Unleashing the Power of ULIPs for Enhanced Returns

In the vast and ever-evolving realm of financial markets, a transformative force has emerged: ulv options trading. With its ability to harness the subtle nuances of market movements, ulv options have captivated the attention of traders seeking to amplify their returns. In this comprehensive guide, we delve into the labyrinthine world of ulv options trading, shedding light on its concepts, strategies, and the insights of industry experts.

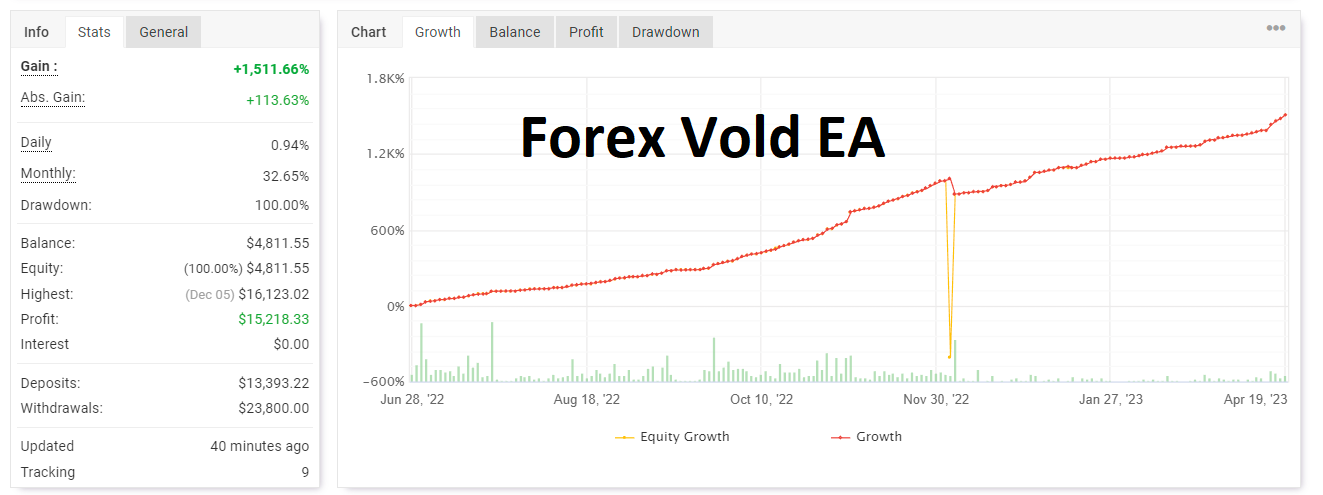

Image: forexearobots.com

What is ULN Options Trading?

ULN options, short for ultra-low volatility options, are a unique type of option contract designed to capture the minuscule price fluctuations of underlying assets. Unlike traditional options, which focus on significant price swings, ULN options hone in on the subtle shifts that often go unnoticed by the broader market. This niche focus grants ULN options traders the ability to harness the untapped potential of incremental price movements, leading to substantial returns over time.

The Mechanics of ULN Options

Understanding the mechanics of ULN options is paramount to harnessing their potential. These options are characterized by extremely low implied volatilities, typically below 10%. This low volatility enables ULN options to be priced at a fraction of the cost of traditional options. Additionally, ULN options often have extended expirations, spanning several months or even years, allowing traders to capture gradual price trends over longer durations.

Strategies for ULN Options Trading

ULN options trading presents a diverse array of strategies tailored to various risk appetites and market conditions. Ranging from conservative to aggressive approaches, traders can choose strategies that align with their individual objectives. popular strategies include:

-

Covered Calls: A low-risk strategy involving selling ULN call options on assets you own, generating additional income while maintaining exposure to potential upside.

-

Cash-Secured Puts: Another conservative strategy where traders sell ULN put options while holding the necessary cash to cover potential obligations, aiming to generate consistent income in a sideways market.

-

Iron Condors: A more advanced strategy involving selling ULN call and put options at different strike prices to profit from a narrow range of price fluctuations.

Image: uk.tradingview.com

Expert Insights and Actionable Tips

To enhance your ulv options trading acumen, it’s crucial to glean insights from industry experts. Seasoned traders recommend:

-

Exercise Patience: ULN options often exhibit slow price appreciation, so patience is essential to reap significant rewards.

-

Manage Risk: Understand the potential risks associated with ULN options trading and implement proper risk management techniques.

-

Stay Informed: Monitor market trends and stay abreast of economic news to make informed trading decisions.

Ulv Options Trading

Image: uk.tradingview.com

Embark on Your ULN Options Trading Journey

With a solid understanding of the concepts, strategies, and expert insights outlined in this guide, you are well-equipped to embark on your ulv options trading journey. Harness the power of these unique contracts to unveil the hidden potential of financial markets. Remember to exercise caution, manage risk, and stay informed to maximize your chances of success in the ever-evolving world of ULN options trading.