Introduction: Unveiling the Hidden Power of Emotions in Options Trading

In the tumultuous realm of financial markets, options trading stands as a tantalizing arena where rewards and risks coexist, often dancing precariously on a knife’s edge. At its core, successful options trading demands more than just technical proficiency; it’s an intimate dance with the very fabric of human nature – the psychological landscape that shapes our decisions and ultimately, our financial fortunes.

Image: blog.elearnmarkets.com

Enter the captivating world of trading psychology, where the interplay between emotions and rational analysis often dictates the trajectory of our investment journeys. Understanding the psychological forces at play is not merely a luxury; it’s a fundamental necessity for navigating the ever-elusive terrain of options volatility.

Deciphering the Enigma of Trading Psychology

In the nuanced realm of trading psychology, we come face to face with the profound influence of emotions on our decision-making. Fear, greed, and hope, those primal human impulses, often steer our actions in unpredictable directions, clouding our judgment and potentially leading us astray from the path of profitability.

At the heart of trading psychology lies the understanding that emotions are not impediments to be suppressed, but rather powerful tools that can be harnessed and channeled for our benefit. The key resides in recognizing our emotional triggers and developing strategies to mitigate their potentially detrimental effects.

Confronting Fear: A Silent Saboteur Unleashed

Fear, that insidious emotion, stalks the minds of traders like a persistent shadow. It has the uncanny ability to cripple our actions, paralyzing us with indecision or driving us to make rash, ill-advised decisions.

Fear’s potency stems from its ability to cloud our judgment, making us overestimate the risks and underestimate the potential rewards. It can lure us into selling promising positions prematurely, resulting in missed profits. Conversely, fear can also prevent us from entering potentially lucrative trades, leaving us mired in regret.

Unveiling the Allure of Greed: A Double-Edged Sword

On the other end of the emotional spectrum lies greed, a powerful motivator that can both propel us towards success and lead us to our financial demise. Greed’s siren song whispers promises of endless wealth, enticing us to hold on to positions too long or to chase after seemingly unattainable profits.

However, it’s crucial to remember that greed can be a treacherous ally. It can blind us to the risks involved and tempt us to overextend our positions, potentially resulting in devastating losses. Striking a delicate balance between ambition and prudence is essential for harnessing the power of greed without succumbing to its perilous embrace.

Image: optionstradingiq.com

Harnessing the Power of Hope: A Vital Ingredient for Enduring Success

Amidst the turbulence of the markets, hope emerges as a beacon of optimism, a resilient force that propels us forward even in the face of adversity. Hope sustains us during inevitable downturns and fuels our determination to achieve our long-term financial goals.

Yet, like all emotions, hope must be tethered to a foundation of realism. Blind optimism can lead us to ignore potential risks and make impulsive decisions that jeopardize our hard-earned capital. It’s in the harmonious interplay between hope and rational analysis that true trading success is forged.

Overcoming Cognitive Biases: Pitfalls to Success

In the labyrinthine world of trading psychology, cognitive biases emerge as insidious traps that can subtly distort our perceptions and lead us down a path of financial ruin. These biases are inherent flaws in our thinking processes, often stemming from our innate desire for certainty and our tendency to seek out information that confirms our existing beliefs.

Confirmation bias, for instance, blinds us to evidence that contradicts our preconceived notions, leading us to make decisions based on limited and potentially erroneous information. Overcoming cognitive biases requires constant vigilance, a willingness to question our assumptions, and a commitment to seeking out diverse perspectives.

Emotional Intelligence: The Path to Mastery

In the relentless pursuit of trading excellence, emotional intelligence reigns supreme. It encompasses our ability to recognize, understand, and manage our emotions, as well as the emotions of others. By cultivating emotional intelligence, we empower ourselves to navigate the turbulent waters of the markets with greater clarity, resilience, and equanimity.

Emotional intelligence enables us to remain objective in the face of adversity, to make decisions based on rational analysis rather than impulsive reactions, and to build strong relationships with mentors, peers, and clients. It’s the cornerstone upon which a successful trading career is built.

Expert Insights: Navigating the Emotional Quagmire

“Trading psychology is not about eliminating emotions; it’s about understanding them and using them to your advantage,” emphasizes renowned trader and author Mark Douglas. “The key is to develop a trading plan that aligns with your personality and risk tolerance, and to stick to it even when emotions run high.”

Echoing this sentiment, trading coach Brett Steenbarger advises, “Focus on developing a process-oriented approach rather than chasing after quick profits. By focusing on the process, you can mitigate the impact of emotions and increase your chances of success in the long run.”

Actionable Tips for Mastering Trading Psychology

-

Identify your emotional triggers: Pinpoint the specific situations or market conditions that evoke strong emotions within you.

-

Develop coping mechanisms: Craft specific strategies to manage your emotions when triggered, such as taking a break from trading or seeking support from a trusted mentor.

-

Embrace mindfulness: Practice mindfulness techniques to cultivate greater awareness of your thoughts and emotions, enabling you to respond more objectively to market events.

-

Seek professional help: Don’t hesitate to seek professional help from a licensed therapist or counselor if you struggle to manage your emotions effectively.

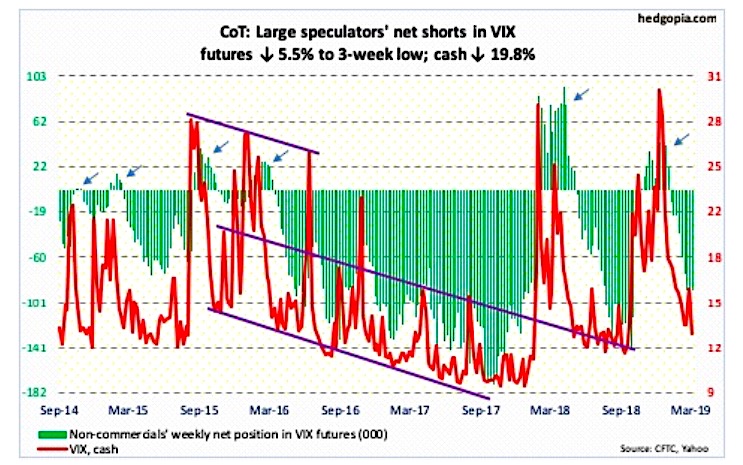

Trading Psychology Options Volatility

Image: www.seeitmarket.com

Conclusion: Embracing the Transformative Power of Trading Psychology

In the dynamic arena of options trading, mastering trading psychology is not an option; it’s an imperative. By understanding the profound influence of emotions on our decision-making, we equip ourselves with the essential tools to navigate the treacherous waters of market volatility.

Through the cultivation of emotional intelligence and the adoption of evidence-based strategies, we can harness the power of our emotions, transform them from potential liabilities into valuable assets, and ascend towards the pinnacle of trading success.

Remember, the journey of mastering trading psychology is an ongoing one, a continuous exploration of the intricate tapestry of human nature. Embrace this journey with an open mind, a relentless determination, and an unwavering belief in your ability to conquer the inevitable emotional challenges that lie ahead. With patience, perseverance, and an unwavering commitment to self-improvement, you will emerge as a formidable presence in the financial markets, a trader who has transcended the realm of mere technical proficiency to become a true master of the mind.