Options trading provides savvy investors with the potential to enhance their returns while managing risks. Warner trading option backspreads, specifically, offer a powerful tool for harnessing volatility and generating consistent profits. This in-depth guide will unlock the intricacies of warner trading, empowering you to navigate this lucrative strategy with confidence and precision.

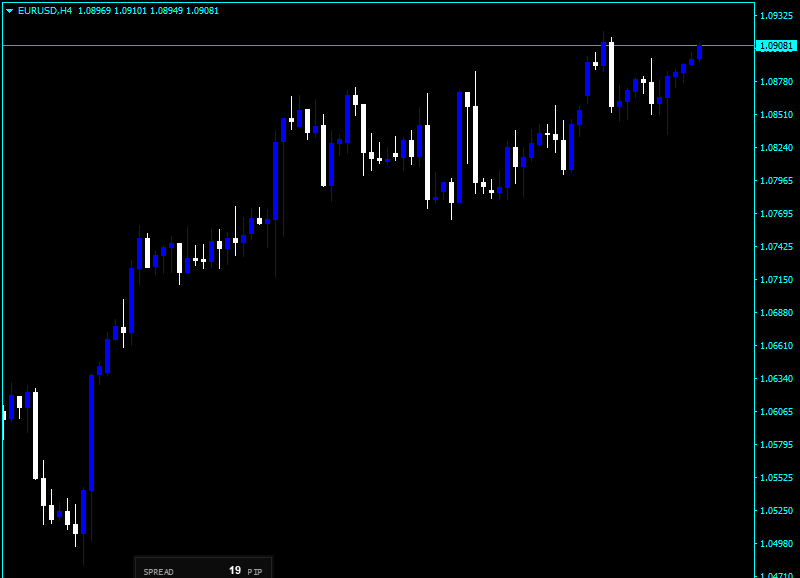

Image: primeforexindicators.com

Understanding the Essence of Warner Trading Option Backspreads

Warner trading option backspreads are a strategy involving the simultaneous purchase and sale of options contracts with different strike prices and expiration dates. This creates a defined risk profile and targeted profit potential. The key to successful warner trading is identifying assets with high implied volatility and choosing suitable parameters for the backspread.

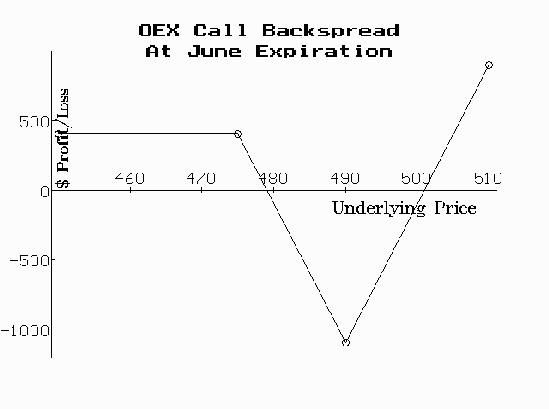

There are two main types of warner trading option backspreads: bullish put spreads and bearish call spreads. Bullish put spreads involve buying a put option with a lower strike price while selling a put option with a higher strike price. This strategy benefits from falling asset prices. Conversely, bearish call spreads involve buying a call option with a higher strike price and selling a call option with a lower strike price, profiting from declining asset prices.

The Mechanics of Warner Trading Option Backspreads

To illustrate the mechanics, let’s consider a bullish put spread. Suppose the stock XYZ is trading at $100. We purchase a put option with an exercise price of $95 for $4 and simultaneously sell a put option with an exercise price of $100 for $2. This creates a backspread where our maximum loss is limited to the difference in premiums ($2) and our profit potential is defined by the distance between the strike prices ($5).

Maximizing Profitability with Warner Trading Option Backspreads

Successful warner trading relies on meticulous strategy and precise execution. Here are proven tips to enhance your profitability:

-

Target high implied volatility: Options with higher implied volatility offer greater profit potential but also higher risk. Balance rewards and risks by selecting assets with suitable volatility levels.

-

Spread width: Optimize the width of the spread based on the volatility of the underlying asset and your desired risk profile. Wider spreads offer higher potential profits but also greater potential losses.

-

Expiration dates: Choose expiration dates that align with your investment horizon and market conditions. Longer-dated options provide more time for price fluctuations but also expose you to greater time decay.

Image: forex-station.com

Expert Insights and Real-World Applications

Renowned options trader Jay Warner, the mastermind behind this strategy, emphasizes the importance of patience and discipline. “Don’t chase quick profits. Focus on setting up high-probability trades and managing risk effectively,” he advises.

Successful warner trading requires a deep understanding of market dynamics, volatility, and the technicalities of option trading. Practice on paper or a simulation platform before venturing into live trading.

Warner Trading Option Backspreads

Image: www.optionstrategist.com

Conclusion: Empowering Your Financial Future

Warner trading option backspreads provide a sophisticated strategy for harnessing volatility and generating consistent profits in the options market. By embracing the principles outlined above and implementing proven techniques, you can unlock the power of this strategy and take control of your financial goals.