In the high-stakes world of stock options trading, mistakes can be costly. But what if you could learn from the errors of others, leveraging their missteps as stepping stones towards your own success? This article delves into the captivating realm of trading stock options using other people’s mistakes, empowering you with valuable insights that can elevate your trading strategy.

Image: moneybliss.org

Understanding Stock Options

Stock options are contracts giving the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific number of shares of a company’s stock at a predetermined price (strike price) and on a specified date (expiration date). Understanding these fundamental concepts allows you to navigate the stock options market confidently.

Analyzing Market Mistakes

The beauty of trading stock options using other people’s mistakes lies in its theoretical underpinnings. When investors make predictable errors, they create market inefficiencies that astute traders can exploit. Common mistakes to watch out for include:

-

Overreacting to News: Retail investors often buy or sell stocks based on emotional reactions to headlines, leading to price fluctuations that can be profitable for contrarian traders.

-

Trading Against the Trend: Igniting market moves, trends are crucial to identify. Buying into an uptrend or shorting a downtrend can yield substantial returns, while attempting to reverse a trend can prove disastrous.

-

Chasing Losses (Revenge Trading): Holding onto losing positions in the hope of recouping losses is a common, yet perilous mistake. It’s essential to recognize when a trade has gone wrong and minimize losses before they escalate.

-

Lack of Risk Management: Neglecting risk management rules, such as setting stop-loss orders or diversifying one’s portfolio, can turn even profitable trades into major losses.

Identifying Trading Opportunities

Trading stock options using other people’s mistakes requires a keen eye for market anomalies. By analyzing news, following price action, and studying technical indicators, you can pinpoint opportunities to:

-

Sell Options to Overreactive Traders: When emotions run high, option premiums often rise, creating opportunities to sell options to overexcited buyers.

-

Buy Options When Trends Reverse: Traders who identify trend reversals can purchase options at potentially favorable prices, capitalizing on the crowd’s overreaction when prices move against them.

-

Short Options on Overvalued Stocks: Options on high-priced stocks can be overpriced, providing chances to sell puts or calls to capitalize on a downward correction.

-

Implement Defined Risk Trading: Trading strategies, such as covered calls or credit spreads, allow traders to define and manage their risk while generating income.

Image: earthcycle.io

Seeking Expert Guidance

While understanding the principles of trading stock options using other people’s mistakes is essential, seeking expert guidance can enhance your trading strategy. Consider the following:

-

Read Books and Attend Webinars: Reputable authors and trading educators share extensive knowledge and insights through books and seminars.

-

Join Trading Communities: Online forums and social media groups provide access to experienced traders, allowing you to connect with and learn from others.

-

Consult with a Financial Advisor: A qualified financial advisor can provide personalized guidance and assist in developing a trading plan tailored to your financial goals and risk tolerance.

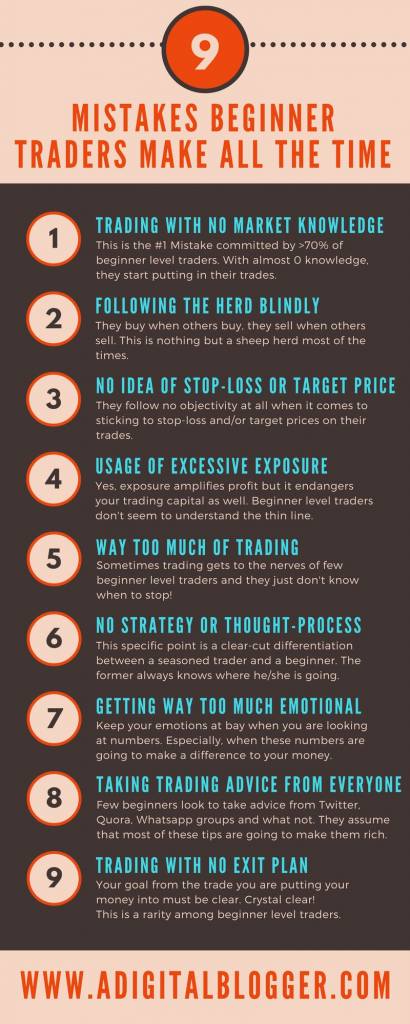

Trading Stock Options Using Other Peoples Mistakes

Image: www.adigitalblogger.com

Conclusion

Trading stock options using other people’s mistakes is an intricate yet rewarding endeavor. By mastering the art of analyzing market inefficiencies, exploiting predictable errors, and implementing sound risk management practices, you can turn the missteps of others into stepping stones towards your own trading success. Remember to approach the market with knowledge, discipline, and a willingness to learn from the mistakes of those who have come before you.