain date. There are two main types of options: calls and puts. A call option gives you the right to buy the underlying asset, while a put option gives you the right to sell the underlying asset.

Understanding Delta

Delta is a measure of how much the price of an option changes in relation to the price of the underlying asset. It’s expressed as a number between -1 and 1. A delta of 1 means that the option’s price will increase by $1 for every $1 increase in the underlying asset’s price. A delta of -1 means that the option’s price will decrease by $1 for every $1 decrease in the underlying asset’s price. A delta of 0 means that the option’s price will not change in relation to the price of the underlying asset.

Choosing the Best Deltas for Option Trading

The best delta for option trading depends on your trading strategy. If you are looking to speculate on the direction of the underlying asset’s price, you will want to choose an option with a high delta. This will give you more bang for your buck when the underlying asset’s price moves in your favor. However, if you are looking to hedge your bets or generate income, you may want to choose an option with a lower delta.

Here is a quick overview of the different deltas and their suitability for different trading strategies:

- Delta 1: Suitable for speculative trading. High risk, high reward.

- Delta 0.8-0.9: Suitable for speculative trading with a slightly lower risk profile.

- Delta 0.5-0.7: Suitable for hedging or generating income. Moderate risk, moderate reward.

- Delta 0.3-0.4: Suitable for hedging or generating income with a lower risk profile.

- Delta 0: Suitable for hedging. Low risk, low reward.

Tips and Expert Advice

In addition to choosing the right delta, there are a few other things you should keep in mind when trading options:

- Do your research. Before you start trading options, it’s important to do your research and understand how they work. This will help you make more informed trading decisions.

- Start small. When you’re first starting out, it’s a good idea to start small. This will help you get a feel for the market and avoid losing too much money.

- Have a trading plan. Before you place any trades, it’s essential to have a trading plan. This will help you stay disciplined and make informed trading decisions.

- Manage your risk. Risk management is crucial in options trading. Make sure you understand the risks involved and take steps to manage your risk.

Image: xumyvymar.web.fc2.com

What Option Deltas Are Best For Option Trading

Image: www.fidelity.com

Conclusion

If you are looking to get started with options trading, it is important to understand delta. Delta is a critical concept that can help you make more informed trading decisions. By choosing the right delta and following the tips above, you can increase your chances of success.

Are you interested in learning more about options trading?