Unveiling the Financial Gateway to Potential Profits

Embarking on the journey as an options trader can often leave aspiring enthusiasts pondering the quintessential inquiry: How much capital is the ideal starting point? This crucial question begets a multi-faceted exploration, taking into account risk tolerance, trading experience, and financial objectives.

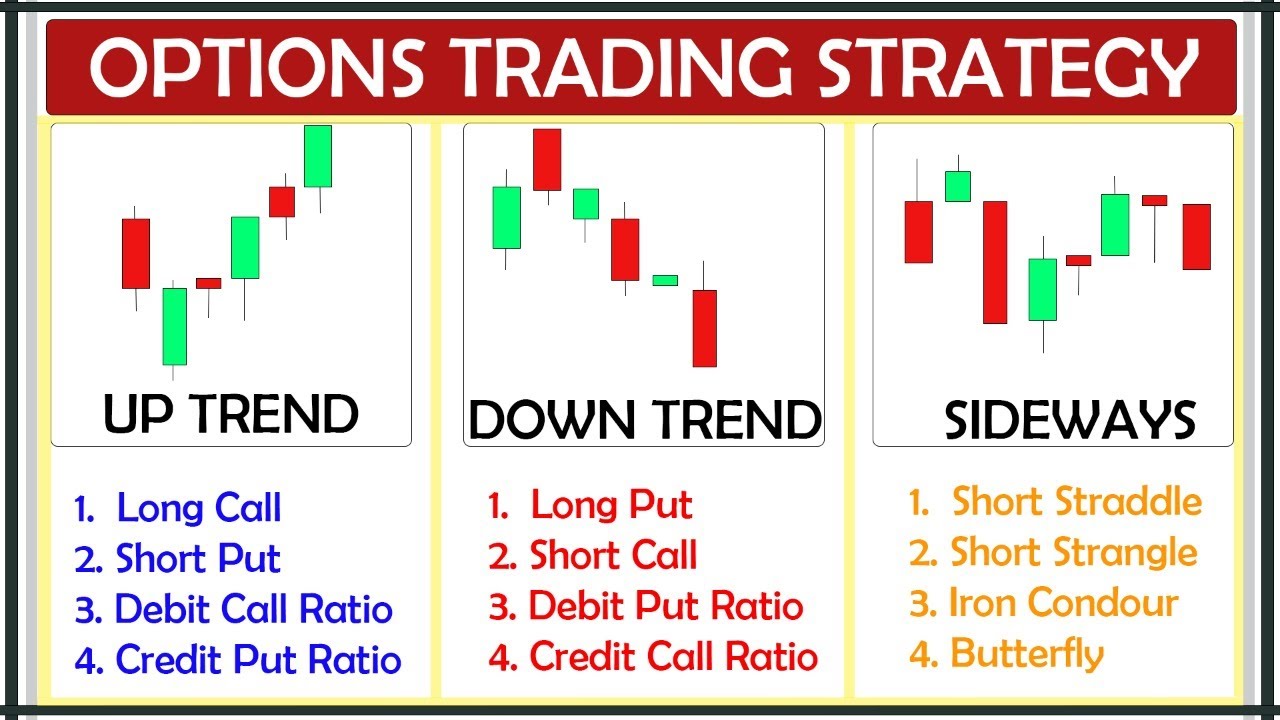

Image: www.youtube.com

Understanding the Mechanics of Options Trading

Options, financial instruments that convey the right, not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date), present traders with both potential for rewards and risks. The allure of leveraged returns beckons, yet the inherent possibility of capital loss lurks ever-present.

Assessing Risk Tolerance and Trading Experience

The cornerstone of prudent options trading lies in a comprehensive comprehension of one’s risk tolerance. A frank self-evaluation of financial resilience is imperative, considering the potential for sizable losses. Novice traders, uninitiated in the nuances of options strategies, should prioritize minimizing risk exposure until proficiency is cultivated. Conversely, seasoned traders may be more inclined to embrace calculated risks in pursuit of enhanced returns.

Formulating Financial Objectives

The quantum of capital earmarked for options trading should be commensurate with personal financial goals. Traders seeking supplemental income may allocate a modest portion of their portfolio, while those aspiring to make options trading their primary revenue stream may elect to commit a more substantial sum. However, it bears emphasizing that the allure of substantial returns should not overshadow the importance of responsible capital management.

Image: www.pinterest.com

Rule of Thumb: Start Small and Scale Up

A prudent approach for both novice and experienced traders alike is to commence with a modest capital outlay, typically ranging from $500 to $2,000. This initial investment allows for experimentation with various options strategies while limiting potential losses. As trading acumen and confidence grow, incremental capital injections can be considered.

Hedging Strategies and Diversification

Seasoned traders often employ hedging strategies to offset risk and enhance portfolio resilience. By pairing offsetting positions in options with contrasting strike prices or expiration dates, they seek to mitigate potential losses. Diversification across multiple underlying assets and options strategies further bolsters risk management.

Continuous Learning and Education

In the ever-evolving realm of options trading, incessant learning is a non-negotiable imperative. Dedicate time to studying market dynamics, mastering trading strategies, and monitoring market trends. Leverage educational resources, such as webinars, seminars, and online courses, to enhance knowledge and sharpen trading skills.

What Is A Good Amount To Start Trading Options

Image: www.pinterest.com

Conclusion

Determining the optimal amount to start trading options requires a holistic examination of risk tolerance, trading experience, and financial objectives. While a prudent initial investment falls within the $500 to $2,000 range, traders should calibrate their capital allocation according to their individual circumstances. Continuous learning, hedging strategies, and diversification contribute to responsible capital management and enhance the potential for success in options trading.