If you’re an experienced trader looking to expand your investment portfolio, option trading can be an exciting and potentially lucrative opportunity. However, choosing the right trading platform is crucial to your success. Two leading contenders in the industry are Vanguard and E*Trade, each offering unique advantages and disadvantages. In this comprehensive guide, we’ll delve into the intricacies of vanguard option trading vs etrade option trading, helping you make an informed decision based on your specific trading needs.

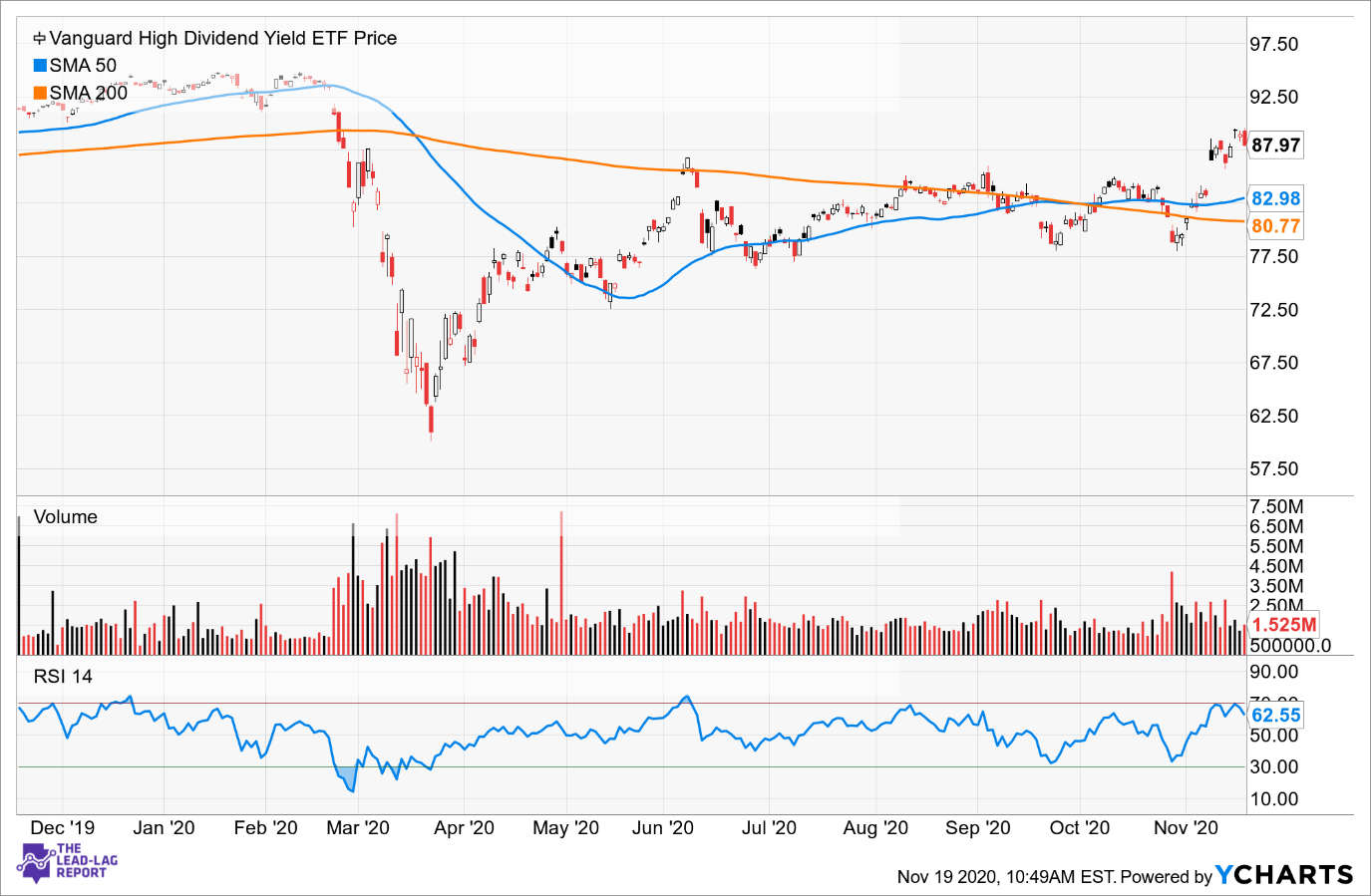

Image: seekingalpha.com

Vanguard Option Trading: A Comprehensive Overview

Vanguard, renowned for its low-cost index funds, has recently entered the options trading arena. Their platform caters to long-term investors seeking cost-effective options strategies. Here are the key aspects of Vanguard option trading:

- Low Trading Commissions: Vanguard boasts some of the lowest trading commissions in the industry, making it an attractive choice for high-volume traders.

- Intuitive Platform: Vanguard’s platform is designed to be user-friendly, offering a clean and straightforward interface.

- Limited Options Strategy Types: Compared to E*Trade, Vanguard offers a more limited range of options strategies, primarily focusing on basic calls and puts.

E*Trade Option Trading: A Versatile Marketplace

ETrade, a well-established brokerage firm, has a robust option trading platform designed to cater to traders of all levels, whether beginners or seasoned professionals. Here’s what ETrade offers:

- Extensive Options Strategy Types: E*Trade provides access to a wide variety of options strategies, including complex multi-leg spreads and advanced order types.

- Advanced Trading Tools: Traders can leverage E*Trade’s powerful suite of trading tools, including customizable charts, real-time news feeds, and technical analysis indicators.

- Higher Trading Commissions: While E*Trade offers a wider array of options, it may come with slightly higher trading commissions compared to Vanguard.

Vanguard vs. E*Trade: Comparison of Key Features

To better understand the differences between these platforms, let’s compare their key features side-by-side:

| Feature | Vanguard | E*Trade |

|---|---|---|

| Trading Commissions | Low | Higher |

| Options Strategy Types | Limited | Extensive |

| Trading Platform Interface | User-friendly | Advanced |

| Trading Tools and Analysis | Basic | Robust |

| Account Minimums | $0 | None |

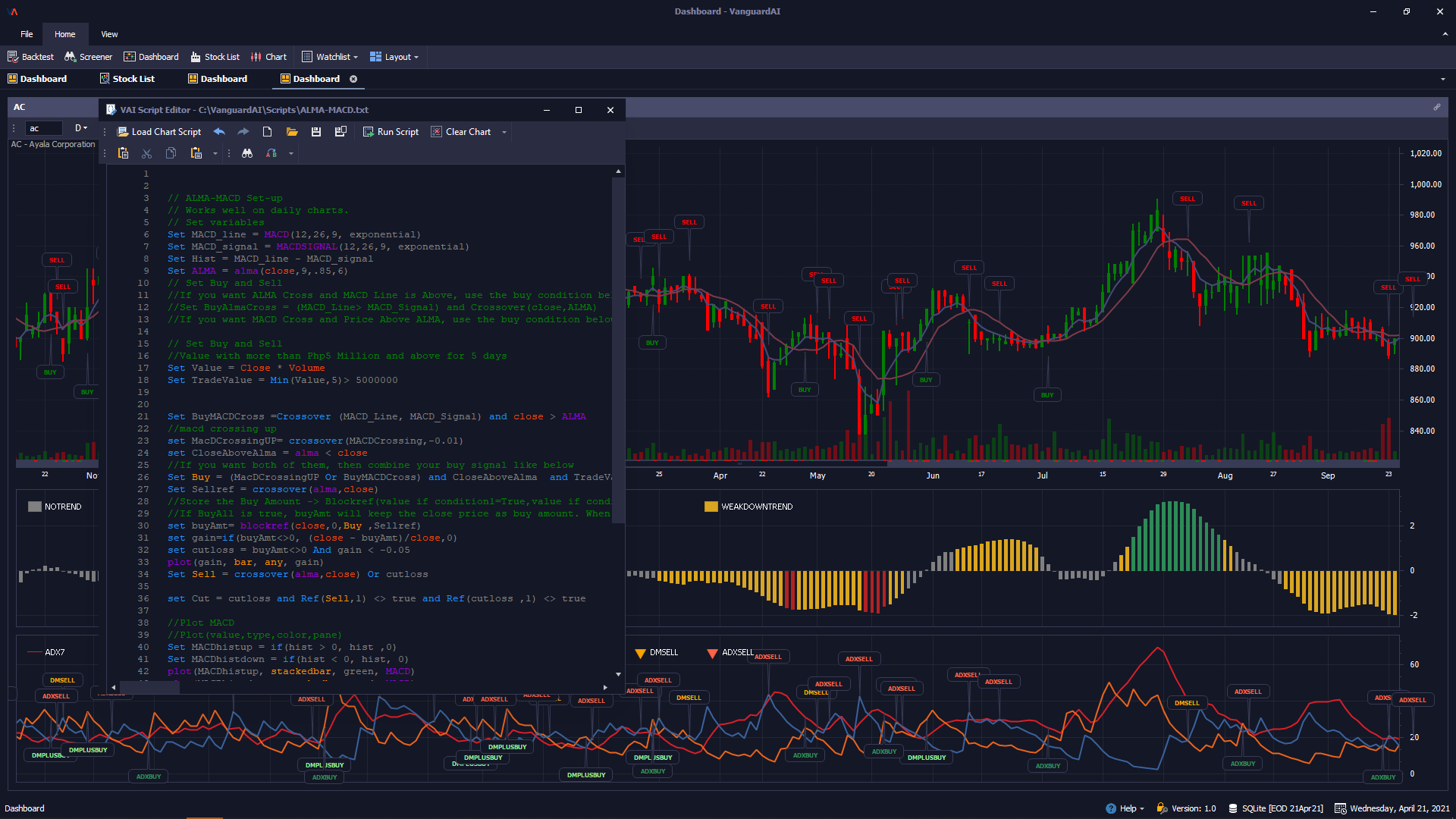

Image: www.brokerage-review.com

Which Platform is Right for You?

The choice between Vanguard and E*Trade ultimately depends on your individual trading needs and preferences.

- Vanguard: Ideal for long-term investors seeking cost-effective options strategies with a user-friendly platform.

- E*Trade: Suitable for experienced traders and those seeking advanced trading tools, a wide range of strategy types, and a powerful trading interface.

Vanguard Option Trading Vs Etrade Option Trading

Image: community.devexpress.com

Conclusion

Vanguard option trading and ETrade option trading provide traders with diverse platforms tailored to their specific requirements. Vanguard excels in low-cost trading and simplicity, while ETrade offers an extensive suite of trading tools and advanced options strategies. Whether you’re a seasoned professional or just starting your options trading journey, carefully assess your needs and preferences to find the platform that empowers you to maximize your returns.