In the realm of options trading, understanding the intricate dynamics that govern different strategies is crucial for maximizing profits and mitigating risks. Among the various strategies employed by seasoned traders, diagonals and verticals deserve special attention due to their uncanny resemblance. This article aims to delve into the depths of these two strategies, unraveling their unique characteristics and demonstrating why, in essence, diagonals are the same as verticals in options trading.

Image: en.rattibha.com

Defining Diagonals and Verticals

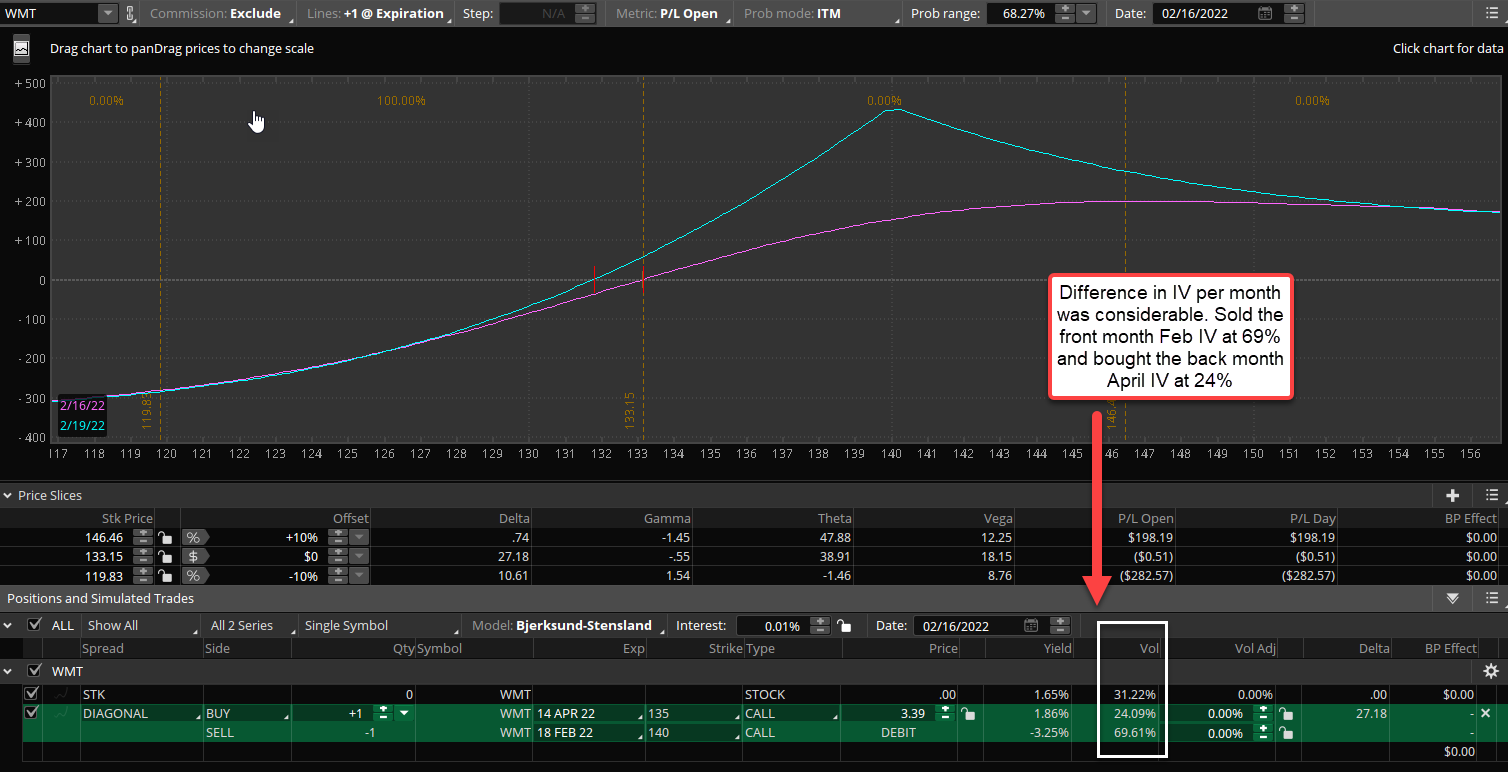

When navigating the labyrinthine world of options trading, it’s imperative to establish a firm grasp of the fundamental concepts underlying diagonals and verticals. Diagonals, as the name suggests, are a strategy involving the simultaneous purchase and sale of options at varying strike prices and expiration dates. On the other hand, verticals, also known as spreads, entail the purchase and sale of options with the same expiration date but different strike prices. By comprehending these fundamental distinctions, we lay the groundwork for exploring their underlying equivalence.

Unveiling the Threads of Equivalence

Despite their seemingly distinct appearances, diagonals and verticals share a profound kinship that emerges when examining their risk and reward profiles. Both strategies aim to capitalize on the inherent volatility of the underlying asset, with the potential for sizable收益 if the market moves in a favorable direction. Moreover, both strategies involve a calculated balancing act between risk and reward, allowing traders to tailor their positions to suit their individual risk tolerance and financial objectives.

Breaking Down the Similarities

To fully appreciate the equivalence between diagonals and verticals, it’s essential to delve into the specific characteristics they share. Firstly, both strategies involve the simultaneous purchase and sale of options, creating a defined spread between two different strike prices. This spread serves as a buffer against adverse market movements, effectively limiting the potential losses while simultaneously leaving ample room for profits when the market cooperates.

Secondly, diagonals and verticals exhibit identical profit and loss profiles, meaning the potential gains and losses associated with each strategy are essentially the same. Traders can adjust the strike prices and expiration dates of the options involved to fine-tune the risk-reward ratio, but the underlying profit potential remains equivalent.

Image: optionshawk.com

Practical Applications in Options Trading

The understanding of diagonals being the same as verticals in options trading extends beyond theoretical musings and has significant practical implications. This equivalence empowers traders with the versatility to adapt their strategies seamlessly to the prevailing market conditions. For instance, during periods of high volatility, traders may opt for diagonals with shorter expiration dates to capture rapid market movements. Conversely, in calmer markets, verticals with longer expiration dates provide a more measured approach, allowing traders to capitalize on gradual market trends.

What Is Diagonals The Same As Verticals In Options Trading

Image: www.cuemath.com

Conclusion

Through a comprehensive analysis of their fundamental characteristics, risk profiles, and profit potential, we have established that diagonals and verticals are indeed two sides of the same coin in options trading. While their structures may differ slightly, their underlying essence remains the same. This understanding empowers traders with the flexibility to tailor their strategies to suit the market conditions and personal risk tolerance, maximizing their chances of success in this dynamic and ever-evolving financial landscape.