Imagine embarking on the exhilarating journey of trading, only to find yourself losing not just money but also your cognitive abilities. It’s a terrifying thought, isn’t it? The world of trading is often fraught with risks, and protecting oneself from mental lapses is crucial for long-term success.

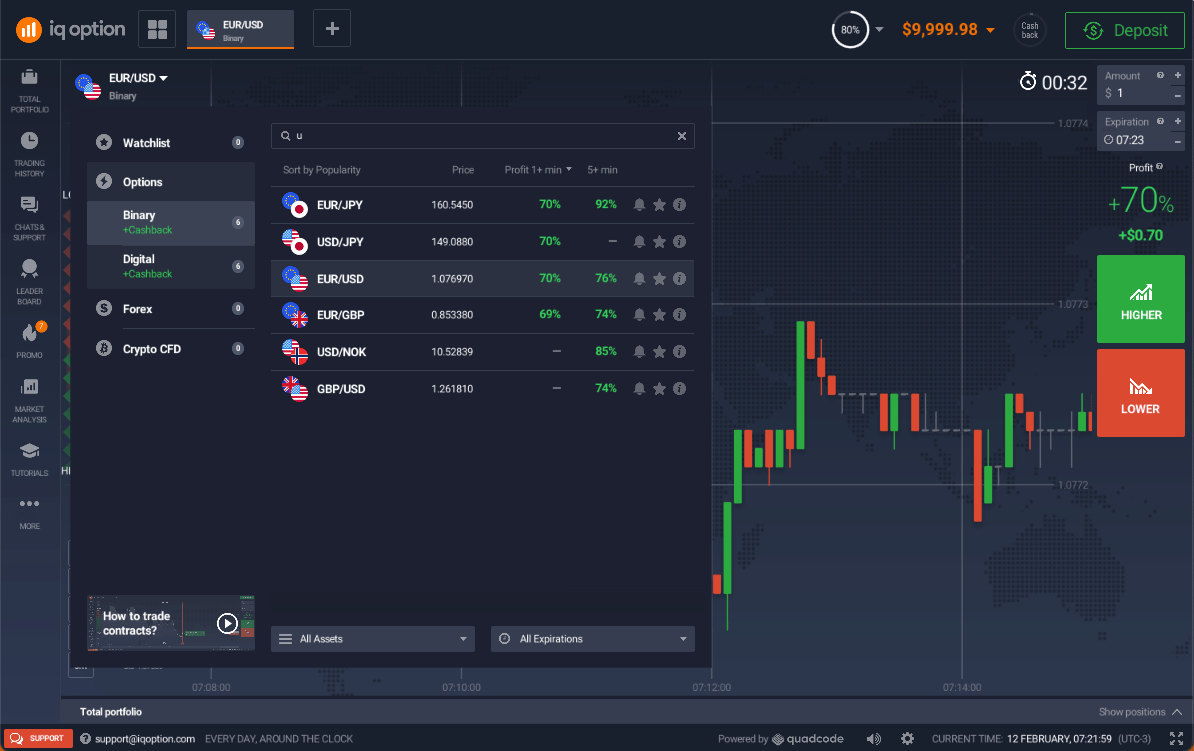

Image: iqbroker.com

In this comprehensive guide, we’ll unveil the secrets of trading without losing your IQ. We’ll delve into strategies, techniques, and expert insights to empower you with the knowledge and skills necessary to navigate the financial markets with clarity and confidence.

The Perils of Overtrading

One of the biggest threats to your IQ in trading is overtrading. The adrenaline rush of placing trades, combined with the allure of potential profits, can lead to reckless behavior. Excessive trading can impair your decision-making abilities, making it difficult to make sound judgments.

To combat overtrading, set clear trading limits and stick to them. Divide your trading capital into specific amounts for each trade, and avoid chasing losses by entering multiple trades in a short period of time.

The Importance of Education

Trading is not a get-rich-quick scheme. It requires continuous learning and development. The more knowledge you possess, the better equipped you’ll be to make informed decisions and withstand market volatility.

Enroll in trading courses, attend webinars, and read articles and books written by experts in the field. The more you learn, the less likely you are to fall prey to common trading pitfalls that can damage your cognitive abilities.

The Power of Emotional Control

Emotions are an intrinsic part of human nature, but they can be a trader’s worst enemy. Fear, greed, and euphoria can cloud your judgment and lead to irrational decisions.

To maintain emotional control, practice mindfulness and meditation. Develop a trading plan and stick to it, even in the face of market fluctuations. When emotions start to overwhelm you, take a break from trading and reassess your strategy.

Image: www.iqoptionwiki.com

The Role of Risk Management

Risk management is the cornerstone of successful trading. It involves identifying and mitigating potential losses. The more risk you take, the greater the strain on your cognitive abilities.

Use stop-loss orders to limit your losses, diversify your portfolio, and manage your position sizing. By implementing robust risk management measures, you can protect your capital and preserve your IQ.

The Benefits of Self-Discipline

Self-discipline is the key to success in all aspects of life, including trading. Execute your trades according to your plan, regardless of market conditions or external influences.

Remain disciplined in your money management, risk management, and trading routine. This will train your mind to focus on the long-term, preserving your IQ and enabling you to make wise trading decisions.

FAQs

Q: How much money do I need to start trading?

A: The amount of money you need to start trading depends on your risk tolerance and trading strategy. It’s recommended to start with a small amount that you can afford to lose.

Q: What is the best trading platform?

A: The best trading platform for you will depend on your individual needs and preferences. Some popular platforms include MetaTrader 4, MetaTrader 5, and IQ Option.

Q: How often should I trade?

A: The frequency of your trading will depend on your trading strategy. Some traders trade frequently, while others trade less often. It’s important to find a trading frequency that suits your personality and lifestyle.

Trading Without Loosing Iq Option

Image: www.publicfinanceinternational.org

Conclusion

Trading without losing IQ option is possible if you approach it with knowledge, discipline, and a clear understanding of your risk tolerance. By implementing the strategies and techniques outlined in this guide, you can enhance your cognitive abilities, preserve your capital, and navigate the financial markets with confidence.

Are you ready to embark on a trading journey that empowers your mind and enhances your financial well-being? Start learning, stay disciplined, and trade wisely.