Understanding the Strategy for Experienced Traders

In the world of options trading, the concept of “roll” holds immense significance as a sophisticated strategy employed by experienced traders to manage their positions and navigate market dynamics. To grasp the essence of rolling in options trading, let’s explore its intricacies through clear and insightful explanations.

Image: www.warriortrading.com

Rolling in Options: A Dynamic Strategy

Rolling refers to the strategic act of simultaneously closing out an existing options position while simultaneously opening a new one at a different strike price or expiration date. This intricate maneuver serves multiple purposes, such as:

- Adjusting the risk profile of a position

- Deferring or extending the life of an existing contract

- Converting it into a spread strategy

The decision to roll an options position often stems from the desire to respond to evolving market conditions, ranging from shifts in volatility to price fluctuations. By carefully planning and executing a roll, experienced traders can adapt their strategies to align with new market dynamics and optimize their potential returns.

Comprehensive Overview: Delving into the Mechanics of Rolling

Rolling involves a coordinated execution of two distinct transactions: first, closing out an existing options contract, and then opening a new contract with different parameters. This can be effectively utilized in both call and put options scenarios, opening up a wide range of strategic possibilities.

It’s crucial to note that the proceeds from closing the original position are then used to fund the establishment of the new contract. This interconnected process enables traders to adjust their risk exposure and maximize their chances of success in a dynamic market environment.

Leveraging Rolling: Enhancing Option Trading Strategies

The rolling strategy shines in various scenarios, offering traders powerful tools to refine their trading techniques. Some of its key applications include:

- Adjusting Volatility Exposure: Rolling allows traders to adjust their position’s sensitivity to price fluctuations, either by increasing or decreasing their exposure to volatility.

- Extending Contract Duration: By rolling over into a new contract with a later expiration date, traders can extend the life of their existing position, granting them more time for potential gains.

- Converting to Spread Strategies: Rolling offers exceptional flexibility by enabling traders to convert existing positions into spread strategies, which can enhance their potential returns while managing risk.

Image: trueforexfunds.com

Expert Tips and Advice: Unlocking the Power of Rolling

Seasoned options traders often rely on insightful tips and strategies to optimize their rolling techniques. Here are a few valuable recommendations:

- Cautious Considerations: Rolling is a complex strategy that should be used with caution and a thorough evaluation of potential risks.

- Commission Costs: Be mindful of the commission costs associated with closing and opening positions as part of a roll.

- Market Liquidity: It’s essential to roll into options contracts that exhibit sufficient market liquidity.

- Hedging Strategies: Advanced traders may employ rolling within hedging strategies to manage risk and improve portfolio management.

Frequently Asked Questions: Illuminating the Nuances of Rolling

To clarify the subject further, let’s delve into a common set of FAQs regarding options rolling:

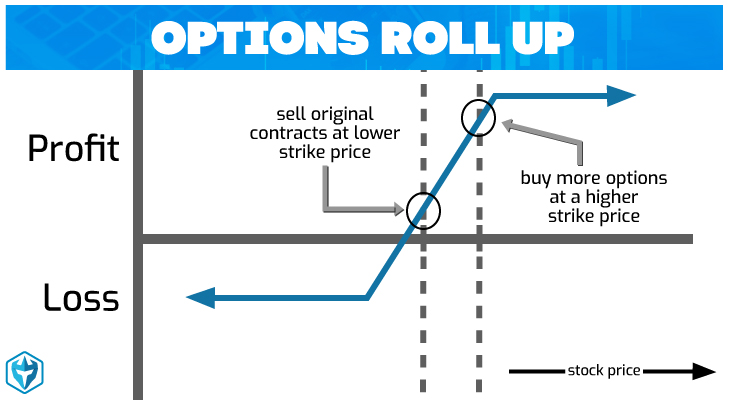

Q. Can you explain the difference between “rolling up” and “rolling down”?

A. Rolling up involves entering a new contract at a higher strike price while rolling down entails a new contract at a lower strike price.

Q. What are the advantages of rolling an options position?

A. Rolling provides traders with flexibility to alter risk exposure, extend contract duration, convert into spreads, and adapt to market conditions.

Q. Are there any limitations or risks associated with rolling options?

A. Yes, rolling can incur commission costs and may not be suitable for all market conditions. It requires careful assessment of potential risks.

What Does Roll Mean In Options Trading

Image: www.youtube.com

Conclusion: Unlocking Trading Potential with Rolling Strategies

Rolling in options trading is a potent strategy that empowers experienced traders to adjust their market positioning and fine-tune their risk management strategies. By effectively executing rolls, traders can enhance their adaptability and seize opportunities while navigating complex market dynamics.

If you’re curious about leveraging rolling techniques in your own options trading pursuits, I encourage you to explore the topic further. Immerse yourself in the intricacies of rolling, seek guidance from seasoned professionals, and practice shrewd decision-making to elevate your trading journey.