Imagine being handed a hefty sum of money to trade options with—a dream come true for many aspiring traders. Enter the world of funded accounts, where you can amplify your profits without risking your own capital. In this comprehensive guide, we’ll delve into the intricacies of trading options with a funded account, empowering you with actionable insights and expert strategies.

Image: www.superfastcpa.com

Funded Accounts: A Path to Scalable Success

A funded account is a game-changer for traders seeking financial growth without the constraints of limited capital. Through rigorous evaluations and performance assessments, traders can qualify for accounts ranging from thousands to millions of dollars, providing them with the leverage to execute larger trades and maximize their profit potential.

Navigating the Nuances of Funded Accounts

Eligibility Criteria

To secure a funded account, traders must meet specific eligibility criteria, which can vary across firms. These typically include a minimum trading experience, a proven track record of profitability, and a comprehensive understanding of options trading strategies.

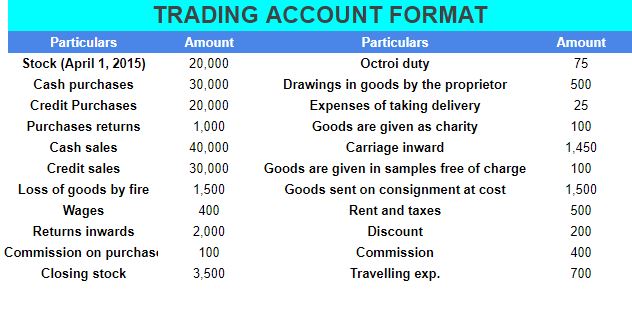

Image: www.bank2home.com

Profit Split

When trading with a funded account, profits are typically split between the trader and the firm. The split ratio varies but generally ranges from 50/50 to 80/20 in favor of the trader. This revenue-sharing model incentivizes both parties to work towards mutual success.

Account Drawdowns

Funded accounts come with predefined drawdown limits. Traders must manage their risk meticulously to avoid exceeding these limits. Breaching drawdowns can result in account closure, suspension, or margin calls.

Maximizing Performance with Proven Strategies

To excel in trading options with a funded account, adherence to proven strategies is paramount. Consider these fundamental principles:

- Establish a robust trading plan, outlining your risk tolerance, trade size, and profit targets.

- Conduct thorough market analysis, identifying market trends and potential trade setups.

- Execute trades with precision, implementing sound risk management techniques.

- Monitor your trades diligently, adjusting positions as market conditions dictate.

- Continuously seek education and stay updated on the latest industry developments.

Expert Insights and Tips

Seasoned traders share their insights for enhancing your funded account trading endeavors:

- Trade with Discipline: Adhere to your trading plan and avoid impulsive trades driven by emotions.

- Manage Risk Wisely: Implement stop-loss orders and closely monitor your risk-to-reward ratios.

- Capitalize on Volatility: Options trading thrives on market volatility. Identify periods of increased price movement for optimal profit opportunities.

- Stay Informed: Continuously monitor market news and economic data to stay on top of market-moving events.

- Seek Mentorship: Benefit from the guidance of experienced traders who can provide valuable insights and support.

Frequently Asked Questions

Q: How do I secure a funded account?

A: Research different funding firms, apply, and demonstrate your trading prowess through assessments.

Q: What are the risks involved in trading options with a funded account?

A: Market volatility, account drawdowns, and margin calls pose potential risks that traders should be aware of.

Q: How do I optimize my chances of success?

A: Implement proven strategies, seek guidance from experts, and continuously refine your trading approach.

Trading Options With A Funded Account

Image: www.toppr.com

Conclusion

Trading options with a funded account is a powerful tool for seasoned traders seeking substantial profit potential. By understanding the intricacies of funded accounts, adopting effective strategies, and leveraging expert insights, you can unlock the path to financial success. Remember, consistent discipline and a commitment to continuous improvement are key to maximizing your returns. Are you ready to embark on this exciting journey and trade options like a pro?