Introduction

As an avid investor with a penchant for high-stakes trading, I’ve delved into the electrifying world of stock options, often utilizing them to enhance my portfolio’s growth potential. One particularly intriguing aspect of options trading is their application in the lead-up to earnings announcements. The volatility and potential market swings that accompany earnings reports can present both opportunities and risks for savvy traders. In this article, we will embark on a comprehensive exploration of stock options trading before earnings, examining strategies, tips, and expert advice.

Image: howtohacks53.blogspot.com

Unveiling Options: Pre-Earnings Considerations

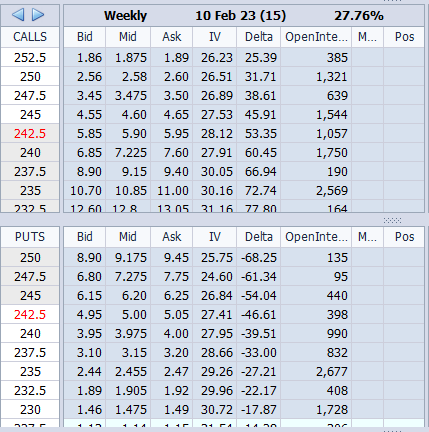

Stock options, derivative instruments granting the right but not the obligation to buy (call option) or sell (put option) an underlying security at a predetermined price (strike price) on or before a specified date (expiration date), play a crucial role in earnings-related trading. By leveraging options, traders can position themselves to capitalize on potential price movements driven by earnings outcomes.

Gauging Earnings Estimates and Volatility

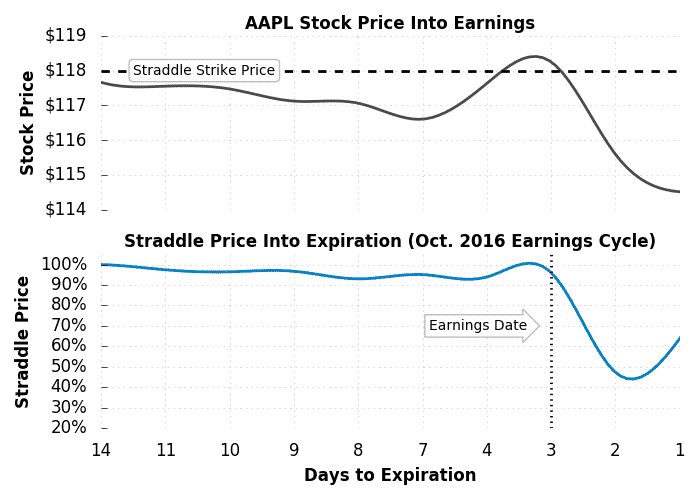

Prior to trading options before earnings, it’s imperative to gauge analysts’ earnings estimates and assess the potential volatility surrounding the announcement. Historical volatility data, implied volatility measures, and market sentiment can provide valuable insights into the expected price swings of the underlying security. Traders should also consider the company’s industry, financial position, and recent performance to make informed decisions.

Decoding Option Strategies for Earnings

When it comes to options trading before earnings, employing effective strategies is key. Let’s delve into a few popular approaches:

Image: optionstradingiq.com

Strategy 1: Buying Calls to Bet on Upside

If you anticipate the underlying security’s price to rise after earnings, you might consider buying call options. These options grant you the right to purchase the stock at a set strike price, potentially profiting from any substantial price appreciation that exceeds the premium paid for the option.

Strategy 2: Selling Puts to Anticipate Stability or Decline

Alternatively, selling put options can offer a bearish stance. By selling a put option, you are obligating yourself to buy the underlying security at the strike price if the market price falls below that level. This strategy is suitable if you expect the stock price to remain stable or decline after earnings.

Tips and Expert Advice for Success

To enhance your options trading acumen before earnings, consider these valuable tips from seasoned experts:

Expert Tip: Manage Risk with Volatility Metrics

Before placing trades, meticulously assess volatility metrics to gauge the potential risk involved. Implied volatility, historical volatility, and beta can provide critical insights into the expected price swings of the underlying security. By understanding volatility, you can make informed decisions about the number of contracts to trade and the appropriate strike prices to target.

Frequently Asked Questions (FAQs)

To clarify any lingering questions, let’s address some common inquiries:

Q: What is the optimal time frame to trade options before earnings?

A: The ideal time frame for trading options before earnings can vary, but many traders opt for options with expirations ranging from one to three months following the earnings announcement. This provides sufficient time for the market to react to the earnings news while allowing for some buffer against unexpected events.

Q: How can I enhance my chances of success when trading options before earnings?

A: To increase your odds of success, consider employing sound risk management practices, such as setting stop-loss orders, diversifying your portfolio, and understanding the underlying company’s financial health and industry outlook. Additionally, thoroughly research historical earnings announcements and market sentiment surrounding the stock.

Trading Stock Options Before Earnings

Image: optionstradingiq.com

Conclusion

Trading stock options before earnings can be both thrilling and daunting, but by carefully considering the factors outlined in this guide, you can increase your chances of success. By understanding options strategies, leveraging expert insights, and cultivating a keen understanding of earnings-related dynamics, you can navigate this market segment with confidence. While this article provides comprehensive knowledge, it is crucial to continually educate yourself, stay abreast of market trends, and seek professional guidance when necessary. Are you ready to embark on the exhilarating journey of options trading before earnings?