Options trading is a complex and often misunderstood subject. One of the most confusing concepts for beginners is the idea of “OTM,” or out-of-the-money options. In this article, we will explain what OTM means and how it affects option prices.

Image: twitter.com

What Does OTM Mean?

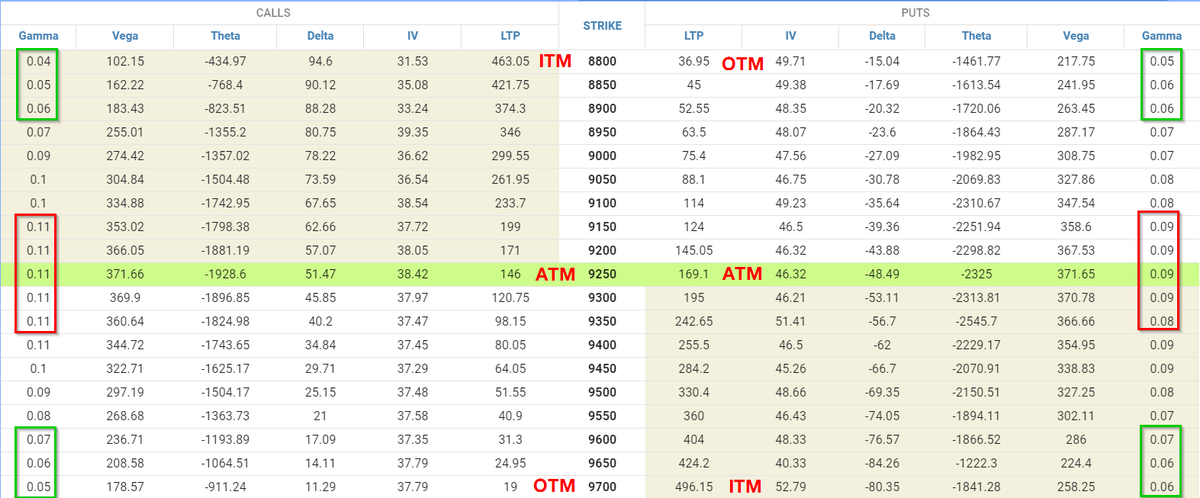

OTM refers to options contracts that have a strike price that is higher (for call options) or lower (for put options) than the current market price of the underlying asset. For example, if the current price of a stock is $50 and you buy a call option with a strike price of $55, that option would be considered OTM.

OTM options are often referred to as “cheap” or “lottery tickets” because they have a low probability of expiring in-the-money (ITM). However, OTM options can still be profitable if the underlying asset price moves significantly in the desired direction.

How Does OTM Affect Option Prices?

The price of an option is determined by several factors, including the strike price, the time to expiration, and the volatility of the underlying asset. OTM options are generally cheaper than ITM options with the same strike price and expiration date because they have a lower probability of expiring in-the-money.

The further OTM an option is, the cheaper it will be. This is because the less likely it is that the option will expire in-the-money, the less valuable it is.

Tips and Expert Advice for Trading OTM Options

OTM options can be a valuable tool for options traders, but they should be used with caution. Here are a few tips for trading OTM options:

- Only trade OTM options on assets that you are familiar with. You should understand the risks and rewards of trading OTM options before you put any money at risk.

- Set realistic profit targets. OTM options have a low probability of expiring in-the-money, so you should not expect to make a large profit on every trade.

- Use OTM options to trade trends. OTM options can be a good way to trade trends in the underlying asset. If you believe that the asset price is going to move in a certain direction, you can buy OTM options to profit from that move.

Image: www.youtube.com

Frequently Asked Questions

Q: What is the difference between OTM, ITM, and ATM options?

A: OTM (out-of-the-money) options have a strike price that is higher (for call options) or lower (for put options) than the current market price of the underlying asset. ITM (in-the-money) options have a strike price that is lower (for call options) or higher (for put options) than the current market price of the underlying asset. ATM (at-the-money) options have a strike price that is equal to the current market price of the underlying asset.

Q: Are OTM options risky?

A: OTM options are considered to be riskier than ITM options because they have a lower probability of expiring in-the-money. However, OTM options can still be profitable if the underlying asset price moves significantly in the desired direction.

What Is Otm In Options Trading

Image: markettaker.com

Conclusion

OTM options are a valuable tool for options traders, but they should be used with caution. If you are looking to trade OTM options, it is important to understand the risks and rewards involved. By following the tips above, you can increase your chances of success when trading OTM options.

Are you interested in learning more about OTM options? Leave a comment below with your questions.