Delving into Options Trading: Uncovering Market Hours and Dynamics

In the realm of financial markets, options trading stands as a sophisticated investment strategy that grants traders the privilege of buying or selling an underlying asset at a predetermined price within a specific time frame. Understanding the intricacies of options trading hours is paramount for navigating this dynamic market effectively. In this comprehensive guide, we will embark on a detailed exploration of options trading hours, empowering you with the knowledge to maximize your trading potential.

:max_bytes(150000):strip_icc()/eurusd-volatility-by-hour-of-day-589e2d885f9b58819cea0e4f.jpg)

Image: www.thebalancemoney.com

Defining Options and Their Trading Mechanics

Options, in essence, represent contracts that confer the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a set price known as the strike price. The expiration date of an option contract denotes the final day on which the buyer can exercise their right to buy or sell the underlying asset. Options trading involves the exchange of these contracts between buyers and sellers in a centralized marketplace.

Options Trading Hours: Navigating Market Open and Close Times

Options trading hours align with the operating hours of the underlying exchanges where they are listed. These exchanges typically follow set schedules to ensure orderly market operations and fair trading practices. The most prominent options exchanges, such as the Chicago Mercantile Exchange (CME) and the CBOE Options Exchange (CBOE), maintain specific trading hours for different types of options contracts.

For instance, on the CME, equity index options, including those based on the S&P 500 and Nasdaq-100 indexes, trade from 8:30 AM to 3:15 PM Central Time (CT). However, individual equity options, tied to specific company stocks, have extended trading hours from 9:30 AM to 4:15 PM ET. It is important to note that these trading hours may vary during market holidays or special events, so staying informed about exchange schedules is crucial.

Understanding Pre-Market and After-Hours Trading

In addition to regular trading hours, some exchanges offer pre-market and after-hours trading sessions. These sessions allow traders to enter or exit options positions before or after the primary trading day. Pre-market trading typically commences around 8:00 AM ET, while after-hours trading extends beyond the regular closing time, often until 6:00 PM ET.

Pre-market and after-hours trading sessions provide traders with greater flexibility and the opportunity to react to market news or events that occur outside of regular trading hours. However, it is essential to exercise caution as liquidity may be lower during these sessions, potentially affecting the execution of trades and price discovery.

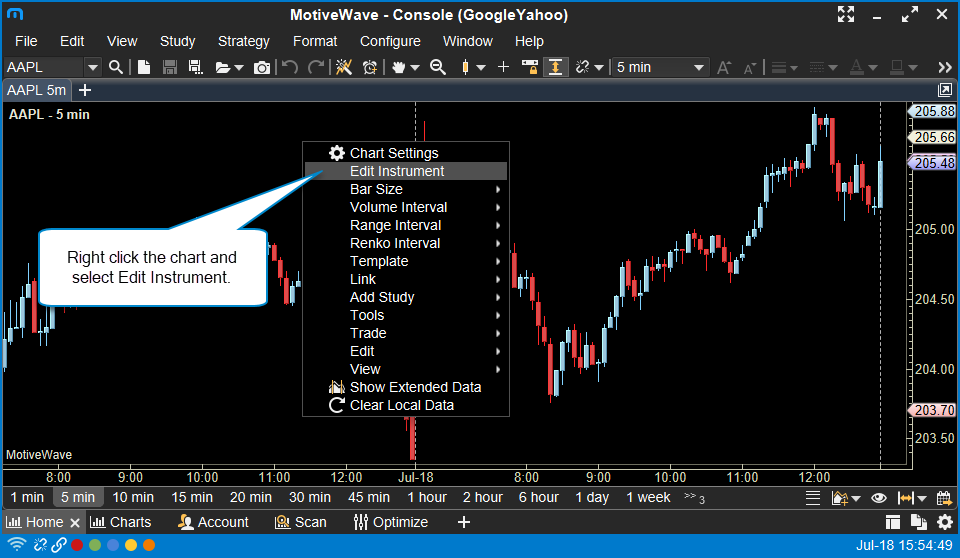

Image: support.motivewave.com

Holidays and Exchange Closures

Financial markets, including options exchanges, observe specific holidays throughout the year. During these designated holidays, all trading activities, including options trading, are suspended. It is imperative for traders to be aware of these holidays to avoid any missed opportunities or potential losses.

Expert Insights: Maximizing Your Options Trading Strategy

Seasoned options traders emphasize the importance of meticulous planning and diligent research before venturing into the market. They underscore the need to thoroughly understand the underlying asset, the dynamics of the options contract, and the potential risks involved.

Acclaimed options trading expert, Mr. Robert C. Merton, advises traders to “adopt a disciplined approach that incorporates thorough due diligence, prudent risk management, and a clear understanding of market dynamics.”

By adhering to these expert recommendations, traders can enhance their decision-making process and improve their chances of success in options trading.

What Are The Hours For Options Trading

Image: forums.babypips.com

In Conclusion

Grasping the nuances of options trading hours is essential for effective navigation of this dynamic market. By understanding the regular trading hours, pre-market and after-hours sessions, and holiday closures, traders can optimize their trading strategies and make informed decisions.