Weekly options are a powerful tool for traders seeking to capitalize on short-term market fluctuations. Unlike their monthly counterparts, weekly options have a shorter expiration period, typically lasting from one to five business days. This condensed lifespan makes them more sensitive to underlying price movements, providing ample opportunities for nimble traders.

Image: www.weeklyoptionsusa.com

Understanding the mechanics of weekly options is crucial for successful trading. The premium paid for an option represents the amount an investor is willing to spend to control the underlying asset at a predetermined price (strike price). The option’s expiration date dictates how long the trader has to exercise this right, which can be either buying or selling the underlying asset.

Options can be classified as either calls or puts. Calls confer the right to buy the underlying asset at the strike price, while puts give the right to sell. Traders choose their options based on their market outlook. For example, a bullish trader would purchase a call option if they anticipate the underlying asset’s price to rise.

Weekly options trading offers several advantages. First, their shorter expiration period allows traders to execute strategy with greater frequency. This increased liquidity reduces the risk of unexpected events disrupting trading plans. Secondly, the lower premiums associated with weekly options make them accessible to traders with limited capital.

Moreover, weekly options provide flexibility for fine-tuning trading strategies. The option’s expiration date can be aligned with specific market events or catalysts, allowing traders to respond swiftly to real-time developments. This ability to adapt quickly can be a significant advantage in volatile markets.

Of course, weekly option trading also carries risks. Traders must carefully manage their positions, considering both the time decay inherent in the options and potential market volatility. It is essential to have a sound understanding of risk management principles and to exercise caution when trading.

To delve deeper into the world of weekly options trading, here are additional key concepts to explore:

-

Greeks: These are mathematical values that measure an option’s sensitivity to changes in various factors such as price, time, and volatility. Understanding the Greeks is crucial for assessing risk and optimizing option strategies.

-

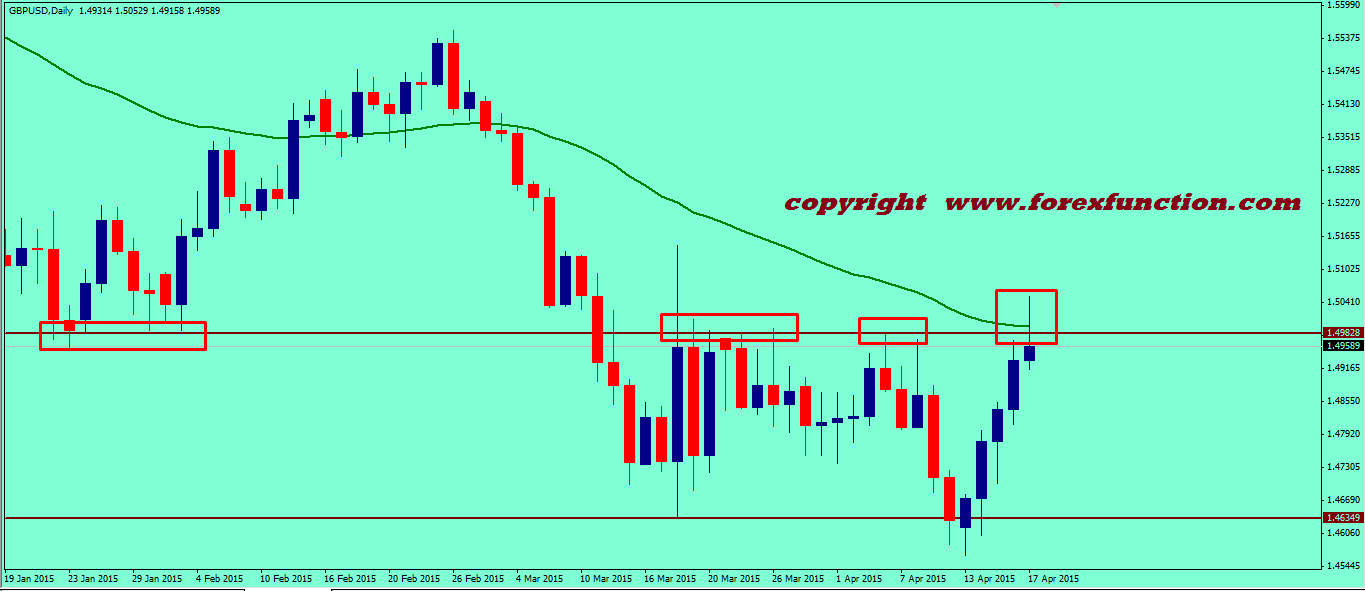

Technical analysis: This involves studying price charts and patterns to identify potential trading opportunities. Technical analysis can be used alongside the analysis of fundamental data to make informed decisions.

-

Volatility: Volatility refers to the magnitude of price fluctuations in the underlying asset. High volatility offers significant profit potential, but it also increases the risk of losses. Managing volatility is essential for successful weekly options trading.

In conclusion, trading weekly options weekly can be a rewarding endeavor for savvy traders. By embracing the unique characteristics of these short-term derivatives, traders can unlock profitable opportunities while managing risk. With a thorough understanding of the mechanics, risks, and strategies involved, traders can navigate the volatile waters of the markets with precision and success.

Image: theministerofcapitalism.com

Trading Weekly Options Weekly

Image: uzodocymujyb.web.fc2.com